Feb 2020 Income At-A-Glance

Gross Income for Feb: $147,335

Total Expenses for Feb: $26,475

Total Net Profit for Feb: $120,860

Difference b/t Feb & Jan: +$7,191

% of net profit to overall gross revenue: 82%

Why We Publish An Income Report

This monthly income report is created for you, Fire Nation!

By documenting the struggles we encounter and the successes we celebrate as entrepreneurs every single month, we’re able to provide you with support – and a single resource – where we share what’s working, what’s not, and what’s possible.

There’s a lot of hard work that goes into learning and growing as an entrepreneur, especially when you’re just starting out. The most important part of the equation is that you’re able to pass on what you learn to others through teaching, which is what we aim to do here.

Let’s IGNITE!

**We’ll receive a commission on the affiliate links below. If you click on my affiliate link and sign up for the products and services I trust and recommend, then I will earn a commission.

Josh Bauerle’s Monthly Tax Tip

What’s up Fire Nation, my name is Josh Bauerle. I’m a CPA and the Founder of CPA On Fire, where we specialize in working with entrepreneurs to minimize their tax liability while keeping them in line with the ever-changing tax laws.

I’ve been working with JLD & Kate at Entrepreneurs On Fire for years now, and they’ve included me in these monthly income reports with unlimited access to all their accounts so I can verify that what they report here is complete and accurate.

And because they believe in delivering an insane amount of value to you, my job doesn’t stop at the verification level; I also provide a new tax and accounting tip every month!

Josh’s Feb Tax Tip: How can I not screw this up?

Sometimes as a CPA you get used to answering the big questions, like:

- “how do I lower my tax liability?”, and

- “what expenses can I deduct?”

And while these are very important questions, it’s easy to forget there’s a lot of people who still need the very basics when it comes to taxes.

I was reminded of this when a Podcasters’ Paradise member asked one simple question:

“How can I not screw this up?”

That question really hit me, because if we can teach people to simply not screw things up when it comes to accounting and taxes, the rest is easy!

If you get that great foundation built, then we can easily add the bells and whistles of minimizing taxes, investing properly, etc.

So for this months tip I’m going to go over three “basics” that if you get right, will put you in tremendous shape for your accounting and taxes, regardless of where you are at in your journey.

1. Proper Bookkeeping

I don’t care if your business is brand new, or has been thriving for 30 years – proper bookkeeping is insanely important.

First of all, it will allow you to properly assess your business. You can’t know how good or bad the business is doing if you don’t know your numbers, and you can’t know your numbers without bookkeeping.

But specifically, from the tax and accounting side of things, proper bookkeeping is absolutely fundamental to everything.

If you are brand new and can’t yet afford an actual bookkeeper, at least get proper account software such as Xero or QuickBooks Online, either of which will allow you to sync up to your bank and credit cards.

And the day you can afford it, I highly recommend outsourcing the bookkeeping to someone else, because chances are, accounting isn’t your strong suit.

Spend your time on what you do best and leave the other tasks to professionals!

2. Choose the Right Entity

Every business has different tax and liability coverage needs, and every entity covers those needs differently.

Should you be a sole proprietor? Partnership? LLC? S Corp or C Corp?

All of these options could be possible depending on your specific needs, and all of them could offer drastically different options.

It’s very important to get this decision right early on, and then continue analyzing your choice of entity as your business and your needs change.

It will impact so many things – from tax liability, to legal liability, to how you pay yourself from the business, and so much more.

Don’t take this decision lightly.

3. Hire Professionals

Want a cheat code that allows you to make sure you get the first two items done correctly right from the start?

Hire the right team of professionals.

Very early on you should have a great CPA, a great attorney, and eventually some type of financial advisor.

The CPA should make sure your accounting and taxes are handled correctly.

The attorney should make sure you are minimizing any potential legal exposure (and for a bonus hire a great insurance agent to make sure you are FULLY covered from legal risk).

And eventually, a financial advisor should be able to help you make sure all the money you are making in the business is going towards making MORE money!

Your team of professionals is incredibly important and something you should look to bring on board as early as possible.

There are all kinds of advanced tips and tactics in the tax and accounting world, and we love discussing them. But if you can start out by just “not screwing things up”, then you are in great shape!

Follow these three steps and you will have a fantastic base to build on.

As always, please feel free to contact me if you’d like to discuss what would be best for YOUR business. I LOVE chatting with Fire Nation!

What Went Down In February

Think Like An Expert Challenge

In February we kicked off what you’ve probably already heard us mention a few times…

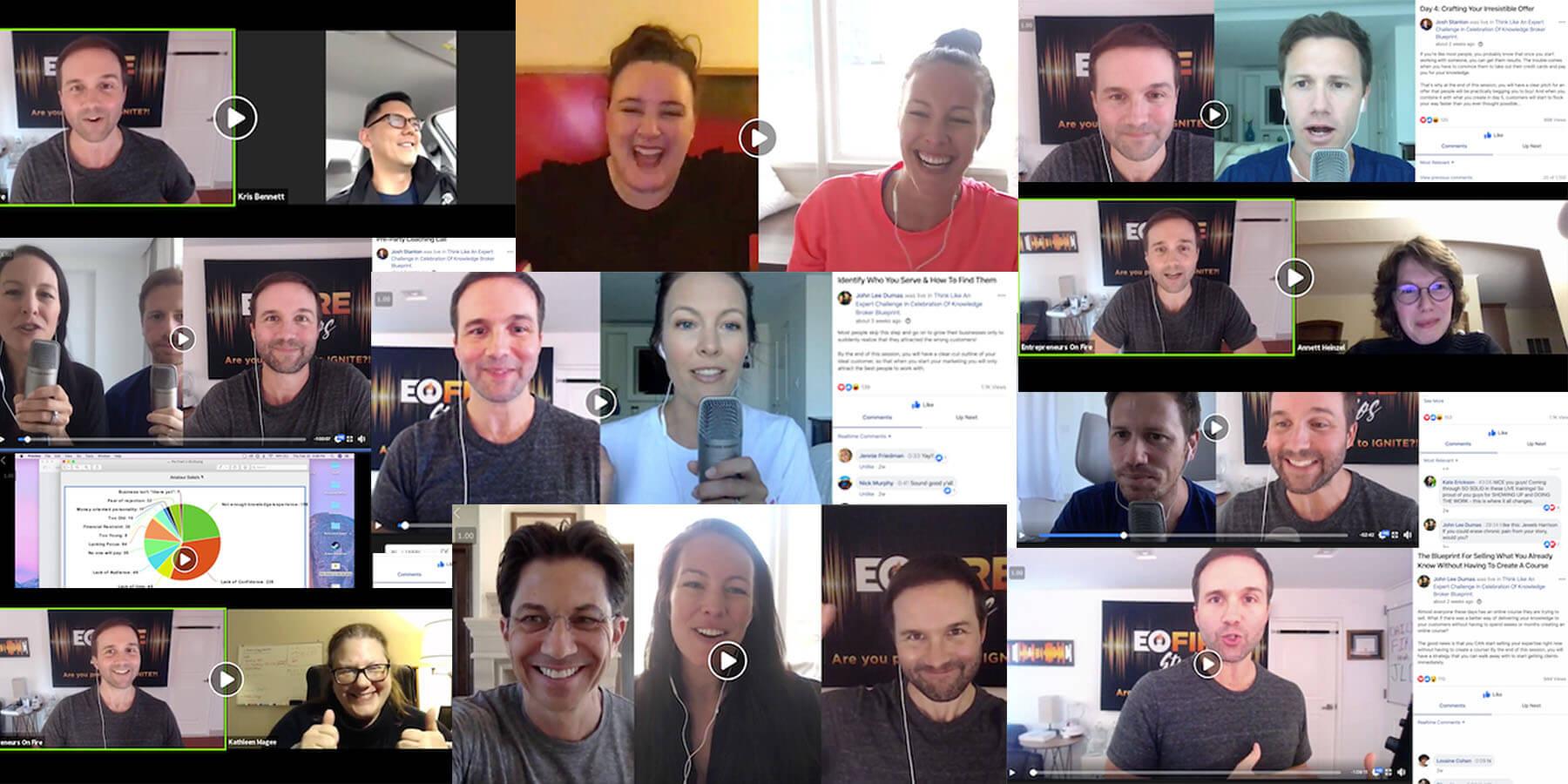

Our Think Like an Expert Challenge!

We teamed up with Jill & Josh Stanton from Screw the Nine to Five to host a 5-day Challenge geared towards helping you identify your perfect customer and create your irresistible offer.

We kicked things off on February 19 with a super fun pre-party to share what to expect over the coming days, and while we said it was a 5-day Challenge, we actually meant 20…

But allow me to clarify by breaking down the itinerary we followed, and in a minute I’m going to share some of our biggest takeaways and lessons from hosting this Challenge in case you decide to run one for your audience, too!

So here’s the Challenge itinerary we followed:

Feb 20 – Day 1: A Dangerously Effective Method for Finding Your Expertise

Feb 21 – Day 2: Defining What Makes Your Area of Expertise Unique

Feb 22 – Day 3: Identifying Who You Serve & How to Find Them

Feb 23 – Day 4: Crafting Your Irresistible Offer

Feb 24 – Day 5: The Blueprint For Selling What You Already Know

And by this time we were having so much fun we decided to just keep the party going!

From Feb 25 – Mar 9 we hosted a LIVE inside the group every day to help those within the Challenge dive deeper in discovering their expertise, identifying their ideal clients, and creating an irresistible offer.

We hosted hot seats, live Q&A’s, and even created additional trainings based on the biggest struggles we were hearing from those within the Challenge group.

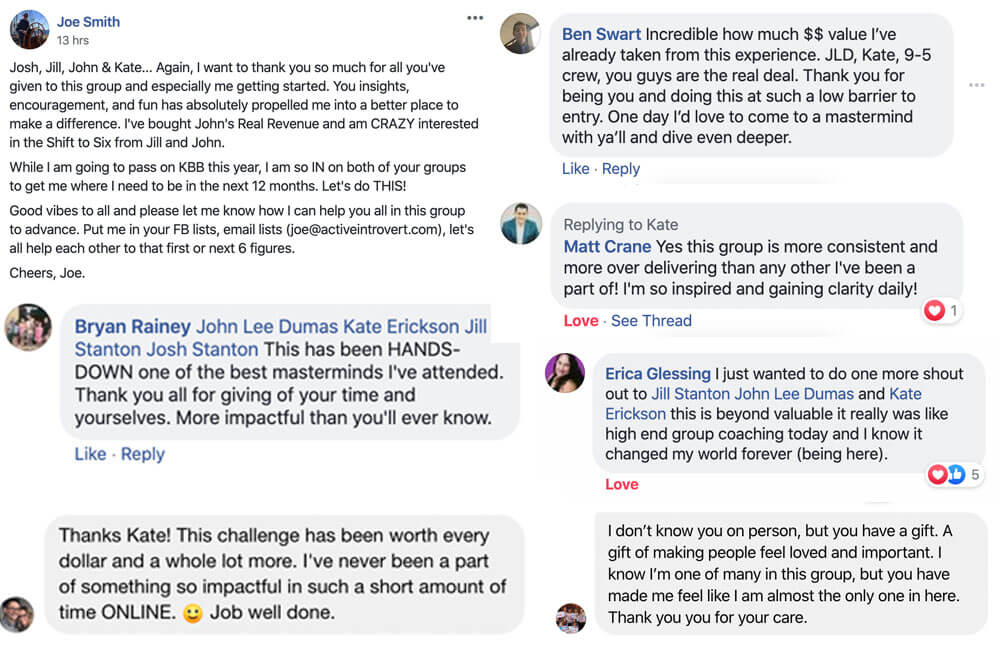

To say this was a powerful 20 days would be an understatement… Here are some of the things our students said about the Challenge:

Where did we come up with the idea to host a 5-day Challenge?

Alright, now let’s get into why we decided to host this Challenge, and what some of our biggest takeaways and lessons were.

So Jill & Josh have run a couple of free Challenges themselves, and as we put together a comprehensive marketing plan for the 2020 Knowledge Broker Blueprint launch, we thought “how can we provide the most amount of value leading up to the promotion?”

Because of the success Jill & Josh had seen with hosting a Challenge leading up to a promotion in their business, we thought it’d be an awesome opportunity for us to experience what it was like to run a Challenge, all while making a huge impact.

What we decided to do a little bit different this time around was make it a paid Challenge versus free. We’d not only seen others in our space do this with great success – we also felt it would be a great way to pre-qualify those coming into the Challenge and ensure everyone was committed to getting results.

And here are a few other key takeaways and lessons learned:

- Paid vs. Free: There are 2 ways to run a Challenge. You can do a free Challenge (great for lead generation and getting a maximum number of participants), or you can run a paid Challenge (great for pre-qualifying those who are coming in plus making sure those joining are committed to getting results)

- Having an agenda: Having a solid outline and agenda for the lessons that would be shared each day was incredibly helpful. This not only gave our students a clear picture of what was to come, but it helped us prepare in the best way possible to deliver maximum value.

- Structure: Without a solid structure for running this Challenge, a lot of things could have gone wrong. We were very regimented each of the 5 days: 7am mindset video, 2pm live video, and a 7pm ‘daily Dean” video. Again, this way everyone knew exactly what to expect, and it allowed us to pre-plan (and pre-record) a lot of the content.

- Teamwork: Without the 4 of us – plus our teams – this Challenge wouldn’t have run as seamlessly as it did. The continuous engagement surpassed what we expected – which is a GREAT thing! – and required ALL hands on deck to provide the level of support and training we did.

I’ll close with this: running a Challenge is A LOT of work. If you’re going to do it right, then plan on it being the only thing you do for the duration of the Challenge.

Knowledge Broker Blueprint Launch

The end of February – and the middle point of our Challenge – brought with it the official 2.0 launch of Knowledge Broker Blueprint, the Tony Robbins and Dean Graziosi method for sharing the knowledge you already have to create next level success and impact.

Knowledge Broker Blueprint is all about helping you extract your existing knowledge and share that with an audience who wants and needs it via live workshops, virtual training, and masterminds.

Throughout the course you’ll not only learn about critical mindset principles from Tony Robbins, you’ll also learned from Dean Graziosi about how to identify your perfect client, niching till it hurts, and top-level marketing strategies he’s tested time and time again.

In addition to all the incredible training included in the KBB course from Tony and Dean, they’ve also brought in several guest expert trainers to pack 2.0 so full of knowledge and tactics that I’m now on Page 60 of notes. That’s no joke!

Everything from social media tactics and advanced ad strategies, to finding your first 100 true fans, to how to crush podcasting (can you guess who that guest expert trainer is?…), to advanced copywriting strategies.

KBB 2.0 truly has it all, including the MindMint Software to act as your operating system. MindMint will help you build your landing and sales pages, create your event agenda, and give you a single place to keep all of your planning tools accessible.

If you want to learn more be sure to check out our review of Knowledge Broker Blueprint!

In March’s income report we’ll be giving you a full recap of how the launch went!

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Feb 2020 Income Breakdown*

Product/Service Income: $117,731

TOTAL Journal sales: 345 Journals for a total of $10,375

The Freedom Journal: Accomplish your #1 goal in 100 days!

- TheFreedomJournal.com: $149 (3 Hardcovers & 2 Digital Pack)

- Amazon: $2,909 (124 Freedom Journals sold!)

- Total: $3,058

The Mastery Journal: Master Productivity, Discipline and Focus in 100 days!

- TheMasteryJournal.com: $124 (2 Hardcovers & 0 Digital Packs)

- Amazon: $1,409 (60 Mastery Journals sold!)

- Total: $1,533

The Podcast Journal: Idea to Launch in 50 Days!

- ThePodcastJournal.com: $106 (2 Hardcovers & 0 Digital Pack)

- Amazon: $5,678 (152 Podcast Journals sold!)

- Total: $5,784

Podcasters’ Paradise: The #1 Podcasting community in the world!

- Recurring: $20,629 (193 recurring)

- New members: $4,349 (17 new members)

- Total: $24,978

Real Revenue: Turn your BIG IDEA into Real Revenue

- New members: $947

The Revenue Crew: An Elite Mastermind ON FIRE!

- Currently closed to new members

Podcast Sponsorship Income: $81,220

Podcast Launch: Audiobook: $160 | eBook: $51

Free Courses that result in the above revenue:

Your Big Idea: Discover your big idea in under an hour!

Free Podcast Course: Create and launch your own podcast!

Funnel On Fire: Create a funnel that converts!

Affiliate Income: $29,604

*Affiliate links below – if you click on my affiliate link and sign up for the products and services I trust and recommend, then I will earn a commission.

Resources for Entrepreneurs: $18,910

- Audible: $188

- BlueHost: $330 Step-by-step guide and 23 WordPress tutorials included! Disclaimer: This is my affiliate link and I will receive a commission if you sign up through my link

- Click Funnels: $17,235

- Coaching referrals: $1,000 (email me for an introduction to a mentor for overall online business or a Podcast focused mentor!)

- ConvertKit: $58

- Disclaimer Template: $0 (legal disclaimers for your website)

- SamCart: $99

- Fizzle Mastermind: $0

- Virtual Staff Finder: $0

Courses for Entrepreneurs: $7,166

- Knowledge Business Blueprint by Tony Robbins: $6,487

- Create Awesome Online Courses by DSG: $679

Resources for Podcasters: $2,340

- Pat Flynn’s Fusebox Podcast Player: $18

- Podcasting Press: $519

- Designrr: $0

- Splasheo: $272

- Tim Paige’s Make My Intro: $0

- Libsyn: $1,399 (Use promo code FIRE for the rest of this month & next free!)

- UDemy Podcasting Course: $132

Other Resources: $1,188

- Amazon Associates: $204

- Other: $984

Total Gross Income in Feb: $147,335

Business Expenses: $22,944

- Advertising: $0

- Affiliate Commissions (Paradise): $1,200

- Accounting: $961

- Cost of goods sold: $1,905

- Charitable Contributions: $0

- Fulfillment (Shipwire): $1,002

- Design & Branding: $455

- Dues & Subscriptions: $71

- Education: $61

- Legal & Professional: $0

- Meals & Entertainment: $301

- Merchant / bank fees: $2,031

- Amazon fees: $4,091

- PayPal fees: $820

- Shopify fees: $11

- Office expenses: $642

- Community Refunds: $1,094

- Promotional: $716

- Travel: $4,029

- Virtual Assistant Fees: $3,238

- Website Fees: $316

Recurring, Subscription-based Expenses: $3,531

- Adobe Creative Cloud: $100

- Boomerang: $50 (team package)

- Bonjoro: $45

- Authorize.net: $70

- Cell Phone: $249

- Direct Heros: $97

- Google Suite: $60

- Internet: $260

- eVoice: $10

- Infusionsoft CRM: $309

- Insurance: $648

- Libsyn: $187

- Chatroll: $49

- Shopify: $68

- Linktree: $6

- Lifeloc: $245 (annual fee)

- Sumo: $29

- TaxJar: $19

- Telestream: $43

- Taxes & Licenses: $523

- Thrive Cart: $37

- Zapier: $15

- Shopify: $312 (annual fee)

- Xero: $30

- Zoom: $70

Total Expenses in Feb: $26,475

Payroll to John & Kate: $15,900

In our May 2014 Income Report and our June 2016 Income Report, Josh focuses on how to pay yourself as an entrepreneur. Check them out!

Wondering what we do with all of our net revenue? We share all in our April 2017 Income Report :)

Total Net Profit for Feb 2020: $120,860

Biggest Lesson Learned

Action builds confidence

There were so many lessons learned throughout February it’s hard to choose just one. However, a recurring limiting belief and theme we picked up on in our Challenge within the first couple of hours of hosting it was around confidence.

When we asked the group what their #1 amateur belief was an astounding 55% replied that it was either they didn’t have enough knowledge or expertise to share with others or they lacked the confidence to do it.

Thing is, within 24 hours of tallying those results we were able to create a huge mindset shift for those people.

By taking 1 single action (posting on social media and asking their friends, family, and followers what they’re best at), a switch flipped. Suddenly they were hearing directly from other people that they were knowledgeable in so many different areas – that their family, friends and followers literally thought of them as an individual when it came to certain topics.

This realization not only flipped the script for those who didn’t believe they had the knowledge or expertise to share, but also for those who lacked the confidence to share it.

Sometimes all it takes is one single action to get that confidence rolling. So what one action will you take today?

Alright Fire Nation, that’s a wrap!

Until next month, keep your FIRE burning!

~ Kate & John

Note: we report our income figures as accurately as possible, but in using reports from a combo of Infusionsoft & Xero to track our product and total income / expenses, they suggest the possibility of a 3 – 5% margin of error.