September 2018 Income At-A-Glance

Gross Income for September: $160,094

Total Expenses for September: $23,137

Total Net Profit for September: $136,957

Difference b/t September & August: -$36,057

Why We Publish An Income Report

This monthly income report is created for you, Fire Nation!

By documenting the struggles we encounter and the successes we celebrate as entrepreneurs every single month, we’re able to provide you with support – and a single resource – where we share what’s working, what’s not, and what’s possible.

There’s a lot of hard work that goes into learning and growing as an entrepreneur, especially when you’re just starting out. The most important part of the equation is that you’re able to pass on what you learn to others through teaching, which is what we aim to do here.

Let’s IGNITE!

**We’ll receive a commission on the affiliate links below. If you click on my affiliate link and sign up for the products and services I trust and recommend, then I will earn a commission.

Josh Bauerle’s Monthly Tax Tip

What’s up Fire Nation, my name is Josh Bauerle. I’m a CPA and the Founder of CPA On Fire, where we specialize in working with entrepreneurs to minimize their tax liability while keeping them in line with the ever-changing tax laws.

I’ve been working with JLD & Kate at Entrepreneurs On Fire for years now, and they’ve included me in these monthly income reports with unlimited access to all their accounts so I can verify that what they report here is complete and accurate.

And because they believe in delivering an insane amount of value to you, my job doesn’t stop at the verification level; I also provide a new tax and accounting tip every month!

Josh’s September Tax Tip: Major Changes to Inventory Deductions

In the tax world, it’s not often we get to report “breaking news”.

Changes to the tax laws tend to be slow and small. Most of the time the average person never even knows the changes happened as they see very little difference in their own personal taxes as a result of them.

This month, that all changes. I finally get to announce some major breaking tax news. And what better place to do it than on Entrepreneurs On Fire!?

Major Changes to Inventory Deductions

You may recall from several past income reports, I discussed how inventory is treated differently than any other deduction. Instead of being deducted in the year it is paid for, like you would for advertising, or travel or almost any other expense, inventory could only be deducted after it was sold.

John and Kate ran into this limitation when they would purchase their various journals and only be allowed to deduct them as they were sold.

Because of this rule, some bad timing on a large inventory purchase could create a major cash flow issue for a business, as they would be paying taxes on profits they didn’t really have.

For example, if XYZ company bought $100,000 worth of inventory on December 15th, and only sold $10,000 worth of it by year end, they would have $90,000 worth of expenses they weren’t allowed to deduct on that years taxes.

It was a silly rule, and it hurt a lot of business owners who didn’t know or understand how it worked.

Suddenly though, this has all changed.

As a part of the major Trump tax law changes, the IRS has recently verified you will now be allowed to deduct ALL inventory purchases in the year you purchase it, regardless of when it sells!

This is a major, major win for inventory based businesses, especially ones who purchase large amounts at a time.

Who Qualifies?

So who qualifies for this awesome new change? Surprisingly, most inventory based businesses. To qualify you only need to meet the two following conditions:

- Less than $25,000,000 in gross sales per year

- Average cost per unit of your inventory is under $2,500

So if you are a book seller who sells $10,000,000 in books per year, and you pay on average $5 per book, you easily qualify for this change.

I would guess 99.9 percent of Fire Nation will qualify as well.

This is a rare, MAJOR change to the tax laws. If inventory is a part of your business it could dramatically impact how much you owe in taxes. It could also open the door to some major tax cutting strategies you can implement before year end.

If you purchase inventory as a part of your business it is more important than ever that you talk to your CPA before year end to make sure you are taking advantage of this change!

As always, please feel free to contact me if you’d like to discuss what would be best for YOUR business. I LOVE chatting with Fire Nation!

David Lizerbram’s Legal Tip

Top 3 Trademark Mistakes

One of the best things business owners can do to protect their intellectual property is to avoid common trademark mistakes. Trademarks are one area of the law where it’s easy to get tripped up.

While many startups don’t seek legal advice when they begin building their trademark portfolio (for obvious reasons), it’s also easy to make serious trademark mistakes that could get you into trouble down the line.

Here are the three most common trademark mistakes that I’ve seen in my practice.

Trademark Mistake #1: Not understanding where trademarks fit into your I.P. portfolio

Intellectual property can be separated into four main categories: patents, copyrights, trade secrets, and trademarks.

Each category is equally important to a startup organization. From the very outset, companies should be thinking about whether to seek protection for the following intellectual assets:

- Patents: Patents provide protection for unique inventions. For example, an inventor could seek a design patent on a new engine design.

- Copyrights: Copyrights protect original works of authorship, regardless of whether they’re published or unpublished. A songwriter, for example, owns the copyright to the songs she writes.

- Trade Secrets: Trade secrets consist of information that is: (1) valuable because it is not known to the public generally; and (2) subject to reasonable efforts to maintain secrecy. A company’s list of sales contacts can be considered a trade secret if the company makes an effort to keep the list secret.

- Trademarks: Trademarks identify and distinguish the source of goods or services. They can include words, logos, symbols, or a combination. Many product names and logos are protected as trademarks.

Understanding these distinctions is critical.

If you spend time and energy seeking a patent on your logo, for example, you’ll be sorely disappointed when your application is rejected by the U.S. Patent & Trademark Office (the “USPTO”) since patent law doesn’t apply to logos.

Trademark Mistake #2: Not understanding “first use in commerce”

United States law protects the person who first uses a trademark in commerce – regardless whether that person ever registered the mark with the USPTO.

Let’s say, for example, that a salon owner in Jefferson County, Texas opened a business called “Nail Party.”

Let’s also assume that she advertised her business throughout the county using flyers and brochures.

Even without seeking trademark protection from the USPTO, the salon owner is said to have a “common law trademark.” A common law mark protects her rights as the first person to use NAIL PARTY in commerce.

Note, however, that common law trademarks are geographically limited. In this instance, the trademark would likely only be protected within Jefferson County.

This is why it’s so important to do nationwide name searches before settling on a business name and applying for a trademark. If other people or companies have used that name in commerce previously, your trademark rights could be severely limited and, by using that business name, you could be subject to a trademark infringement lawsuit.

Trademark Mistake #3: Using the wrong symbol

Using the wrong symbol is one of the most frequent trademark mistakes I see.

Let me explain…

There are two principal types of trademarks, common law trademarks (mentioned above) and registered trademarks. A registered trademark offers the greatest legal protection. It means the owner has applied for a formal trademark with the USPTO and the agency has registered the mark.

Registered marks are designated with a ® symbol. Legally, use of this symbol in connection with an unregistered mark constitutes fraud.

The other trademark designation is the ™ symbol. It can be affixed to a logo or name without formal application or registration with the USPTO. This means that you are free to use ™ on any brand names or logos even if you haven’t applied for a trademark registration, as long as you believe in good faith that you aren’t infringing on anyone else’s trademark rights.

Getting Trademarks Right

Trademark mistakes are easy to make and the consequences can be vast. If you have questions about how to best protect your trademarks, please feel free to contact me. I can provide more information about your trademark issues or handle a full trademark registration.

What Went Down In September

EOFire turns 6!

Happy anniversary, Fire Nation! This month marks our 6 year anniversary since launch on Sept 22, 2012.

Over the past 6 years we’ve been through a lot of ups and downs, and even through the toughest situations we forge ahead because of the ripple effect that, with your help, the Entrepreneurs On Fire podcast continues to create.

Thank you for your continued support, encouragement, and FIRE!

Free Podcast Course

Keeping with one of our favorite strategies in business – continuous improvement – we decided to completely revamp Free Podcast Course.

Simultaneous to its move to Thinkific, we rewrote and re-recorded the entire course, which will help you create and launch your podcast – for free!

Notice we said “will help you create and launch your podcast”. With our revamp we decided to get a lot more focused with what the free course promises to do – straightforward and simple.

While before we included all 3 of the pillars in the free course that we promise to cover in-depth inside of our paid podcasting course, Podcasters’ Paradise, (Create, Grow, & Monetize), we’ve now niched Free Podcast Course to deliver just the very first step: create and launch.

It’s a little too soon to tell if this niche and revamp will improve our leads and conversion, but you know we’ll definitely keep you posted on that!

If you’re ready to create and launch your own podcast, head over to FreePodcastCourse.com today!

Podcast Launch: 3rd Edition

In addition to re-writing and re-recording Free Podcast Course, we also published the 3rd edition of Podcast Launch, the #1 ranked book on Amazon on podcasting!

Podcast Launch continues to be an incredibly valuable piece of content for us in several ways:

- As an extension of our brand on a wide-reaching platform: Amazon

- As a ‘first step’ for many into the world of podcasting

- As a gift on our Podcast Masterclass

Updating Podcast Launch helped us not only improve our calls to action throughout the book, but it also allowed us to update some new tools that have been released in the past several months, along with some new strategies we’ve seen implemented very successfully.

Again, continuous improvement!

If you want to check out the newest edition of Podcast Launch, head over to Amazon today!

Puerto Palooza

We did it for the first time in 2017, and we’re back to do it again in 2019!

We’ve officially locked in Puerto Palooza II for Feb 2019, and we’re so excited to share 3 full days masterminding and enjoying Paradise in Puerto Rico with the 5 attendees who lock in their spot!

Over the 3 days we’ll have 2 full days of hot seats, where you’ll get 2 full sessions: 1 with John on creating your funnel, and 1 with Kate on creating your content plan.

The 3rd day will be a fully planned day of fun in the sun on the beautiful island of Puerto Rico.

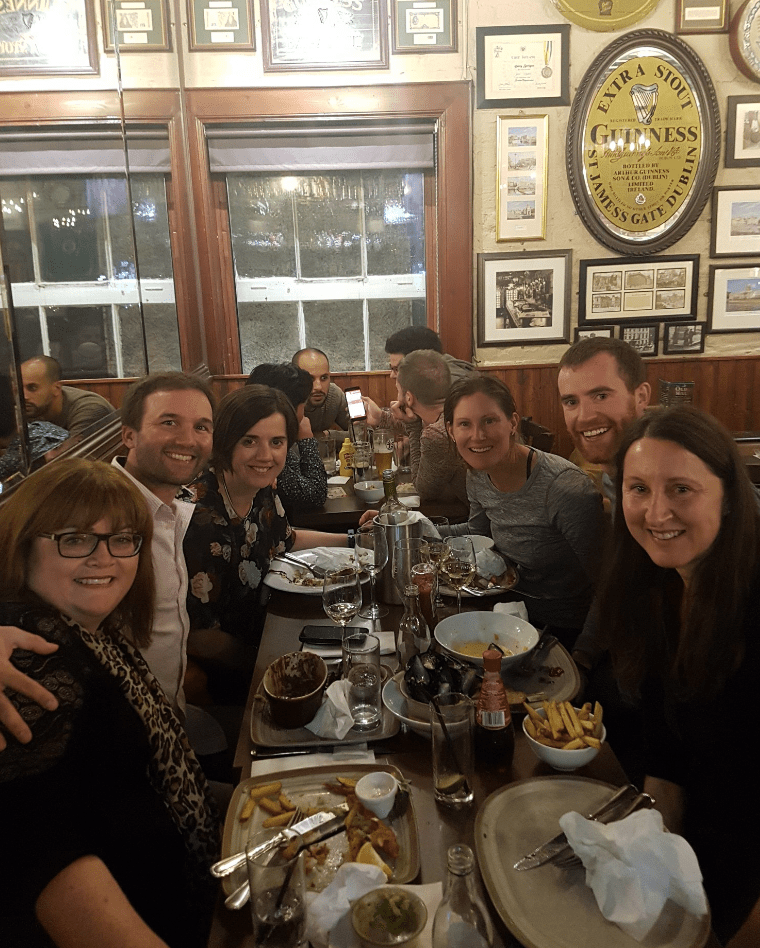

Ireland, Scotland, Belgium, Netherlands, and Denmark

September is also the month that kicked off our 60-day, 12 country European Adventure! Talk about being a location independent entrepreneur… we’re definitely living that throughout September and October!

On Sept 11 we put on our backpacks and jumped on a plane from Puerto Rico to our first stop, Dublin, Ireland.

Our plan? To meet up with as many Fire Nation fans as possible and to explore parts of Europe we haven’t been to before!

In Dublin, Ireland, we had the pleasure of spending time with Mark, Louise, Carmel. We chatted about live webinars, creating software within the podcasting space (and where the medium is headed), plus the power of connecting with others in person at live events.

In Edinburgh, Scotland, we got to spend time with our great friends Mark and Kieran and scare ourselves silly at the underground dungeon!

In Brussels, Belgium, we chatted about our upcoming mastermind event, Puerto Palooza. We set up our strategy for the 3 full days, created an email to send out to our newsletter list announcing the event, and started to set up chats with those who expressed interest via our application form.

In Amsterdam, Netherlands we met up with Gerjo, Mireille & her husband, and Marty. We chatted about the pivot, the dip (if you haven’t read Seth Godin’s book on it, you should!), and exchanged experiences about the saying “work hard, play hard”.

In Copenhagen, Denmark, we strategized Cities By Sound, which has been a huge part of this trip. Cities By Sound is a business idea we’ve been researching and scheming on this Euro Adventure. Stay tuned for more on that :)

I know I’ve just focused on a lot of business-related chats and opportunities we’ve embraced thus far on our travels, but trust me, we’ve had plenty of exploration time mixed in! You can follow along with our trip updates at every stop right here :)

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

September 2018 Income Breakdown*

Product/Service Income: $123,487

TOTAL Journal sales: 320 Journals for a total of $11,682

The Freedom Journal: Accomplish your #1 goal in 100 days!

- TheFreedomJournal.com: $490 (8 Hardcovers & 6 Digital Packs)

- Amazon: $7,254 (204 Freedom Journals sold!)

- Total: $7,744

The Mastery Journal: Master Productivity, Discipline and Focus in 100 days!

- TheMasteryJournal.com: $237 (2 Hardcovers & 4 Digital Packs)

- Amazon: $2,653 (73 Mastery Journals sold!)

- Total: $2,890

The Podcast Journal: Idea to Launch in 50 Days!

- ThePodcastJournal.com: $656 (14 Hardcovers & 1 Digital Pack)

- Amazon: $392 (8 Podcast Journals sold!)

- Total: $1,048

Puerto Palooza: $7,500 (In-person Mastermind in Puerto Rico, Feb 2019!)

Podcasters’ Paradise: The #1 Podcasting community in the world!

- Recurring: $23,732 (213 monthly)

- New members: $6,013 (25 new members)

- Speak to Sell: $6,723

- Total: $36,468

Real Revenue: Turn your BIG IDEA into Real Revenue

- New members: $2,245

The Revenue Crew: An Elite Mastermind ON FIRE!

- Recurring Monthly: $790

Podcast Sponsorship Income: $59,500

Podcast Websites: $5,000

Podcast Launch: Audiobook: $232 | eBook: $70

Free Courses that result in the above revenue:

Your Big Idea: Discover your big idea in under an hour!

Free Podcast Course: Create and launch your own podcast!

Funnel On Fire: Create a funnel that converts!

Affiliate Income: $36,607

*Affiliate links below – if you click on my affiliate link and sign up for the products and services I trust and recommend, then I will earn a commission.

Resources for Entrepreneurs: $25,152

- Audible: $199

- BlueHost: $750 Step-by-step guide and 23 WordPress tutorials included! Disclaimer: This is my affiliate link and I will receive a commission if you sign up through my link

- Click Funnels: $20,652

- Coaching referrals: $3,145 (email me for an introduction to a mentor for overall online business or a Podcast focused mentor!)

- ConvertKit: $125

- Disclaimer Template: $162 (legal disclaimers for your website)

- Fizzle: $119

Courses for Entrepreneurs: $8,420

- Create Awesome Online Courses by DSG: $3,007

- Webinars that Convert by Amy Porterfield: $1,241

- Self-Publishing School by Chandler Bolt: $0

- ASK by Ryan Levesque: $3,506

- Virtual Staff Finder by Chris Ducker: $100

- Opesta by Ethan Sigmon: $566

Resources for Podcasters: $2,395

- Pat Flynn’s Fusebox Podcast Player: $0

- Podcasting Press: $660

- Tim Paige’s Make My Intro: $250

- Libsyn: $1,385 (Use promo code FIRE for the rest of this month & next free!)

- UDemy Podcasting Course: $100

Other Resources: $640

- Amazon Associates: $326

- Other: $314

Total Gross Income in September: $160,094

Business Expenses: $20,451

- Advertising: $676

- Affiliate Commissions (Paradise): $1,650

- Accounting: $350

- Cost of goods sold: $1,895

- Design & Branding: $657

- Education: $20

- Legal & Professional: $0

- Meals & Entertainment: $1,068

- Merchant / bank fees: $2,644

- Amazon fees: $3,406

- PayPal fees: $284

- Shopify fees: $284

- Office expenses: $150

- Community Refunds: $976

- Promotional: $58

- The Freedom, Mastery & Podcast Journal: $0

- Travel: $2,922

- Virtual Assistant Fees: $2,814

- Website Fees: $597

Recurring, Subscription-based Expenses: $2,686

- Adobe Creative Cloud: $100

- Boomerang: $60 (team package)

- Bonjoro: $45

- Authorize.net: $70

- Cell Phone: $202

- Google Suite: $50

- Internet: $80

- eVoice: $10

- Infusionsoft CRM: $309

- Insurance: $648

- Libsyn: $277

- Chatroll: $49

- Shopify: $214

- TaxJar: $19

- Taxes & Licenses: $523

- Zapier: $15

- Zoom: $15

Total Expenses in September: $23,137

Payroll to John & Kate: $15,900

In our May 2014 Income Report and our June 2016 Income Report, Josh focuses on how to pay yourself as an entrepreneur. Check them out!

Wondering what we do with all of our net revenue? We share all in our April 2017 Income Report :)

Total Net Profit for September 2018: $136,957

Biggest Lesson Learned

Initiative wins

This trip has taught me a lot of things about business and life, and that the experiences we continue to share every single day are shaping our reality.

But one of my biggest takeaways up to right now is that initiative wins.

We’ve met up with a lot of incredible people in the countries we’re traveling to, and every one of them has shared a story about how taking initiative has helped them get on the right path to achieving the freedom that they want in their lives.

If you want something, you better get ready to go out and get it for yourself because it will not be brought to you.

Take the initiative to attend that next meet-up, to invest in that mastermind, to reach out to 10 more people than you originally expected to reach out to, to say yes! to an opportunity that – at first glance – might not seem like “the right opportunity”.

You never know who you’re going to meet or where you’ll end up as a result of just taking initiative.

Alright Fire Nation, that’s a wrap!

Until next month, keep your FIRE burning!

~ Kate & John

Note: we report our income figures as accurately as possible, but in using reports from a combo of Infusionsoft & Xero to track our product and total income / expenses, they suggest the possibility of a 3 – 5% margin of error.