April 2018 Income At-A-Glance

Gross Income for April: $123,669

Total Expenses for April: $54,323

Total Net Profit for April: $69,346

Difference b/t April & March: -$63,681

Entrepreneurs On Fire: April 2018 Income Report

Why We Publish An Income Report

This monthly income report is created for you, Fire Nation!

By documenting the struggles we encounter and the successes we celebrate as entrepreneurs every single month, we’re able to provide you with support – and a single resource – where we share what’s working, what’s not, and what’s possible.

There’s a lot of hard work that goes into learning and growing as an entrepreneur, especially when you’re just starting out. The most important part of the equation is that you’re able to pass on what you learn to others through teaching, which is what we aim to do here.

Let’s IGNITE!

**We’ll receive a commission on the affiliate links below. If you click on my affiliate link and sign up for the products and services I trust and recommend, then I will earn a commission.

Josh Bauerle’s Monthly Tax Tip

What’s up Fire Nation, my name is Josh Bauerle. I’m a CPA and the Founder of CPA On Fire, where we specialize in working with entrepreneurs to minimize their tax liability while keeping them in line with the ever-changing tax laws.

I’ve been working with JLD & Kate at Entrepreneurs On Fire for years now, and they’ve included me in these monthly income reports with unlimited access to all their accounts so I can verify that what they report here is complete and accurate.

And because they believe in delivering an insane amount of value to you, my job doesn’t stop at the verification level; I also provide a new tax and accounting tip every month!

Josh’s April Tax Tip: 3 Steps you MUST take to prepare for taxes each year

When I’m not helping Fire Nation with their taxes, you can usually find me coaching our local girls high school tennis team. And we are pretty dang good: we were undefeated last year and we won a league title!

But I’ve noticed a funny thing that happens at the beginning of every season… Our new crop of freshmen come in, most of whom have never picked up a racket before, they see our really good junior and senior varsity girls doing amazing things on the court, and they immediately want to do all the advanced stuff.

The problem is they don’t see the years those girls put into mastering the basic fundamentals.

They don’t yet understand that matches are won almost entirely because of those fundamentals – not because of the amazing shots and serves that rarely happen during a match.

And the more they focus on the advanced stuff, the longer it takes these young players to improve.

They aren’t getting the basics right.

Funny enough, I see this all the time in taxes, too.

Every single year I have multiple clients get smacked with an enormous tax bill that they had no idea was coming, and their first response is always, “I need a more advanced tax strategy”.

They don’t seem to understand that this happened almost entirely because they failed to prepare – NOT because they didn’t have a good enough strategy.

In other words, they want to learn the backhand down-the-line shot before they’ve even learned a basic forehand to keep the match going!

There’s certainly a time and place for advanced tax strategy, but that time and place doesn’t come until you have all the basics in place.

With that in mind, here are 3 steps you MUST take to prepare for taxes each year.

3 Steps to prepare for taxes

1. Proper Bookkeeping

I’ve mentioned bookkeeping on at least 50% of the income report tips I’ve done for EOFire. It’s simply THAT important.

If you aren’t properly tracking your income and expenses during the year, you will have no idea what taxes will look like or what can be done about them.

It’s a must-do, and guess what? There’s not one successful businesses out there that’s ignoring their bookkeeping.

2. Make Estimated Tax Payments

When you’re an employee, your paycheck automatically withholds your expected taxes from your check.

When you’re self-employed, paying taxes becomes your own responsibility.

It can be tempting to just hang on to your money and pay all the taxes owed at year end. But the IRS doesn’t want that to happen, and they will charge you penalties for doing that.

If you want to avoid penalties and drawing the attention of the IRS – plus have a significant portion of your tax liability knocked out before tax season even comes – then do it right and make quarterly estimated payments.

3. Set Aside Extra Tax Money if Needed

Paying those estimated taxes is a fantastic start to preparing properly for year-end taxes, but remember that estimates are always based on what you owed the prior year.

If your business does appreciably better the next year, as we all hope ours do, you will owe more than just your estimates.

What I recommend doing is only paying the minimum amount of estimates required, and then setting up a savings account dedicated solely to saving for additional taxes.

Communicate with your CPA on your plan so you know exactly how much to set aside during the year.

I know the advanced tax strategies are fun and sexy – I enjoy talking about them! But the truth is they are a tiny part of your tax picture.

If you are still getting hit with unexpected tax bills at year-end, then the reality is you are simply not preparing properly.

If you follow the 3 steps above this year, then I can 100% guarantee that you will be completely prepared for whatever tax liability hits you get come tax season. From there, you can work on lowering that amount as much as possible!

As always, please feel free to contact me if you’d like to discuss what would be best for YOUR business. I LOVE chatting with Fire Nation!

What Went Down In April

A look back at 2,000 episodes

When Episode 2,000 dropped on Friday, April 13 – and we shared the results of our Fire Nation survey with you – we also took a big step back…

We really just wanted some time to reflect and appreciate the journey we’ve been on to get where we are right now.

This included going all the way back to the very start: literally to the moment in time that John told me about his idea for Entrepreneurs On Fire for the first time.

After some digging, we were able to find the exact email he sent to me explaining what he had in mind.

We also found a follow up email he sent with more ideas – and the points he thought were most important to express about his idea and what he had in mind for the business. You should definitely tune in to this month’s income report recording to hear us read through parts of these emails :)

But it wasn’t just reflection that Episode 2,000 brought; it also brought a new format for the Entrepreneurs On Fire podcast: an audio masterclass with a successful entrepreneur every Monday, and a Q&A or solo episode with yours truly, JLD, every Thursday.

Let’s be honest: we were a little nervous about the switch – and even more nervous about the feedback we’d receive as a result of the switch.

Great news: we’ve heard nothing but GREAT feedback as a result of the switch – THANK YOU so much, Fire Nation, for reaching out and sharing your thoughts with us! We LOVE hearing from you!

Here are just a couple of the notes we’ve received from you…

Aaron Henderson, founder of LoveTimeFreedom.com, sent us an email with a voice message attached. The subject line: John you rocked ep 2004! And here’s why…

Click here to hear what Aaron had to say…

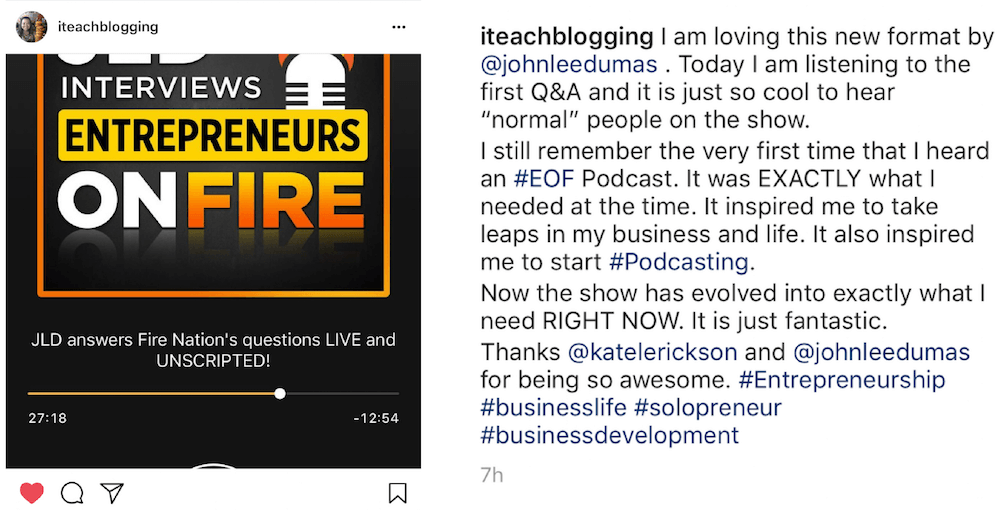

And @ITeachBlogging (Renee Groskreutz) posted on Instagram:

Fire Nation, we so appreciate your feedback and support – thank you!

The Daily Refresh Launches!

The Daily Refresh is our new DAILY podcast where JLD shares a daily quote to inspire the mind, gratitude to warm the soul, and guided breathing to energize the body!

Not only can you subscribe to The Daily Refresh on your favorite Podcast App, but you can also tune in on Amazon Alexa. To check out how to add The Daily Refresh to your daily Alexa Flash Brief, here’s a video tutorial John made just for you!

The Podcast Journal goes to print in China

We’re right on schedule with The Podcast Journal and SO anxious to receive our first sample copy! In the meantime, we’re gathering loads of amazing feedback from our beta users and working hard to get our Fillable PDF ready for launch.

Richie and team from Prouduct are in China right now overseeing the first sample copy and the overall production for The Podcast Journal, which we’ll be launching at Podcast Movement this July!

Sign up for updates and behind-the-scenes content as we produce The Podcast Journal, and if you’ll be attending Podcast Movement, be sure to use promo code FIRE for a special discount – no commissions for us, as we’re passing all the savings on to you!

The Super Funnel is born

I love it when John comes up with new ideas because I feel like I have a backstage pass to look into his brain – exciting stuff!

In April, John came to me with a pretty HUGE idea, which let’s be real, most of his ideas are. But this idea seemed to really fit.

We’ve been producing content here at Entrepreneurs On Fire for over 5 years, and John’s idea for a Super Funnel was kind of blowing up the norm when it comes to how we create content.

Instead of trying to come up with an overall plan to integrate and have all of our 8 free courses and funnels somehow work together, John’s idea for a Super Funnel would be to just have ONE free course and funnel.

My first reaction was to question “what happens to all of our other free courses?”

And after many conversations and back-and-forth, it finally clicked: with ONE focused call to action we can not only improve the user experience for those who come to our website, but we can also improve how we introduce what we have to offer to our prospects.

When you look at it that way, it’s such a no brainer: one call to action, and an easier path through our content.

So the Super Funnel we’re now working on putting together will start with the podcast (as all of our funnels have always started), and then go to one of two places:

- For entrepreneurs who are ready to ROCK their journey: 3 Hours to Your BIG Idea

- For entrepreneurs who are interested in Podcasting: Free Podcast Course

That’s it. No mas.

We cannot wait to launch 3 Hours to Your BIG Idea, and we’ve been working hard behind the scenes to make this free course, and the accompanying upgraded content, the BEST it can be.

If you want to be the first to hear when 3 Hours to Your BIG Idea is ready, sure sure to sign up for exclusive updates!

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

April 2018 Income Breakdown*

Product/Service Income: $80,388

TOTAL Journal sales: 458 Journals for a total of $17,350

The Freedom Journal: Accomplish your #1 goal in 100 days!

- TheFreedomJournal.com: $1,402 (29 Hardcovers & 8 Digital Packs sold!)

- Amazon: $7,839 (216 Freedom Journals sold!)

- Total: $9,241

The Mastery Journal: Master Productivity, Discipline and Focus in 100 days!

- TheMasteryJournal.com: $1,011 (24 Hardcovers & 4 Digital Packs sold!)

- Amazon: $7,098 (189 Mastery Journals sold!)

- Total: $8,109

Podcasters’ Paradise: The #1 Podcasting community in the world!

- Recurring: $24,715 (216 monthly)

- New members: $3,680 (17 new members)

- Total: $28,395

Podcast Sponsorship Income: $29,250

Podcast Websites: $5,000

Podcast Launch: Audiobook: $308 | eBook: $85

Free Courses that result in the above revenue:

Your Big Idea: Discover your big idea in under an hour!

Free Podcast Course: Create and launch your own podcast!

Funnel On Fire: Create a funnel that converts!

Affiliate Income: $43,281

*Affiliate links below – if you click on my affiliate link and sign up for the products and services I trust and recommend, then I will earn a commission.

Resources for Entrepreneurs: $31,914

- Audible: $352

- BlueHost: $300 Step-by-step guide and 23 WordPress tutorials included! Disclaimer: This is my affiliate link and I will receive a commission if you sign up through my link

- Click Funnels: $26,531

- Coaching referrals: $650 (email me for an introduction to a mentor for overall online business or a Podcast focused mentor!)

- Mentorship: $3,750

- ConvertKit: $142

- Disclaimer Template: $50 (legal disclaimers for your website)

- Fizzle: $139

- Infusionsoft: $0

Courses for Entrepreneurs: $7,647

- Create Awesome Online Courses by DSG: $5,688

- Webinars that Convert by Amy Porterfield: $824

- Copywriting Academy by Ray Edwards: $0

- 10k Readers by Josh Turner: $47

- The Amazing Seller by Scott Voelker: $0

- Self-Publishing School by Chandler Bolt: $1,088

- ASK by Ryan Levesque: $0

Resources for Podcasters: $1,521

- Pat Flynn’s Fusebox Podcast Player: $151

- Podcasting Press: $390

- Tim Paige’s Make My Intro: $0

- Libsyn: $925 (Use promo code FIRE for the rest of this month & next free!)

- UDemy Podcasting Course: $55

Other Resources: $2,199

- Amazon Associates: $421

- Other: $1,778

Total Gross Income in April: $123,669

Business Expenses: $50,993

- Advertising: $4,304

- Affiliate Commissions (Paradise): $1,845

- Accounting: $980

- Cost of goods sold: $2,880

- Consulting: $3,767

- Design & Branding: $1,980

- Education: $347

- Legal & Professional: $970

- Meals & Entertainment: $635

- Merchant / bank fees: $3,883

- Amazon fees: $11,525

- Shopify fees: $56

- PayPal fees: $131

- Office expenses: $1,062

- Payroll Tax Expenses / Fees: $1,513

- Paradise Refunds: $1,750

- Promotional: $187

- Total Launch Package fees: $0

- Sponsorships: $5,500

- The Freedom & Mastery Journal: $0

- Travel: $1,776

- Virtual Assistant Fees: $3,364

- Website Fees: $2,538

Recurring, Subscription-based Expenses: $3,330

- Adobe Creative Cloud: $100

- Boomerang: $70 (team package)

- Brandisty: $24

- Bonjoro: $25

- Authorize.net: $70

- Cell Phone: $235

- DocuHub: $60 (annual fee)

- Internet: $249

- eVoice: $10

- Infusionsoft CRM: $396

- Insurance: $551

- Libsyn: $288

- Chatroll: $49

- ScheduleOnce: $470 (annual fee)

- Shopify: $176

- TaxJar: $19

- Taxes & Licenses: $523

- Zoom: $15

Total Expenses in April: $54,323

Payroll to John & Kate: $15,900

In our May 2014 Income Report and our June 2016 Income Report, Josh focuses on how to pay yourself as an entrepreneur. Check them out!

Wondering what we do with all of our net revenue? We share all in our April 2017 Income Report :)

Total Net Profit for April 2018: $69,346

Biggest Lesson Learned

Always be on your toes

It was my least favorite lesson when I was a basketball player in high school, but it’s proven to be a valuable one time and time again – even off the court.

It’s easy to get comfortable in business. Things have been going really great for Entrepreneurs On Fire over the past several years, and sometimes, that means we’re not paying as close attention to the details as we should be.

Whether it’s a glitch in Infusionsoft, a mis-match in the books, a labeling issue with our Journals, or not paying close enough attention to deadlines, you have to always be on your toes.

It’s not easy being an entrepreneur and taking responsibility for everything that happens in your business, but it’s a requirement if you want to continue to be successful.

Alright Fire Nation, that’s a wrap!

Until next month, keep your FIRE burning!

~ Kate & John

Note: we report our income figures as accurately as possible, but in using reports from a combo of Infusionsoft & Xero to track our product and total income / expenses, they suggest the possibility of a 3 – 5% margin of error.