February 2018 Income At-A-Glance

Gross Income for February: $172,606

Total Expenses for February: $43,181

Total Net Profit for February: $129,425

Difference b/t February & January: -$9,954

Free and amazing trainings!

Free Podcast Course: Learn how to create and launch your podcast!

Your Big Idea: Discover Your Big Idea in less than an hour!

Entrepreneurs On Fire: February 2018 Income Report

Why We Publish An Income Report

This monthly income report is created for you, Fire Nation!

By documenting the struggles we encounter and the successes we celebrate as entrepreneurs every single month, we’re able to provide you with support – and a single resource – where we share what’s working, what’s not, and what’s possible.

There’s a lot of hard work that goes into learning and growing as an entrepreneur, especially when you’re just starting out. The most important part of the equation is that you’re able to pass on what you learn to others through teaching, which is what we aim to do here.

Let’s IGNITE!

**We’ll receive a commission on the affiliate links below. If you click on my affiliate link and sign up for the products and services I trust and recommend, then I will earn a commission.

Josh Bauerle’s Monthly Tax Tip

What’s up Fire Nation, my name is Josh Bauerle. I’m a CPA and the Founder of CPA On Fire, where we specialize in working with entrepreneurs to minimize their tax liability while keeping them in line with the ever-changing tax laws.

I’ve been working with JLD & Kate at Entrepreneurs On Fire for years now, and they’ve included me in these monthly income reports with unlimited access to all their accounts so I can verify that what they report here is complete and accurate.

And because they believe in delivering an insane amount of value to you, my job doesn’t stop at the verification level; I also provide a new tax and accounting tip every month!

Josh’s February Tax Tip: What if I can’t pay my tax bill?

One of the most frequent questions I get this time of year is:

What can I do about an IRS tax bill that I’m not in a position to pay?

What are your options if after filing your taxes you have a big, fat, nasty tax bill that you just don’t have the cash to pay?

The first thing to note is: you absolutely need to improve your planning and preparing for future taxes!

Taxes aren’t an unexpected expense.

If you make money, then you will pay taxes, and they do come up at the same time every year…

When you’re doing things right, you should have a really good idea of how much you will owe in taxes, and you should be:

- Making estimated tax payments throughout the year, and

- Setting extra money aside to pay taxes above the estimates.

But I know the last thing you want to hear when you’re looking at a large IRS bill that can’t be paid is a lecture on what you should have done…

So let’s focus on what you can do now to get the bill taken care of.

If you owe taxes when filing your return, here are your options:

You can pay the bill in full.

As painful as this may feel, if you have the funds available to do it, this is always the best course of action. Getting the IRS and state out of your hair is always the preferred way to go.

If your total bill is under $50,000, then you can make a payment arrangement with the IRS and states.

Believe it or not, the IRS is actually very easy to work with here.

The easiest thing to do is call them up (1-800-829-1040), tell them the exact amount you owe and that you need to set up an installment agreement.

They will ask how much you want to pay per month, and as long as that monthly payment will have the total paid off within five years, then they will almost definitely agree to it.

Also note: they will charge you interest, likely between 4 and 6 percent.

If you have a very LARGE tax bill and you not only can’t pay it now – but know you will never have the ability to pay it back – you can attempt an offer to compromise with the IRS.

This is basically where you tell the IRS: “I know I owe you $XXX, but I have no funds to pay this now – and it’s not looking like I will in the future, either. Will you accept $XXX instead?”

If you go this route I highly recommend using a tax attorney to help. Getting the IRS to wipe out a tax bill is serious business, and you need to make the best case possible.

Use an expert.

Here is one course of action you should not take: extending you return because you know you have a large bill looming you can’t pay right now.

The IRS gives you an extension to file, but not to pay.

Even if you extend your return they will expect your payments to be made by April 15th, and they will hit you with some potentially hefty failure to pay penalties if they aren’t.

An unexpected tax bill can happen to the best of us. If it happens to you, follow one of the courses of action above to take care of it.

Remember, one tax bill you aren’t prepared for can be chalked up to ignorance, but if it happens again, then it’s irresponsible financial management on your part – and the IRS will see it as such.

Take control of your business finances right now and understand that taxes are one of the biggest parts of that!

As always, please feel free to contact me if you’d like to discuss what would be best for YOUR business. I LOVE chatting with Fire Nation!

What Went Down In February

East Coast to West Coast

February brought with it a lot of cross-country travel for us, and luckily, we were prepared!

Well, kind of…

Our travels started Feb 1 with a trip to Maine to visit the Dumas clan. We literally went from 87 degrees to -7 degrees in 48 hours!

Weather aside, we had an awesome trip, which included:

- A ski weekend at Sugarloaf Mountain

- Quality time with the family

- An 8-hr trip down to Providence College for a campus tour and to watch the Friars take down Georgetown

- Multiple birthday celebrations :)

Our 2 weeks in Maine were amazing, but we were definitely ready to thaw out!

Next stop: San Diego.

We spent the next 3 weeks in San Diego visiting the Erickson’s, and while SD didn’t quite live up to its “perfect sunny-all-the-time weather”, we were happy to be out of the teens.

Our first 2 weeks consisted of a quick trip up to SF for Kate with her sister, followed by loads of family and friends time, and then a solid week of all things meetup and conference-related!

We kicked off conference week with an all-day tour of Pacific and Mission Beach with our great friend Mark Asquith.

Within a couple of days we were moving out of Pacific Beach and into Downtown for Traffic and Conversion Summit (more on T&C in just a minute), followed by Social Media Marketing World (more on SMMW in March’s report).

Traffic & Conversion Summit

Traffic and Conversion Summit is put on by Ryan Deiss and the team over at Digital Marketer. It’s largely targeted towards online marketers and entrepreneurs who are looking to drive more traffic to their website and content, and then, turn that traffic into qualified leads and sales.

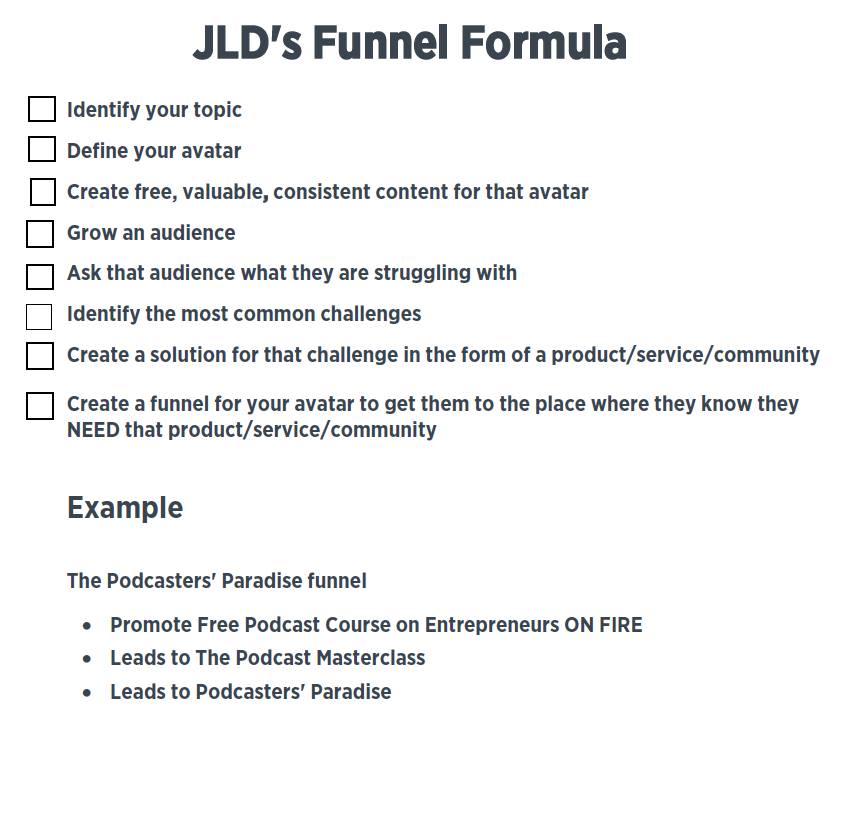

John took the stage to talk about The Fire Funnel, and how you have to funnel up BEFORE you even think about funneling down.

Here’s a little sneak peek at JLD’s Funnel Formula:

With Traffic and Conversion Summit came a lot of amazing opportunities to network and meet up with those who had traveled near and far to join forces with some of the brightest minds in the online entrepreneurial space.

John had an amazing opportunity to meet up with a great crew for dinner, organized by our good friend Andrew Warner of Mixergy.

Another meet up was hosted by Pat Flynn at WeWork in downtown San Diego, which was filled with friends both old and new!

By the end of the Summit we were ready to do it all over again, starting with John doing a presentation for Frank Kern’s full-day Mastermind (I know, how does he do it?!)

Here’s a mini recap of Traffic and Conversion Summit…

Social Media Marketing World

Right on the heels of Traffic and Conversion (literally the day T&C ended, SMMW started!) we were moving into the hotel next door for Social Media Marketing World.

But because that brings us into March, we’ll dive into SMMW and our biggest lessons learned in our March income report!

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

February 2018 Income Breakdown*

Product/Service Income: $120,710

TOTAL Journal sales: 470 Journals for a total of $18,499

The Freedom Journal: Accomplish your #1 goal in 100 days!

- TheFreedomJournal.com: $1,586 (27 Hardcovers & 18 Digital Packs sold!)

- Amazon: $9,087 (233 Freedom Journals sold!)

- Total: $10,673

The Mastery Journal: Master Productivity, Discipline and Focus in 100 days! +2

- TheMasteryJournal.com: $845 (18 Hardcovers & 5 Digital Packs sold!)

- Amazon: $6,981 (192 Mastery Journals sold!)

- Total: $7,826

Podcasters’ Paradise: The #1 Podcasting community in the world!

- Recurring: $25,694 (231 monthly)

- New members: $7,262 (19 new members)

- Total: $32,956

Podcast Sponsorship Income: $64,000

Podcast Websites: $5,000

Podcast Launch: Audiobook: $200 | eBook: $55

Free Courses that result in the above revenue:

Your Big Idea: Discover your big idea in under an hour!

Free Podcast Course: Create and launch your own podcast!

Funnel On Fire: Create a funnel that converts!

Affiliate Income: $51,896

*Affiliate links below – if you click on my affiliate link and sign up for the products and services I trust and recommend, then I will earn a commission.

Resources for Entrepreneurs: $42,364

- Audible: $689

- BlueHost: $150 Step-by-step guide and 23 WordPress tutorials included! Disclaimer: This is my affiliate link and I will receive a commission if you sign up through my link

- Click Funnels: $31,930

- Coaching referrals: $750 (email me for an introduction to a mentor for overall online business or a Podcast focused mentor!)

- Mentorship: $7,500

- ConvertKit: $116

- Disclaimer Template: $148 (legal disclaimers for your website)

- Fizzle: $581

- Infusionsoft: $500

Courses for Entrepreneurs: $4,650

- Create Awesome Online Courses by DSG: $3,457

- Webinars that Convert by Amy Porterfield: $824

- 10k Readers by Josh Turner: $70

- The Amazing Seller (Amazon Course) by Scott Voelker: $0

- Self-Publishing School by Chandler Bolt: $0

- ASK by Ryan Levesque: $299

Resources for Podcasters: $4,091

- Pat Flynn’s Fusebox Podcast Player: $36

- Podcasting Press: $519

- Tim Paige’s Make My Intro: $2,547

- Libsyn: $943 (Use promo code FIRE for the rest of this month & next free!)

- UDemy Podcasting Course: $46

Other Resources: $791

- Amazon Associates: $579

- Other: $212

Total Gross Income in February: $172,606

Business Expenses: $40,878

- Advertising: $850

- Affiliate Commissions (Paradise): $1,602

- Accounting: $1,026

- Cost of goods sold: $2,455

- Consulting: $3,485

- Design & Branding: $1,980

- Education: $224

- Legal: $0

- Meals & Entertainment: $2,124

- Merchant / bank fees: $1,186

- Amazon fees: $5,103

- Shopify fees: $27

- PayPal fees: $232

- Office expenses: $354

- Payroll Tax Expenses / Fees: $1,526

- Paradise Refunds: $615

- Promotional: $40

- Total Launch Package fees: $0

- Sponsorships: $11,875

- The Freedom & Mastery Journal: $0

- Travel: $861

- Virtual Assistant Fees: $3,170

- Website Fees: $2,143

Recurring, Subscription-based Expenses: $2,303

- Adobe Creative Cloud: $100

- Boomerang: $70 (team package)

- Brandisty: $24

- Authorize.net: $70

- Cell Phone: $270

- Internet: $80

- eVoice: $10

- Infusionsoft CRM: $396

- Insurance: $551

- Libsyn: $270

- Manychat: $65

- Chatroll: $49

- Shopify: $176

- TaxJar: $19

- MeetEdgar: $49

- Interact Quiz Software: $89

- Zoom: $15

Total Expenses in February: $43,181

Payroll to John & Kate: $15,900

In our May 2014 Income Report and our June 2016 Income Report, Josh focuses on how to pay yourself as an entrepreneur. Check them out!

Wondering what we do with all of our net revenue? We share all in our April 2017 Income Report :)

Total Net Profit for February 2018: $129,425

Biggest Lesson Learned

The Power of Live Events

Since I became an entrepreneur I’ve always been a big fan of live events, because no matter your personality type or where you are in your business, they bring such a huge benefit (if leveraged correctly).

Over five years ago I was attending a live event in Portland, ME. I had just taken my first entrepreneurial leap, and I was scared, I felt alone, and I had no clue what I was doing.

That live event – and the twenty + that I attended over the next six months – taught me how to talk to other business people, some of whom were potential clients.

This month, I attended Traffic and Conversion Summit, and I was excited, surrounded by people who are on the same path as me, and I loved every minute of it.

Not only have live events helped me become more confident when it comes to talking with other entrepreneurs and business owners, but they’ve also helped me connect with both existing and new friends along my journey.

And while I’m a huge fan of the benefits online communication have brought us, that in person connection cannot be replaced.

So whether you’re just starting out and feeling scared and alone on your journey, or you’ve been rockin’ the entrepreneurial thing for a while now, I highly encourage you to leverage live events for the confidence and relationship building opportunities they offer.

Alright Fire Nation, that’s a wrap!

Until next month, keep your FIRE burning!

~ Kate & John

Note: we report our income figures as accurately as possible, but in using reports from a combo of Infusionsoft & Xero to track our product and total income / expenses, they suggest the possibility of a 3 – 5% margin of error.