June 2017 Income At-A-Glance

Gross Income for June: $178,750

Total Expenses for June: $43,449

Total Net Profit for June: $135,301

Difference b/t June & May: +$20,182

Free and amazing trainings!

Free Podcast Course: Learn how to create and launch your podcast!

Your Big Idea: Discover Your Big Idea in less than an hour!

Entrepreneurs On Fire: June 2017 Income Report

Why We Publish An Income Report

This monthly income report is created for you, Fire Nation!

By documenting the struggles we encounter and the successes we celebrate as entrepreneurs every single month, we’re able to provide you with support – and a single resource – where we share what’s working, what’s not, and what’s possible.

There’s a lot of hard work that goes into learning and growing as an entrepreneur, especially when you’re just starting out. The most important part of the equation is that you’re able to pass on what you learn to others through teaching, which is what we aim to do here.

Let’s IGNITE!

**We’ll receive a commission on the affiliate links below. If you click on my affiliate link and sign up for the products and services I trust and recommend, then I will earn a commission.

CPA On Fire’s Monthly Tax Tip

What’s up Fire Nation, my name is Josh Bauerle. I’m a CPA and the Founder of CPA On Fire, where we specialize in working with entrepreneurs to minimize their tax liability while keeping them in line with the ever-changing tax laws.

I’ve been working with JLD & Kate at Entrepreneurs On Fire for years now, and they’ve included me in these monthly income reports with unlimited access to all their accounts so I can verify that what they report here is complete and accurate.

And because they believe in delivering an insane amount of value to you, my job doesn’t stop at the verification level; I’ll also be providing tax and accounting tips to you along the way!

Josh’s June Tax Tip: Spending money in the startup phase

The startup phase of a business is an exciting time. It’s filled with hope and possibilities of what the future will hold for your brand new business.

But it’s also likely a time of spending money.

From office equipment, to software, to mentors and everything in between, before you are bringing in money you are likely spending a decent chunk of it.

And that’s fine – most businesses have to spend a little money on the essentials before they can start making money. However, when it comes to taxes there are some rules to be mindful of when it comes to spending money in the startup phase.

First, let’s define the startup phase

In the eyes of the IRS, the startup phase lasts until you are open for business and ready to start accepting money from paying customers.

This doesn’t mean you have to have your first sale to be out of startup phase, you just have to be open and ready for business.

Why does it matter what the IRS considers the startup phase of your business?

Because the amount of deductions you can write-off during the startup phase may be limited.

Basically, the IRS will only allow you to write off up to $5,000 of startup expenses in the year they were incurred. The remaining amount will have to be amortized over 15 years.

Let’s look at an example and see how this plays out in real life.

Lets say you started a new business around a podcast.

And lets say that between your equipment, education (including Podcasters’ Paradise, of course!), mentors, etc. you racked up $20,000 in expenses before your business was officially ready to take on sponsors and start making money.

In that case, the first $5,000 of the $20,000 total will be immediately deductible on that years taxes.

The remaining $15,000 will have to be amortized over 15 years – meaning you can only deduct $1,000 per year over the next 15 years.

That’s quite a bite out of what seemed like a huge tax deduction!…

When you’re just getting started with a new business, it’s easy to get carried away in the excitement and start spending more money than you need to, and a lot of people use the idea that the money being spent is a tax deduction as justification for spending it.

That’s why it’s important to understand the tax rules around startup expenses.

If it’s something you truly need, the deduction is just an added bonus. Otherwise, it’s always best to start out lean and stick to the necessities. The IRS rules around startup expenses are just one more reason to do so.

As always, please feel free to contact me if you’d like to discuss what would be best for YOUR business. I LOVE chatting with Fire Nation!

What Went Down In June

JLD’s Providence College 15-yr Reunion

It’s always tough for me (JLD) to come to terms with the fact that College only lasted for four years, because the impact it had and the memories made seem to outweigh that reality by a long shot.

To think I have been OUT of college 4 times longer than I was IN college is mind-blowing, but all we can do is try to enjoy the moment and treasure the memories.

Memories were made on my 15-year Providence College reunion, which happened to coincide with PC’s 100 year anniversary.

It was a weekend of fun, sun, and friends. I hope your summers are filled with the same Fire Nation!

3 Weeks in Maine & Cali

Once the reunion weekend was over, John and I met up in Maine for a week filled with more sunshine, docks, lakes and family time.

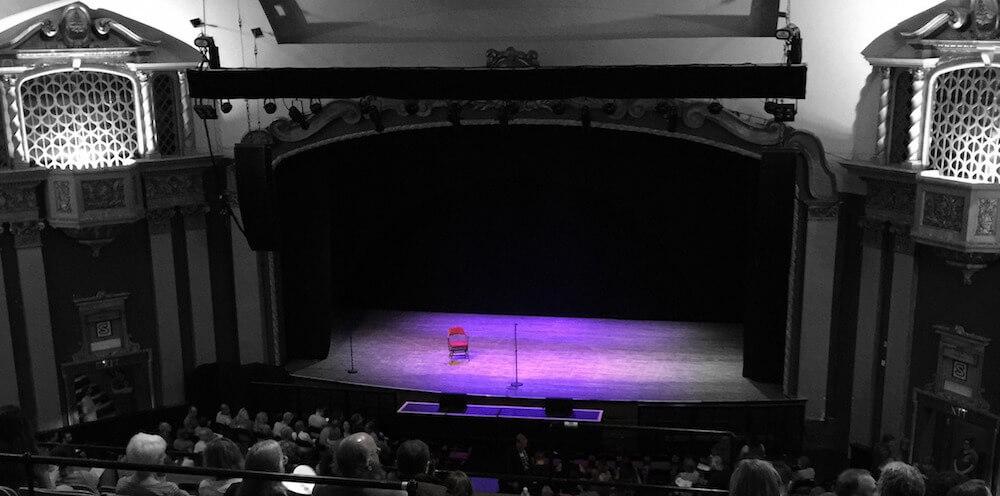

It’s pretty amazing what we were able to fit into a single week, including seeing Mamma Mia at the Ogunquit Playhouse and getting tickets to see The Moth podcast LIVE at the State Theater in Portland!

With beautiful weather, great company and a ton of games and laughs, Maine proves once again it’s The Way Life Should Be.

The end of week one sent me packing to Las Vegas to meet up with my family for four days, followed by a 3 day camping trip in Carlsbad, and then a fun-filled week of water parks and bbq’s in San Diego!

John stayed put in Maine to speak at Maine’s Startup & Create Week in Portland, check out the American Ninja Warrior gym, meet up with Puerto Palooza Alum Steve Cabral, and spend some great QT with his family ==>

Working on the road continues to get easier as we learn how to prepare better and how to best set aside specific focus time for work.

A Farewell to FireUP

A couple of months ago we announced a new project in one of our income reports: FireUP.

FireUP was a suite of website apps we were creating with a partner, JC, to help improve email optin conversions and turn your website visitors into leads and sales.

Sounds pretty awesome, right?!

Unfortunately, our MVP didn’t make it.

With low interest and a lot of time invested, we chatted with JC and made the tough decision to shut it down.

Fire Nation, proof of concept is SO important; otherwise you could end up spending a lot of time and money creating something that doesn’t stick. Fortunately, with several checkpoints we were able to recognize the early signs and cut our losses.

We’re so grateful for the partnership and friendship we’ve solidified through this experience. JC and his team are absolute rockstars, and we’ve really enjoyed this experience working with them.

Never be afraid to say good-bye to a project or something else in your business that you know isn’t working. Be sure you have the analytics and data in place to backup your decision, as this can make a really tough decision at least a little bit easier to make.

A Merchant Roadblock

Turns out moving ourselves and the business to Puerto Rico involves way more moving pieces than we had originally anticipated…

While we knew the move wouldn’t be easy, there were a lot of unknowns that, one year later, we’re still running into.

One of the bigger roadblocks we’ve faced has to do with our merchant account, which is the service that pays us after our customer’s credit card has been successfully charged.

This has always been so confusing to me… but essentially how it works when you own an online business and accept online payments is:

- Your customer pays for a product / service via an online form

- That payment is ‘processed’ by a payment processor

- The payment processor sends an approval code to your merchant

- Your merchant charges the customer

- Upon a successful charge, your merchant then sends you the money

There are a lot of providers that make this process super simple so you’re not having to involve multiple companies. A few of those easy-to-use payment systems are Shopify, Amazon, Stripe and PayPal.

When you use one of these services as your gateway to selling products, the processor and the merchant are bundled up.

However, with the requirements of our business being here in Puerto Rico, it’s been tough to find a simple solution because a lot of these ‘all-in-one’ services don’t support Puerto Rico.

So about a year ago, as we were getting things set up after our move, we were contacted by someone who told us that Heartland, a merchant provider, was definitely the merchant for us – they could support Puerto Rico and we’d be in great hands.

Of course, the honeymoon phase of our relationship with Heartland was incredible, but one year later I found myself wishing we’d never been introduced.

It’s all part of being an entrepreneur and running your own business, right?

In the moment, that reminder doesn’t always make you feel better. This is one of the toughest, most challenging situations I’ve dealt with in my 4+ years as an entrepreneur.

What it came down

Heartland couldn’t handle Puerto Rico, and so they passed us off to another merchant company called Global about one year after taking us on as a client.

Once we were transferred over to Global, everything fell apart:

- Insanely poor communication on Heartland’s part

- AMEX transactions weren’t being settled

- Discover cards were all being declined

- Our payment processor was actually shut down at one point, causing EVERY online payment to be declined

- 2 merchant accounts were opened simultaneously…

…the list goes on.

The worst part about our merchant situation…

NONE of this was brought to our attention by Heartland or Global – we caught all of it ourselves.

This alone proves how insanely important it is to take 100% ownership and responsibility for your business. This could have happened to anyone – whether you’re in Alabama, California, the UK, or anywhere else in the world, having your finger on the pulse is a HUGE deal.

After about 20 hours of customer service calls and reaching out to anyone and everyone I could think of, it turns out Global won’t process AMEX payments for Puerto Rico.

Seems like something that should have been communicated at the very beginning, right?

This meant we not only had to have our merchant account open with Global, but we now had to open a completely independent merchant account with AMEX (and in the end, we opted to no longer accept Discover cards because we would have had to go through the same process there).

I could go on, but I won’t.

Roadblocks are inevitable – it’s how you handle them that determines your success.

The bottom line here is that there are going to be roadblocks you’ll face on your journey that will make you feel like giving up.

They don’t make any sense.

They are frustrating and feel like a huge waste of time.

And it can feel like NO ONE else cares.

Over the past several months I’ve felt completely helpless, angry, upset, and everything in between. But it is this type of challenge that sets successful entrepreneurs apart: we don’t give up.

Never forget that you, as a business owner, must take 100% ownership and responsibility for what’s happening (or not happening) in and to your business.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

June 2017 Income Breakdown*

Product/Service Income: $117,198

TOTAL Journal sales: 732 Journals for a total of $28,801

The Freedom Journal: Accomplish your #1 goal in 100 days!

- TheFreedomJournal.com: $3,697 (76 Hardcovers & 25 Digital Packs sold!)

- Amazon: $11,417 (279 Freedom Journals sold!)

- Total: $15,114

The Mastery Journal: Master Productivity, Discipline and Focus in 100 days!

- TheMasteryJournal.com: $3,783 (78 Hardcovers & 25 Digital Packs sold!)

- Amazon: $9,904 (249 Mastery Journals sold!)

- Total: $13,687

Podcasters’ Paradise: The #1 Podcasting community in the world!

- Recurring: $21,669 (5 annual, 207 monthly)

- New members: $8,925 (31 new members)

- Total: $30,594

Podcast Sponsorship Income: $51,500

Podcast Websites: $5,700

Skills On Fire: $452

Podcast Launch: Audiobook: $128 | eBook: $23

Free Courses that result in the above revenue

Your Big Idea: Discover your big idea in under an hour!

Free Podcast Course: Create and launch your own podcast!

Funnel On Fire: Create a funnel that converts!

Affiliate Income: $61,552

*Affiliate links below – if you click on my affiliate link and sign up for the products and services I trust and recommend, then I will earn a commission.

Resources for Entrepreneurs: $53,936

- Audible: $272

- BlueHost: $0 Step-by-step guide and 23 WordPress tutorials included! Disclaimer: This is my affiliate link and I will receive a commission if you sign up through my link

- Click Funnels: $51,324

- Coaching referrals: $750 (email me for an introduction to a mentor for overall online business or a Podcast focused mentor!)

- ConvertKit: $131

- Disclaimer Template: $50 (legal disclaimers for your website)

- Fizzle: $552

- LeadPages: $657

- Virtual Staff Finder: $200

Courses for Entrepreneurs: $5,942

- DSG’s Create Awesome Online Courses: $3,589

- Ray Edwards’ Copywriting Academy: $110

- Ramit Sethi: $1,995

- Self-publishing School: $150

- Bryan Harris’ 10k Subscribers: $98

Resources for Podcasters: $974

- Pat Flynn’s Fusebox Podcast Player: $24

- Podcasting Press: $360

- Libsyn: $530 (Use promo code FIRE for the rest of this month & next free!)

- UDemy Podcasting Course: $60

Other Resources: $700

- Amazon Associates: $632

- Other: $68

Total Gross Income in June: $178,750

Business Expenses: $40,036

- Advertising: $1,620

- Affiliate Commissions (Paradise): $1,007

- Accounting: $350

- Cost of goods sold: $3,491

- Design & Branding: $1,980

- Education: $230

- Legal & Professional: $1,357

- Meals & Entertainment: $1,341

- Merchant / bank fees: $1,419

- Amazon fees: $8,502

- Shopify fees: $169

- Stripe fees: $9

- PayPal fees: $302

- Office expenses: $922

- Payroll Tax Expenses / Fees: $1,422

- Paradise Refunds: $870

- Sponsorships: $7,750

- Show notes: $372

- Travel: $2,143

- Virtual Assistant Fees: $3,295

- Website Fees: $1,485

Recurring, Subscription-based Expenses: $3,413

- Adobe Creative Cloud: $100

- Boomerang: $70 (team package)

- Brandisty: $24

- Authorize.net: $91

- Cell Phone: $200

- Dropbox: $100 (annual)

- Internet: $300

- eVoice: $10

- Infusionsoft CRM: $396

- Insurance: $551

- Libsyn: $207

- Manychat: $30

- Chatroll: $49

- PureChat: $20

- ScheduleOnce: $9

- Skype: $3

- Shopify: $190

- TaxJar: $19

- ThriveCart: $690 (1-time fee)

- Workflowy: $5

- MeetEdgar: $49

- Taxes & Licenses: $300

Total Expenses in June: $43,449

Payroll to John & Kate: $15,900

In our May 2014 Income Report and our June 2016 Income Report, Josh focuses on how to pay yourself as an entrepreneur. Check them out!

Wondering what we do with all of our net revenue? We share all in our April 2017 Income Report :)

Total Net Profit for June 2017: $135,301

Biggest Lesson Learned

Don’t rush; practice patience

I’ve realized over the past several months that patience comes in a lot of shapes and sizes and is used in many different situations:

- In line at the grocery store,

- When we’re driving in traffic,

- As we’re setting up our first funnel,

- During a product launch,

- Every time our friend or partner ‘does that thing’…

What I’ve learned from this realization is that life is so much better when we’re able to separate ourselves from whatever frustration or anger might come as a result of the waiting game.

When I saw this quote from Joyce Meyer, it felt like it came at the perfect time:

Patience is not simply the ability to wait – it’s how we behave while we’re waiting.

Just the same way you can’t move the line at the grocery store, or dictate traffic, or know how to set up a funnel before you’ve actually set one up, you can’t rush your business journey.

Take a step back and appreciate what it is you’re creating.

Work hard, power through the tough roadblocks, get back up after you’ve been knocked down – but never let a lack of patience be the reason you quit.

Alright Fire Nation, that’s a wrap!

Until next month, keep your FIRE burning!

~ Kate & John

Note: we report our income figures as accurately as possible, but in using reports from a combo of Infusionsoft & Xero to track our product and total income / expenses, they suggest the possibility of a 3 – 5% margin of error.