June 2015 Income At-A-Glance

Gross Income for June: $388,643.22

Total Expenses for June: $98,468.52

Total Net Profit for June: $290,174.70

Difference b/t June & May: –$136,908.30

EOFire’s June 2015 Monthly Income Report

Why We Publish An Income Report

This monthly income report is created for you, Fire Nation. By documenting the struggles we encounter and the successes we celebrate as business owners every single month, we’re able to provide you with support – and a single resource where we share what’s working, what’s not and what’s possible.

There’s a lot of hard work that goes into learning and growing as an entrepreneur, especially when you’re just starting out. The most important part of the equation is what you’re able to pass on what you learn to others through teaching, which is what we aim to do here at EntrepreneurOnFire.

Let’s IGNITE!

**We’ll receive a commission on the affiliate links below. If you click on my affiliate link and sign up for the products and services I trust and recommend, then I will earn a commission.

CPA On Fire

Our CPA, Josh Baurle, shares his June Income Report Tip!

What’s up Fire Nation, my name is Josh Bauerle. I’m a CPA and the Founder of CPA On Fire, where we specialize in working with entrepreneurs to minimize their tax liability while keeping them in line with the ever changing tax laws.

I’ve been working with EntrepreneurOnFire to make sure their accounting systems are running smoothly and their taxes are as low as possible. John and Kate have included me in the monthly income reports with unlimited access to all their accounts so I can verify that what they report here is complete and accurate.

And because they believe in delivering an insane amount of value, my job doesn’t stop at the verification level; I’ll also be providing tax and accounting tips to you along the way!

4 Tips to securing a mortgage as an entrepreneur

I spend a lot of time on these income report tips sharing the financial benefits of being an entrepreneur instead of an employee – and there are certainly a lot of benefits.

But I’d be lying if I said everything was better as an entrepreneur.

There are some things that become more difficult, and as I’ve discovered first-hand over the past few months, one of those things is buying a house. Or more specifically, securing a mortgage.

As an employee, the process of getting a mortgage is fairly simple and straightforward. As an entrepreneur, it’s anything but.

Since I just went through the grueling process of buying a house and securing the mortgage for it, we thought we’d change it up a bit this month and give you four tips to securing a mortgage as an entrepreneur.

1. You will likely need at least two years of tax returns

Your mortgage lender is probably going to want to see at least two years of tax returns showing that your business is making money, and they’re probably going to take the average of those two years to determine your income.

This can present a problem if you are in your first few years of business. For example, if you are two years into your business and made $20,000 the first year and $80,000 the next, they’ll probably only consider your income to be $50,000 a year.

This is also another good reason not to delay in filing your tax returns (as some entrepreneurs are prone to doing).

2. Some expenses may be able to be added back into your income

The bad news is all those great tax deductions you spent all year planning for and using to reduce your taxes could hurt you when you go to get a mortgage.

The good news is, many of them, such as depreciation and mileage, can be added back to your income with the right lender.

Make sure to ask your lender about add back expenses.

3. Your debt is a big deal

A lot of entrepreneurs, especially those just starting out, are carrying some added debt. Maybe you took on some credit card debt to get your business up and running, or maybe you carry a little extra debt to keep a comfortable cash reserve in the bank.

Either way, this debt makes things difficult when it comes buying a home.

Basically, the lender is going to look at the amount of money you pay towards debt each month vs. the amount of money you make each month. So even if you can’t pay off the debt entirely, you can make your case stronger by reducing your monthly payments.

4. Use a lender experienced in working with entrepreneurs

As I always say about working with a tax professional, you want to work with someone who understands your line of work. A mortgage broker or lender is no different.

I highly recommend finding someone who works heavily with entrepreneurs and can guide you through the process.

This tip could very well be the difference between landing your dream house and not!

As with all areas of finance, securing a mortgage as an entrepreneur takes time and planning. If you plan to buy a house and are self-employed, following these four tips will make your life much easier!

I’m always here as a resource if you have any questions! Please feel free to contact me if you’d like to discuss what would be best for YOUR business. I LOVE chatting with Fire Nation!

What Went Down In June

Rock The Stage – Live

John joined Pat Flynn up in Northern Cali for a 1-day event put on by Josh Shipp (former EOFire guest and one of our Top 10 interviews!) called Rock The Stage. Check out these two!

Listen in to the income report recording for a recap of the event from John!

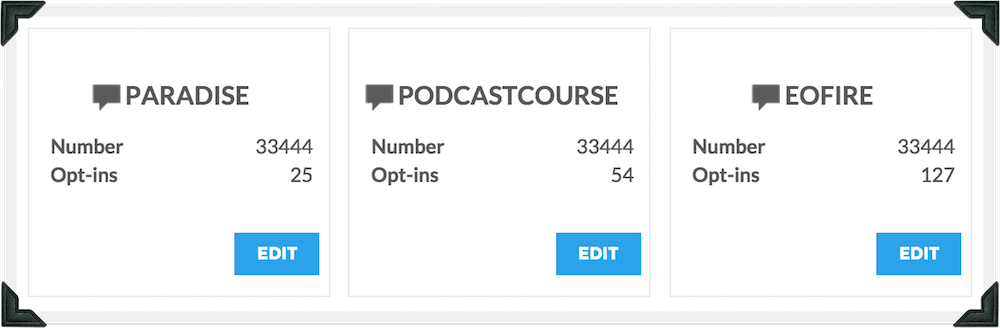

LeadDigits

In June we went live with our text message call to action on the podcast to help drive opt in’s to our bi-weekly live Podcast Workshop.

This isn’t the first time we’ve tried the text message opt in call to action – in fact, last year we were on quite the roll with text opt ins, increasing our Workshop show up rates by an average of nearly 15% most weeks.

But when we pulled back on our weekly live Workshops in early 2015, the flat rate we were paying each month to continue using the text opt in service didn’t make as much sense.

Now that LeadDigits has come out with a much more direct opt in opportunity for mobile users – instead of texting in to receive text notification / reminders, you’re opting in to the actual email notifications, with the convenience of a text message vs. having to remember a website URL that you have to go visit later to opt in – making it much more user-friendly for those who are listening to the podcast on-the-go.

Now those who are listening to the podcast while driving, on a run or while they’re multi-tasking (away from their computer), have a quick and easy option to opt in for the next live Podcast Workshop via text.

LeadDigits made it a no brainer to start testing out text message opt in’s again.

Over the past month, we’ve seen a steady stream of attendees who are opting in using the text option – as you can see in the image above, we also have text message opt in opportunities for our newsletter list and The Free Podcast Course.

The biggest plus to implementing text message opt in’s in your business? Well, if you’re a podcaster it’s one of the best ways to transition your listeners into newsletter subscribers.

John’s Computer Meltdown

It’s Saturday at 4pm and John has been on 10-minute blitz calls with new members of Podcasters’ Paradise for about 10 hours (yes – you heard that right – 10 hours!)

As he kicks his feet up on his desk, headed into the home stretch, he bumps his water glass, which then tips over.

No biggie since he keeps his monitor on a raised platform, right?

WRONG.

What’s not on a raised platform is his brand new power tower: a space, memory and speed machine that ran around $3k, and that he purchased earlier in June.

I had just walked in the door, and when I saw the look on John’s face, I knew whatever had just happened wasn’t good.

Unexpected disasters happen to everyone, but the good news is that YOU choose how to react to – and handle – the situation.

Was it fun to run around San Diego – trying to recover and reboot his power tower? Of course not. But it certainly could have been A LOT worse.

Recovery and reboot was ultimately a success!

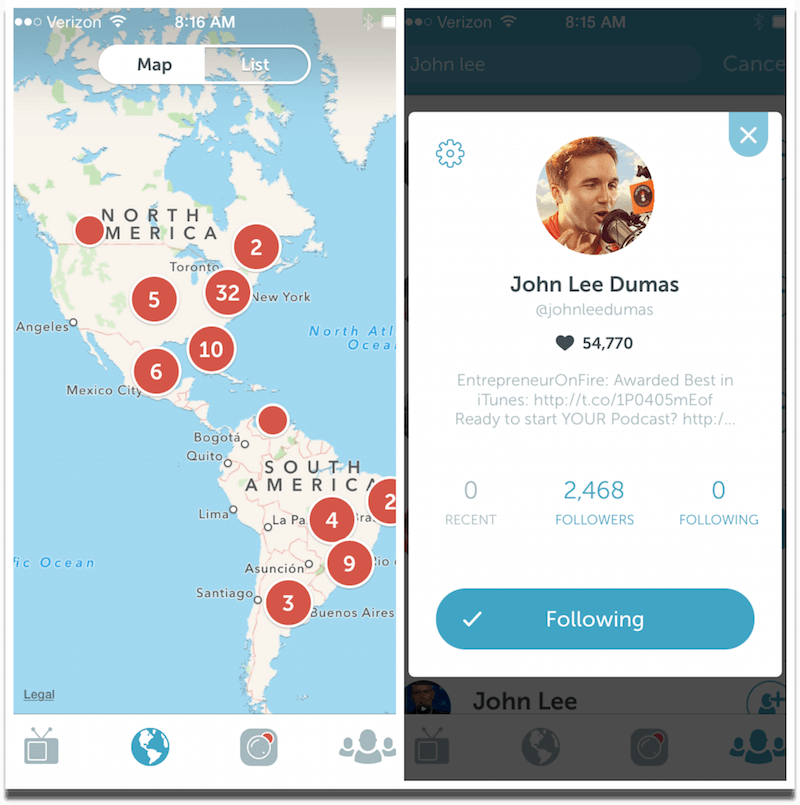

Cool New Tools: Periscope & Clammr

Cool new tools are coming out ALL the time, and there is definitely a fine line when it comes to checking these cool new tools out. Are they going to be something you can actually leverage to grow your business, or will they simply be another shiny object you should have ignored?

In June, we spent time checking out 2 fairly new tools, Periscope and Clammr, in an attempt to figure out whether or not these would make good feature videos in our Podcasters’ Paradise community to help our members grow their podcast audience and promote their business.

Here’s what we found out…

What is it, a who is Periscope for?

Periscope is a live video feed – you press record and those on Periscope who are looking for a stream to watch (or who are following you) tune in to check out what it is you’re up to!

Periscope is for you if you have a podcast, a blog, a vlog, or any other media-focused business where you’re looking to share a “behind-the-scenes” look into your day-to-day (or your time at an event, meet up or other business-related activity).

Not to say you have to do it day-to-day, but growing a following on Periscope can be difficult, so it’s probably best leveraged if you already have an audience who you can direct to your Periscope channel to tune in when you decide to “go live” with a video.

Periscope is a great way to continue the relationships you’ve already established with your audience and help your audience get to know, like and trust you on a whole new level!

What is it, and who is Clammr for?

Clammr is an app on iOS and Andriod that will allow you to “advertise” your podcast episode with an 18-second audio clip. It might be your voice, a snippet from your actual podcast episode, or a combination of the two.

Clammr is for you if you have a podcast and are looking to promote each of your episodes consistently through sharing an 18-second bit that links back to your entire mp3 episode (or a webpage of your choice).

If you’re thinking Clammr might be for you, then the discoverability potential is definitely high – another platform means more opportunities to be “found”; however, we definitely recommend going “all-in” if you’re going to try Clammr – consistency on platforms like this are key.

How We Met In The Middle to Re-open Paradise

When May rolled around, we decided to close the doors to Paradise.

We rolled out a “closing campaign” during those 5 days, and as a result, we welcomed 254 new members into Paradise.

Then, during almost the rest of May, the doors were close. During that period, we had 560 people opt in to find out when the doors re-opened, and on May 29th we started rolling out sequences announcing the reopening to select contacts (segmented lists).

That re-opening campaign resulted in 122 new members ($165,851 in invoice total revenue).

But what happened during the month we were closed?

How did we even decide on when we’d reopen?

…and what would that re-opening would look like?

Well, for starters, during the month we were closed we did a lot of work bringing our community team members up to speed on the new programs we have to offer; plus, John and I did a significant amount of work to update and re-record a lot of the videos in Paradise that were becoming out of date.

We knew the re-opening would result in a lot of excitement, especially for those who had signed up to hear about it, but the “scarcity” part is something we went back and forth with quite a bit.

What should the pricing be?

How can we best communicate this to a list of people who have heard us already promise specific things about the re-opening?

We spent a lot of time going back and forth about these things because above all else, we wanted to be sure the re-opening followed the path we had set up.

As an example, while John wanted to open Paradise back up at the same price we closed it at, that seemed like quite the risk to me since a huge part of our closing campaign was telling people that the price would never be the same.

A great lesson learned for us is that you won’t always have a clear path ahead – sometimes figuring out what happens next doesn’t actually take place until you’re there, and having each other to bounce ideas off of and someone to review our past campaigns with can make all the difference.

RescueTime summary

RescueTime is an incredibly powerful tool for anyone looking to manage their time more efficiently. In fact, John and I both attribute a huge chunk of our time management and efficiency skills to the RescueTime App itself.

Honing these skills starts with fully recognizing what it is you’re spending your time on, and most people don’t take the time to track this because it’s difficult to write down every single thing you do in a day.

With RescueTime, you have software constantly working behind the scenes to log your time for you. Simply, easy and so powerful!

Kate’s June: 188.25 hours (vs. 147.5 in May)

Kate’s top 3 sites for the month:

1. EntrepreneurOnFire.com

2. Infusionsoft

3.Facebook (Community Mgmt)

John’s June: 195 hours (vs. 162 in May)

John’s top 3 sites for the month:

1. Gmail

2. Adobe Audition

3. Skype

Our team

We also have our teams’ contributions to add! We’re so grateful for each and every one of our team members, who without, we couldn’t be doing what we’re doing.

Our team includes 3 full-time virtual team members: JM, Jess, and Tipu; and 1 part-time virtual team member: Lisa. Much love to Team Fire!

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

June 2015 Income Breakdown

Product/Service Income: $360,811.08

Podcasters’ Paradise: $218,876 (invoice total)

Create, grow, and monetize YOUR Podcast.

Free Podcast Course: $0 (it’s free :-)

A 15-day Podcast course on how to create, grow, and monetize YOUR Podcast.

Complete Podcast Course: $195

WebinarOnFire: $23,967 (invoice total)

Create and present a Webinar that converts.

The Webinar Course: $0 (it’s free :-)

A 10-day Webinar course on how to create and present Webinars that convert!

Complete Webinar Course: $10

The Fire Path Action Guide: $27

Sponsorship Income: $105,875.08

Fire Nation Elite Mastermind: $10,926

Total Launch Package: $0

Blitz Calls: $750

Podcast Launch (Audiobook on Audible): $132

Podcast Launch (eBook on Amazon): $53

Affiliate Income: $27,832.14

*Affiliate links below – if you click on my affiliate link and sign up for the products and services I trust and recommend, then I will earn a commission.

- BlueHost: $3,300 Step-by-step guide and 23 WordPress tutorials included! Disclaimer: This is my affiliate link and I will receive a commission if you sign up through my link

- Ramit Sethi’s 3 Courses: $0

- LeadPages: $1,435

- Coaching referrals: $3,826 (email me for an introduction to a mentor for overall online business or a Podcast focused mentor!)

- Tim Paige Voice Over: $160 (ask for the Fire Special)

- Audible: $1,272

- AudioBooks FREE Audio Book!: $595

- Infusionsoft: $371

- Fizzle: $0

- Aweber: $0

- Amber Ludwig-Vilhauer: $170

- Easy Webinar: $0

- Fire Pole Marketing: $127

- Music Radio Creative: $45

- David Siteman Garland: $8,782

- Optimize Press: $0

- LifeOnFire: $801

- Rick Mulready’s Facebook & Instagram Ads Training: $485

- Libsyn: $437 (promo code Fire)

- Podcast Movement: $0 (promo code Fire)

- WP Curve: $290

- Optin Monster: $0

- Virtual Staff Finder: $0

- UDemy Podcasting Course: $181

- SendOutCards: $738

- Viper Chill: $2,640

- ClickBank: $286

- Amazon: $1,098

- Other: $793.14 (includes cash rewards from cc)

Total Gross Income in June: $388,643.22

Business Expenses: $96,647.51

- Advertising: $4,068 (includes Facebook ads)

- Affiliate Commissions (Paradise): $8,348

- Accounting: $250

- Design & Branding: $1,715

- Education: $904 (conferences included)

- Meals & Entertainment: $1,242

- Merchant / bank fees: $5,617

- PayPal fees: $1,241

- Office expenses: $4,069 (includes postage, comp repair)

- Software expenses: $250.67

- Libsyn: $255

- Other Business Expenses: $716 (promotional & conference wear included)

- Paradise Refunds: $37,035 (invoice total)

- WebinarOnFire Refunds: $4,007 (invoice total)

- The Fire Path Refunds: $0 (invoice total)

- Fire Nation Elite expenses: $5,113

- TheMidRoll (Sponsorships): $17,645.84

- Total Launch Package Fees: $155

- Travel: $1,553

- Virtual Assistant Fees: $2,227

- Website Fees: $236

Recurring, Subscription-based Expenses: $1,821.01

- Adobe Creative Cloud*: $100

- Boomerang*: $14.99

- Authorize.net*: $91.10

- Cell Phone*: $240

- Internet*: $110

- eVoice*: $9.95

- Infusionsoft CRM*: $389

- Insurance*: $551

- Chatroll: $49

- ScheduleOnce*: $16

- Skype*: $2.99

- Spotify: $9.99

- Payroll fee: $77

- Workflowy*: $4.99

- MeetEdgar*: $49

- WPCurve*: $29

- Taxes & Licenses (recurring): $77

Total Expenses in June: $98,468.52

Payroll to John and Kate: $13,193

In our May Income Report, Josh focused on how to pay yourself as an entrepreneur. Check it out!

Total Net Profit for June 2015: $290,174.70

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Lesson Learned In June

How you know it’s time to move on or pivot

Just because your community or members tell you they want something doesn’t necessarily mean they are going to leverage and utilize it, and YOU have to be the judge of whether or not a specific project or program is worth the time you or your team are investing in it. This was a huge lesson learned for us in June.

But how do you figure this out?

Well, it starts with setting SMART goals for everything you work on in your business, because with SMART goals you’ll know whether or not whatever you’re doing is working. SMART goals are what will help make it an easy decision as to whether you should move on or pivot.

The specific project we were working on in June that we had to stop and ask ourselves: is it time to move on from this? were the Paradise Meet Up Hubs.

We started doing the Hub Meet Ups in Paradise in Q4 2014 in an effort to help Paradisers who lived in the same city meet up in person once per quarter. What we quickly found out after two quarters of this was that they weren’t quick picking up the steam we had hoped for.

So we pivoted.

One of the biggest pivots we made with the Hubs was going to monthly to try and gain traction and momentum.

But when the third monthly meet up came around – after we had implemented a bunch of additional engagement ideas to boot – we continued to receive emails from our Hub Leaders saying they were showing up to meet ups and no one was there.

That’s when we knew it was time to move on.

Being in The Dip

There will be several times along your journey when you’ll find yourself in The Dip – the space where you need to decide whether or not continuing on in order to try and get yourself out is worth the time, energy, and resources you’re giving it.

Moving on from the Hub Meet Ups was a tough decision emotionally speaking, but we know it was the right one to make not just because our gut said so, but because we had set SMART goals for what we wanted the Hubs to look like: Full participation in at least 10 locations on a consistent basis, which was not happening.

Next time you’re faced with moving on or pivoting with a project or business idea, remember: if what it is you’re working on isn’t getting you one step closer to your SMART goal – if you’re not making progress day after day towards achieving what it is you set out to do – then it’s time to move on or pivot.

In order to communicate our decision to Paradise, we started at the top: it was important to notify our Hub Leaders (those who helped us in each of the locations) first, and subsequently, the entire community. We let our Hub Leaders know that we still encourage the meet ups, and will help support those who wish to continue, but that we wouldn’t be continuing to push the meet ups the same way we had in the past.

We also decided to maintain an Events Page in Paradise so that those Paradisers who are interested in continuing to meet up with other podcasters in person are “in-the-know” when it comes to in person events. This made it an easy transition away from the Hubs without completely letting go of the importance of meeting up with other like-minded people in person.

Alright Fire Nation, that’s a wrap!

Until next month, keep your FIRE burning!

~ Kate & John

Note: we report our income figures as accurately as possible, but in using reports from Infusionsoft to track our product income, they suggest the possibility of a 3 – 5% margin of error.

Click here for all of EntrepreneurOnFire’s Income Reports