April 2023 Income At-A-Glance

Gross Income for April: $181,607

Total Expenses for April: $15,914

Total Net Profit for April: $165,693

Difference b/t April & March: +$26,374

% of net profit to overall gross revenue: 91%

Why We Publish An Income Report

This monthly income report is created for you, Fire Nation!

By documenting the struggles we encounter and the successes we celebrate as entrepreneurs every single month, we’re able to provide you with support – and a single resource – where we share what’s working, what’s not, and what’s possible.

There’s a lot of hard work that goes into learning and growing as an entrepreneur, especially when you’re just starting out. The most important part of the equation is that you’re able to pass on what you learn to others through teaching, which is what we aim to do here.

Check out all of our monthly income reports – from the very beginning!

Let’s IGNITE!

**We’ll receive a commission on the affiliate links below. If you click on my affiliate link and sign up for the products and services I trust and recommend, then I will earn a commission.

Ron Parisi’s Monthly Tax Tip

Hello, Fire Nation! Ron Parisi from CPA On Fire here with our April 2023 Tax and Accounting tip.

At CPA On Fire, we specialize in working with entrepreneurs to minimize their tax liability while keeping them in line with the ever-changing tax laws.

Our firm has been working with JLD & Kate at Entrepreneurs On Fire for years now, and they’ve included me in these monthly income reports with unlimited access to all their accounts so I can verify that what they report here is complete and accurate.

And because they believe in delivering an insane amount of value to you, my job doesn’t stop at the verification level; I also provide a new tax and accounting tip every month!

Ron’s April Tax Tip: Venture Capital (VC): What you need to know

Today I’m discussing Venture Capital (VC). I’m excited to share CPA on Fire’s experiences with VC deals in 2022 & YTD 2023!

I’ll cover two main topic areas today:

- Why you should be familiar with VC, and why VC may be interested in your company; and

- The VC process, and how to prepare yourself for a possible exit.

Why Be Aware of VC Firms? Why Are They Interested in You?

Most recent VC deals we’ve seen are on a consolidated/aggregated basis.

They are bringing together companies for scale – merging 3 to 5, or even up to 10 businesses of similar types.

The larger, resulting operation allows many expenses to be cut and redundancies eliminated.

VC’s know how to operate businesses – from a CPA standpoint, they will often know your numbers better than you. They are financially savvy, always delving into and maintaining current financial records.

They excel in increasing profit margins and generating cash flow.

This is something important to remember, especially if planning a potential exit – VC is a valid option to maximize your company’s value.

The VC Process and How to Prepare

Before the transaction, there’s a due diligence stage where the VC firms dig deep – especially when they see any variations within the organization.

They scrutinize the financials, looking for any discrepancies.

One of the biggest surprises is their emphasis on past forecasts and budgets. They wanted to hear about previous projections and how those estimated revenues and expenses compare to actuals.

This surprises me because it is a new VC emphasis. It is interesting to see that VC firms are checking in on how well you were able to predict your own businesses.

Best to understand the possible exit strategies involving VC; it is worthwhile to understand and prepare for the VC process when contemplating exit strategies.

Again, this is Ron Parisi, from CPA on Fire, always wonderful to be with you, Fire Nation. Till next month, go out there and crush it!

Those of you in Fire Nation who are entrepreneurs and business owners and are looking to upgrade your financial operations in 2023, check out our website: CPAOnFire.com!

We’ve been able to get our clients amazing results and would love to help you out as well. Book a call through our website and let us show you how we can help your business grow.

What Went Down In April

Interview of the Month

How to Do a TEDx Talk in the Next 90 Days (even if you aren’t a speaker) with Taylor Conroy

3 Value Bombs

- You have a message inside you. Don’t let it just stay inside until the day you die. It’s meant to come out to the world and impact the people that it is meant to reach.

- Your higher perceived value correlates to how much you get paid to speak. So, if you want to do free gigs, don’t do a TEDx talk. If you want to get paid gigs, do a TEDx talk.

- In reality, the one thing that matters, and the one thing that will contribute more to a paid speaking career than anything else, is having one authority-building, credibility-building talk that you can send to the right people who have a budget to pay you to speak.

Thought-Leader.com: You’re One Step Away From Becoming A Speaker On The World’s Biggest Stage. Book a free call today!

Preparing for a month away

Come May 1 we will be off on our next epic adventure: a 23-day river cruise across Europe on the Danube and Rhine! We start in Bucharest and make our way West to Amsterdam.

Because we only plan to record this specific income report while we’re on the boat – and we want to have as much free time as possible to enjoy the tours and views from our balcony and the top deck of our Viking cruise boat – we batched A LOT of work ahead of time!

We still plan on checking in each day while we’re traveling. Typically speaking, we probably log about 30 minutes to 1 hour of work each day while we’re on the road.

This time is spent:

- Checking email

- Doing any related tasks from emails

- Doing our social media sweep

But this isn’t our first rodeo. You might remember us talking about prepping for our 90-day European adventure back in 2018. We even created a 4-part series on how to prepare for your next trip (whether it’s 3 days or 90!)

Well, that’s pretty much what our April looked like: preparing for our time away.

Here’s a list of the things we wanted to check off before our departure:

John’s list:

- Record and edit EOFire episodes through June 15

- Record sponsor reads and insert into episodes through June 15

- Upload EOFire episodes through June 15

Kate’s list:

- Complete sponsor reads for May – June 15

- Schedule weekly emails through June 15

- Record, edit, upload Kate’s Take episodes through June 15

- Record, edit, upload NKCR episodes through May 30

- Draft income report for April 2023

- Review all show notes through May 30

- Wrap up all pending tax items

I put specific dates on things to show that we don’t just give ourselves space for the trip, but also a good amount of breathing room after.

We know traveling – even when it’s meant to be a relaxing vacation – doesn’t always provide a smooth transition back into your daily life and work routines. So whenever we travel, we’re not only batching for our time away, but also for a block after we return.

In this case we return from our trip May 26, but we’ve batched several bigger tasks through June 15. This will ensure our transition back home is a smooth one!

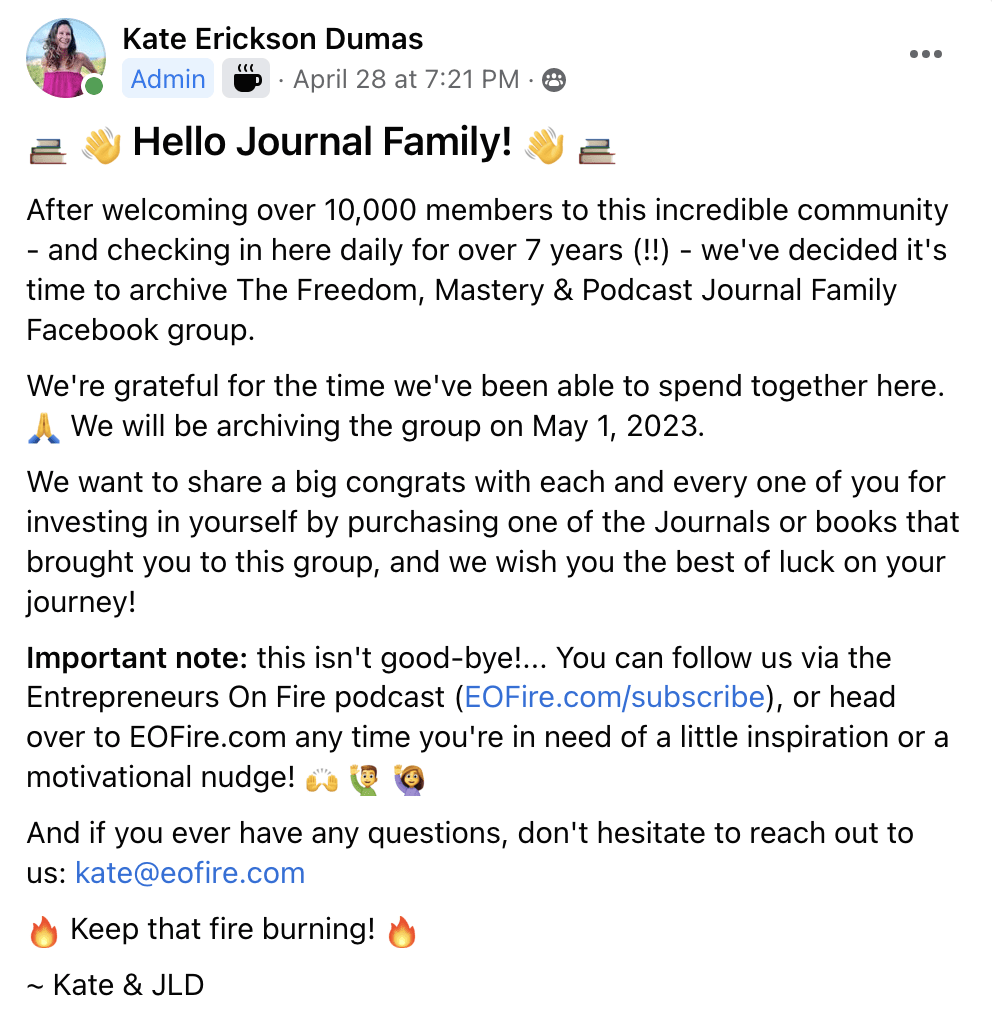

Saying Goodbye to our Freedom, Mastery, and Podcast Journal Facebook Group

Running an engaged Facebook Group is not easy.

Anyone who has tried knows that a great group requires a lot of time and effort.

Since we launched The Freedom Journal in 2016 we’ve been dedicated to running a Facebook Group, which grew to over 10,000 members. Over the past 7 years we’ve expanded the group for all of our Journal members: anyone who has invested in The Freedom Journal, The Mastery Journal, The Podcast Journal, or The Common Path to Uncommon Success is invited to join.

But over the past year or so I’ve noticed a pretty big drop in engagement.

A lot of people request to join, and when they answer the group questions they say they want to join for accountability and to connect with others using the journals.

Thing is, accountability and connection require work. And I get it – most people are busy – and so they don’t make the time to jump into the group and engage.

So over the past year I’ve pulled out all the stops. I’ve followed every piece of guidance I’ve learned about creating and running an engaged Facebook Group – to no avail.

Last month I had a bit of an ah-ha moment about the group

I realized that despite my 100 Day Goal Challenge (where I published an episode and posted in the group every single day for 100 days), plus my consistent twice per week (and sometimes more) posts to try and get the community to engage (even after the 100 days had finished), 99.5% of group members still weren’t active.

So John and I had a quick chat, and made the easy decision to sunset the group.

Sure, the group wasn’t much work given that there wasn’t a ton of engagement, but what I think we don’t always realize is that even the smallest tasks add up.

Every single day I was going into that group and either accepting new requests to join, posting in the group, or commenting on others’ posts. It might not have taken me more than a couple of minutes, but the group would pop into my mind several times throughout the day, too.

- I’d wonder why people weren’t engaged;

- Whether I was doing something wrong;

- I’d brainstorm ways I could get the group more active…

And that time definitely added up.

So, I had to ask myself: what’s the point of any of this if the group isn’t making an impact for – or being leveraged by – the members themselves? I certainly wasn’t running the group just for me.

We knew the best thing was to be transparent and let the group know about our decision:

These decisions aren’t always easy.

Closing a group you’ve been running for 7 years can bring up any number of emotions.

But at the end of the day, you have to come back to what your goals are and how you’re spending your time.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

April 2023 Income Breakdown*

Product/Service Income: $175,864

TOTAL Journal Sales: $2,624 | Total Journals Sold: 77

The Freedom Journal: Accomplish your #1 goal in 100 days!

- Total: $1,663 (49 Freedom Journals + 1 Digital Packs sold)

The Mastery Journal: Master Productivity, Discipline and Focus in 100 days!

- Total: $601 (16 Mastery Journals + 2 Digital Packs sold)

The Podcast Journal: Idea to Launch in 50 Days!

- Total: $360 (9 Digital Packs sold)

Podcasters’ Paradise: The #1 Podcasting community in the world!

- Recurring: $5,358 (53 recurring)

- New members: $1,497 (1 new member)

- Total: $6,855

Real Revenue: Turn your BIG IDEA into Real Revenue

- Total: $150

Podcast Sponsorships: $166,165

Podcast Launch: Audiobook: $40 | eBook: $30

Free Courses that contribute to the above revenue:

Your Big Idea: Discover your big idea in under an hour!

Free Podcast Course: Create and launch your own podcast!

Funnel On Fire: Create a funnel that converts!

Affiliate Income: $5,743

*Affiliate links below – if you click on my affiliate link and sign up for the products and services I trust and recommend, then I will earn a commission.

Resources for Entrepreneurs: $4,469

- Audible: $31

- Bluehost: $0

- Click Funnels: $4,418

- CovertKit: $20

- Coaching referrals: $0 (email me for an introduction to a mentor for overall online business or a Podcast focused mentor!)

Resources for Podcasters: $366

- Podcasting Press: $0

- Splasheo: $60

- Fusebox: $0

- Libsyn: $256 (Use promo code FIRE for the rest of this month & next free!)

- Repurpose House: $10

- UDemy Podcasting Course: $40

Other Resources: $908

- Amazon Associates: $43

- Other: $865

Total Gross Income in April: $181,607

Business Expenses: $12,011

- Advertising: $49

- Affiliate Commissions (Paradise): $521

- Cost of goods sold (Journals): $517

- Fulfillment: $1,056

- Consulting: $141

- Design & Branding: $0

- Dues & Subscriptions: $283

- Legal & Professional: $191

- Meals & Entertainment: $1,855

- Merchant / bank fees: $917

- Amazon fees: $1,376

- PayPal fees: $269

- Office expenses: $681

- Community Refunds: $97

- Promotional: $0

- Travel: $108

- Virtual Assistant Fees: $3,875

- Website Fees: $75

Recurring, Subscription-based Expenses: $3,903

- Adobe Creative Cloud: $110

- Accounting: $1,338

- Boomerang: $90 (team package)

- Business Insider: $13

- Authorize.net: $36

- Google: $60

- Cell Phone: $152

- CookieYes: $10

- Internet: $63

- eVoice: $12

- Infusionsoft (Keap) CRM: $232

- Insurance: $669

- Libsyn: $226

- Linktree: $6

- Taxes & Licenses: $523

- Revoicer: $67 (annual fee)

- Patreon: $40

- Shopify: $36

- Zoom: $150 (annual fee)

- Xero: $70

Total Expenses in April: $15,914

Payroll to John & Kate: $15,900

In our May 2014 Income Report and our June 2016 Income Report, Josh focuses on how to pay yourself as an entrepreneur. Check them out!

Wondering what we do with all of our net revenue? We share all in our April 2017 Income Report :)

Total Net Profit for April 2023: $165,693

Biggest Lesson Learned

Preparation makes all the difference

As you know by now, we’re currently on our 23-day European River Cruise, and earlier in this income report we talked about how we prepared from a work standpoint for this trip.

I’m happy to report our preparation has been a success!

We’ve worked less than 1 hour each day doing our check-in’s, and there have been zero fires to put out.

The best part is, preparation isn’t that hard. You just need a plan to follow, and the focus and discipline to execute that plan.

- Do you have a big project coming up?

- A launch you want to go really well?

- An event you’re planning?

- A new opening for a team member you’re trying to fill?

It doesn’t have to be a trip that you’re preparing for. Preparation can work magic in every area of your life – outside of work, too.

No matter what it is you’re preparing for, give it a try. Put in the work to set up a step-by-step plan you can follow, and then ask a friend, colleague, mentor, or accountability partner to check in on you. Practice focus and discipline in order to follow through and execute your plan.

If you need a little helping hand, The Mastery Journal is an awesome companion for helping you prepare for any project or life event.

Until next month, keep your FIRE burning!

~ Kate & John

Note: we report our income figures as accurately as possible, but in using reports from a combo of Infusionsoft & Xero to track our product and total income / expenses, they suggest the possibility of a 3 – 5% margin of error.