May 2022 Income At-A-Glance

Gross Income for May: $249,139

Total Expenses for May: $23,828

Total Net Profit for May: $225,311

Difference b/t May & April: +$18,774

% of net profit to overall gross revenue: 90%

Why We Publish An Income Report

This monthly income report is created for you, Fire Nation!

By documenting the struggles we encounter and the successes we celebrate as entrepreneurs every single month, we’re able to provide you with support – and a single resource – where we share what’s working, what’s not, and what’s possible.

There’s a lot of hard work that goes into learning and growing as an entrepreneur, especially when you’re just starting out. The most important part of the equation is that you’re able to pass on what you learn to others through teaching, which is what we aim to do here.

Check out all of our monthly income reports – from the very beginning!

Let’s IGNITE!

**We’ll receive a commission on the affiliate links below. If you click on my affiliate link and sign up for the products and services I trust and recommend, then I will earn a commission.

Ron Parisi’s Monthly Tax Tip

Hello Fire Nation! Ron Parisi from CPA On Fire here for our May 2022 Tax and Accounting tip.

This month, we’re talking about the general taxes and fees online businesses and their owners are responsible for.

At CPA On Fire, we specialize in working with entrepreneurs to minimize their tax liability while keeping them in line with the ever-changing tax laws.

Our firm has been working with JLD & Kate at Entrepreneurs On Fire for years now, and they’ve included me in these monthly income reports with unlimited access to all their accounts so I can verify that what they report here is complete and accurate.

And because they believe in delivering an insane amount of value to you, my job doesn’t stop at the verification level; I also provide a new tax and accounting tip every month!

Ron’s May Tax Tip: What Taxes & Fees Are Online Entrepreneurs Responsible For?

As an entrepreneur there are taxes and fees that you are going to have to pay. While everyone’s financial and tax situation is different, below are the ones that you are likely to run into while operating your business.

Taxes

Two big taxes that you as an entrepreneur are responsible for are income tax and sales tax.

Federally, it all depends on what type of entity you created with your business.

For example, a C-Corp will pay its own taxes as a business, and you will pay your own taxes on your 1040 tax return.

Whereas a partnership, single-member LLC or an S-Corp will not pay income tax at the federal level. Instead the income flows on to your personal return, and you pay income taxes at your personal rates.

At the state level, it gets a bit more complex.

We see companies that have employees in multiple different states, and companies that do business in other states, so you potentially could be responsible for income tax in many states.

It’s something that you need to be aware of as an entrepreneur.

You also have the potential for local income tax, but that will be specific to you and your business’s location.

Make sure you speak with a tax professional to determine which, if any, local taxes you need to pay for your business.

For the most part, digital products are not subject to sales tax. However, if you are an ecommerce seller, it could be a real thorn in your side. This is because you need to look at nexus, especially if you are an Amazon seller since you could be potentially selling in a lot of different states and not even know it.

Fees

Moving onto the fees you might have as an entrepreneur…

Particularly, if you are based out of California, Delaware, or any other state that has this, you may have what is called “franchise fees” or “franchise taxes” that you would be responsible for.

So, if you live in, or are registered in, any of the 14 states that have franchise taxes/fees, you need to be aware of that.

Disclosures

A lot of people overlook disclosures, and the IRS has really come down hard with some significant penalties for that.

Let’s start with what is called FBAR.

This is when you have money (brokerage accounts, bank accounts, etc.) outside the United States.

There are no taxes or fees incurred on that money per se, but you do need to make those disclosures with both the Treasury and the FinCEN. It is very important that you make those accounts known to your tax professional so that they can properly handle those disclosures for you.

The next new area that the IRS is trying to tackle is cryptocurrency. So if you have sold/bought/had any transactions with crypto, you need to make certain disclosures on your personal tax return for that.

Just be mindful of that when you’re having conversations about filings and your taxes with your tax professional.

Those of you in Fire Nation who are entrepreneurs & business owners and are looking to upgrade your financial operations going into 2022, check out our website: CPAOnFire.com!

We’ve been able to get our clients amazing results and would love to help you out as well. Book a call through our website and let us show you how we can help your business grow.

David Lizerbram’s May Legal Tip

Do you need to register your podcast as a business?

A question we recently received in Podcasters’ Paradise was: “Do you need to register your podcast as a business even when you are not selling any product?”

This is a good question, and of course the answer is going to vary for every person based on their unique circumstances. As you know, this is not legal advice!

There are a few factors to consider when you’re deciding whether or not to create a formal business entity like a corporation or LLC. One is liability.

Protecting personal assets

An advantage of running your podcast through an LLC or corporation is that if there are any legal or monetary claims made against the podcast, the plaintiff can typically only go after the assets of the business entity. Your personal assets, and the personal assets of any other owners of the LLC/corporation, are shielded from liability.

The “corporate shield” is not effective 100% of the time, and going into every variable about it is beyond the scope of this post. However, on a high level, running any kind of business, including a podcast, through a limited liability entity can provide a significant amount of protection.

So that leads us to another question – what kind of liability are you exposed to?

Decreasing liability

If you’re a podcaster and you’re not using your podcast in connection with any sorts of products or services, you might have fairly limited liability. But that depends on the type of podcast.

For example, if your show explores controversial topics, or discusses the actions of individual people in a manner that they might object to, you may find yourself in legal trouble at some point.

Likewise if your show can be understood to be giving any kind of advice, whether that has to do with investments, business, health, fitness, or other issues where someone could be exposed to risk if they follow through on your suggestions.

Hiring a team

Another factor to consider is whether your podcast has employees or independent contractors.

If so, then there may be legal issues having to do with employment that might make it wise to form an LLC or corporation.

Maybe you do have a connection to products or services?

Finally, it’s worth reviewing whether your podcast really does have a connection to products or services. If your show relates to what you do for work, it’s arguably related to goods or services even if you don’t directly advertise.

For example, if you’re a lawyer, and your show has to do with legal topics, it may be considered an advertisement.

Make sure to think this through when you’re weighing whether or not to form and register a business entity in connection with your show.

The bottom line is that there are some situations where a podcast is not directly advertising products or services, but it would still be wise to create a limited liability entity such as an LLC or corporation.

For most podcasts, it’s not necessary, but every situation is unique. If you have more questions about this issue, it’s best to reach out to an attorney who handles these matters.

Have more podcast law questions?

As it happens, I’ve written an ebook called Podcast Law, which you can get for free at the website PodcastLawGuide.com – enjoy!

What Went Down In May

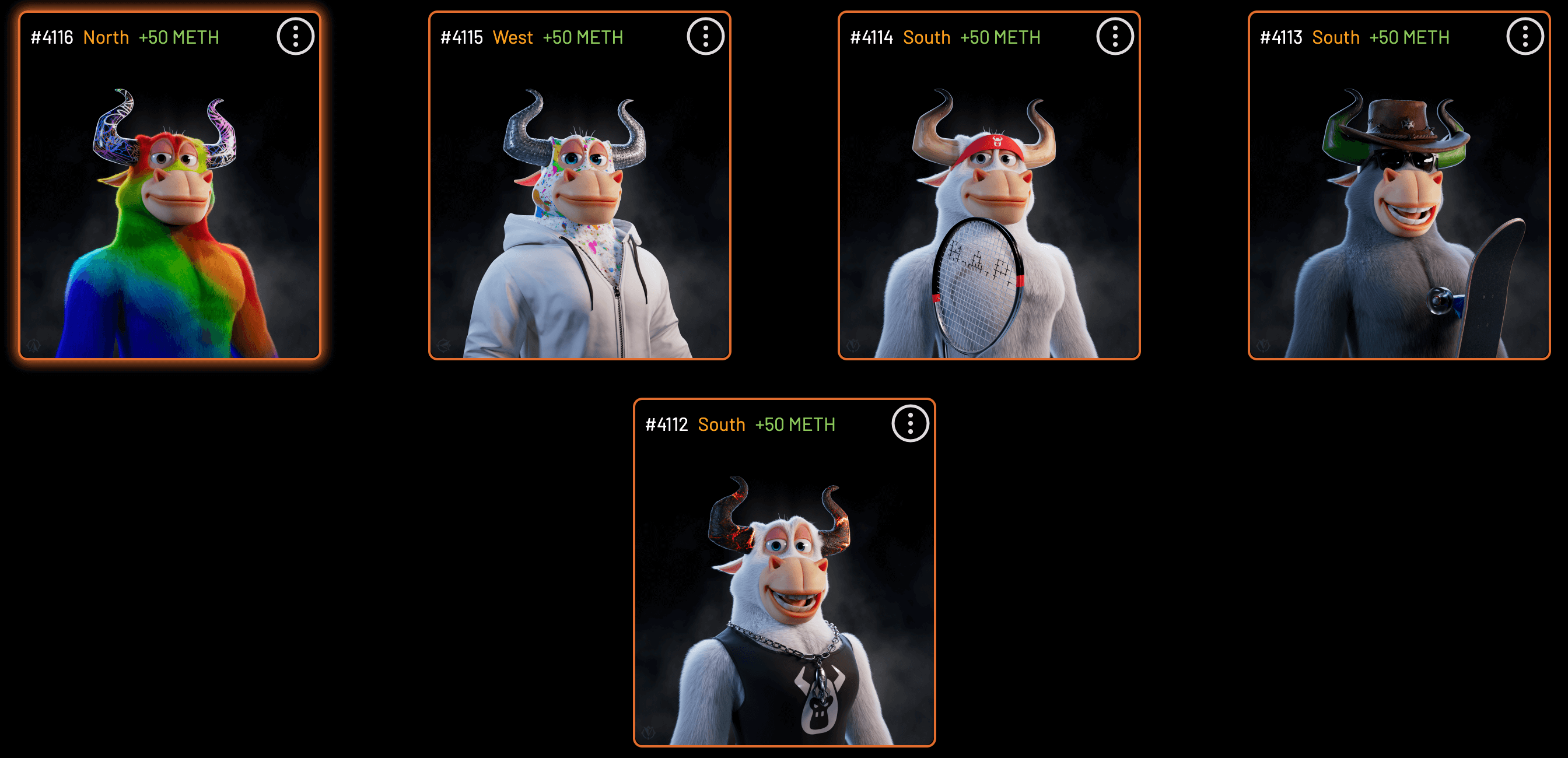

NFTs & Kate’s Inaugural Minting Experience

The very last day of the month brought with it a cool milestone: Kate minted her first NFTs!

I’ve been into the NFT space for a while now, but Kate has been pretty comfortable on the sidelines – checking things out from afar.

But when I had the creator of the Bulls & Apes project on Entrepreneurs On Fire to talk about the project, Kate decided to get her feet wet.

This isn’t financial advice, but there are some pretty cool things happening in the NFT space right now. If you haven’t tuned in to that episode with the Bulls & Apes founder, Anthony Mongiello, it’s a great one!

Gary Vee’s VeeCon Conference in Minneapolis

Speaking of NFTs, a really cool experience I had in May was attending Gary Vee’s VeeCon!

In order to get a ticket to this event, you had to own one of Gary’s NFTs. Because I own 4, I not only had a pass in my pocket, but I gave the other 3 out to some good friends here in Puerto Rico.

So a group of 4 of us flew out to Minneapolis together for 5 days of mixing and mingling with a lot of big players in the NFT space.

Gary definitely brought out a power lineup with Snoop Dogg, Lisa Leslie, Eva Longoria and many, many others.

The event was in the Vikings stadium, which was cool in and of itself! But they added a bunch of other great features and activities, too, which added to the fun!

Oh, and I went to my first EDM concert (and probably my last, although I did enjoy it!) And I met THE Steve Aoki, DJ and record producer!

My major criticism of the event is almost every session was a “Fire Side chat” or a panel… both of which bring low value compared to a solo presentation IMO.

Gary’s talks were FIRE, as per usual! :-)

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

May 2022 Income Breakdown*

Product/Service Income: $240,937

TOTAL Journal sales: Total Journals Sold 101 – $3,601

The Freedom Journal: Accomplish your #1 goal in 100 days!

- Total: $1,465 (38 Freedom Journals sold)

The Mastery Journal: Master Productivity, Discipline and Focus in 100 days!

- Total: $498 (16 Mastery Journals sold)

The Podcast Journal: Idea to Launch in 50 Days!

- Total: $1,638 (47 Podcast Journals sold)

Podcasters’ Paradise: The #1 Podcasting community in the world!

- Recurring: $8,863 (96 recurring)

- New members: $2,720 (10 new members)

- Total: $11,583

Real Revenue: Turn your BIG IDEA into Real Revenue

- Total: $0

Podcast Sponsorships: $225,680

Podcast Launch: Audiobook: $28 | eBook: $45

Free Courses that contribute to the above revenue:

Your Big Idea: Discover your big idea in under an hour!

Free Podcast Course: Create and launch your own podcast!

Funnel On Fire: Create a funnel that converts!

Affiliate Income: $8,202

*Affiliate links below – if you click on my affiliate link and sign up for the products and services I trust and recommend, then I will earn a commission.

Resources for Entrepreneurs: $6,149

- Audible: $51

- Bluehost: $0

- Click Funnels: $2,875

- CovertKit: $23

- Coaching referrals: $3,200 (email me for an introduction to a mentor for overall online business or a Podcast focused mentor!)

Resources for Podcasters: $273

- Podcasting Press: $0

- Splasheo: $50

- Fusebox: $0

- Libsyn: $174 (Use promo code FIRE for the rest of this month & next free!)

- Repurpose House: $0

- UDemy Podcasting Course: $49

Other Resources: $1,780

- Amazon Associates: $93

- Other: $1,687

Total Gross Income in May: $249,139

Business Expenses: $21,609

- Advertising: $0

- Affiliate Commissions (Paradise): $191

- Cost of goods sold (Journals): $619

- Consulting: $78

- Design & Branding: $0

- Dues & Subscriptions: $162

- Education: $300

- Legal & Professional: $5,239

- Meals & Entertainment: $268

- Merchant / bank fees: $1,023

- Amazon fees: $1,633

- PayPal fees: $81

- Office expenses: $363

- Community Refunds: $291

- Promotional: $126

- Travel: $8,060

- Virtual Assistant Fees: $3,100

- Website Fees: $75

Recurring, Subscription-based Expenses: $2,219

- Adobe Creative Cloud: $100

- Audible: $16

- Accounting: $375

- Boomerang: $50 (team package)

- Authorize.net: $38

- Google: $49

- Glow.fm: $5

- Bonjoro: $45

- Loom: $10

- Cell Phone: $239

- Internet: $40

- eVoice: $12

- Infusionsoft CRM: $241

- Insurance: $89

- Libsyn: $211

- Linktree: $6

- TaxJar: $19

- Taxes & Licenses: $523

- Shopify: $36

- Zoom: $55

- Xero: $60

Total Expenses in May: $23,828

Payroll to John & Kate: $15,900

In our May 2014 Income Report and our June 2016 Income Report, Josh focuses on how to pay yourself as an entrepreneur. Check them out!

Wondering what we do with all of our net revenue? We share all in our April 2017 Income Report :)

Total Net Profit for May 2022: $

Biggest Lesson Learned

Journaling can be whatever you want it to be

I’m sure you’ve heard it, too: journaling can be a powerful exercise. It can help clear your mind, help you generate ideas, and can serve as a great reminder of just how much you have to be grateful for.

I used to journal as a little girl a lot – and maybe even got back into in college. But then I stopped.

I’ve been thinking about journaling a lot lately, and honestly, even after I added it to my daily routine, I still wasn’t doing it.

So I brought it up to a group of girlfriends – just to talk through it and get their advice and input. I figured if they journaled, maybe they could give me some pointers on how to actually start doing it.

Turns out, I wasn’t journaling because I just didn’t know where to start. And I think this can be the case with a lot of things in business – and in life. Sometimes we stall because we don’t know what the first step is, or we have some vision in our mind of what it’s “supposed to look like”.

What I’ve taken away from this experience is that it doesn’t have to be any one particular way. As long as you start, you’re one step closer to figuring out what it will look like for you – and that’s the most important part.

So if there’s something you’re putting off because you don’t know where to start – or because you think it has to look a certain way – let that go. And just start!

Alright Fire Nation, that’s a wrap!

Until next month, keep your FIRE burning!

~ Kate & John

Note: we report our income figures as accurately as possible, but in using reports from a combo of Infusionsoft & Xero to track our product and total income / expenses, they suggest the possibility of a 3 – 5% margin of error.