May 2024 Income At-A-Glance

Gross Income for May: $194,452

Total Expenses for May: $12,327

Total Net Profit for May: $182,125

Difference b/t May & April: +$64,207

% of net profit to overall gross revenue: 94%

Why We Publish An Income Report

This monthly income report is created for you, Fire Nation!

By documenting the struggles we encounter and the successes we celebrate as entrepreneurs every single month, we’re able to provide you with support – and a single resource – where we share what’s working, what’s not, and what’s possible.

There’s a lot of hard work that goes into learning and growing as an entrepreneur, especially when you’re just starting out. The most important part of the equation is that you’re able to pass on what you learn to others through teaching, which is what we aim to do here.

Check out all of our monthly income reports – from the very beginning!

Let’s IGNITE!

**We’ll receive a commission on the affiliate links below. If you click on my affiliate link and sign up for the products and services I trust and recommend, then I will earn a commission.

Ron Parisi’s Monthly Tax Tip

Hello, Fire Nation! Ron Parisi from CPA On Fire here with our May 2024 Tax and Accounting tip.

At CPA On Fire, we specialize in working with entrepreneurs to minimize their tax liability while keeping them in line with the ever-changing tax laws.

Our firm has been working with JLD & Kate at Entrepreneurs On Fire for years now, and they’ve included me in these monthly income reports with unlimited access to all their accounts so I can verify that what they report here is complete and accurate.

And because they believe in delivering an insane amount of value to you, my job doesn’t stop at the verification level; I also provide a new tax and accounting tip every month!

Ron’s May Tax Tip: Mapping Out Your Long-Term and Annual Tax Strategies

This month, let’s dive into a critical topic for all entrepreneurs: tax planning.

Understanding when and how to plan your taxes throughout the year can save you money and headaches.

Here’s a roadmap to keep your financial operations on point.

By mid-year, you should have long-term and short-term tax strategies.

Long-Term Strategy (3-5 years): Outline your revenue goals and expected expenses for the next few years. This forward-looking approach helps you see where your business is headed and what tax strategies will be available and most advantageous through the next 3-5 years.

Annual Tax Plan: By May or June, revisit your long-term strategy and solidify this year’s plan. Ensure you know your goals for the year and the strategy you’ll implement to achieve them.

Regular Check-ins and Implementation

Keeping your tax strategy on track requires regular check-ins with your tax expert.

During mid-year (July and August), have an implementation meeting to go through your tracking sheets, which include expenses, salaries, and withholdings. This may mean getting to the nitty-gritty details, but getting it out of the way means you can focus on growing your business.

Year-to-date Check-in

And, by end of Q3 (September-October) you should review your financials and compare them with your tax projections. Adjust as necessary to avoid surprises when tax season – April 15th – rolls around.

Final Year-End Prep

Lastly, as the year wraps up by mid-December, ensure you’re fully prepared by having a final meeting to handle last-minute items like bonuses, loss harvesting, and maximizing deductions.

This is your last chance to make adjustments and ensure your cash flow can cover your tax liabilities.

Following this roadmap will keep your tax planning more efficient and stress-free. It’s all about being proactive and organized to keep your financial operations running smoothly.

Until next month, Fire Nation, here’s to your clarity and success!

CPA on Fire offers vCFO and fractional financial operation services. We have vast experience working with high-growth entrepreneurs. If you recognize the need to level up your financial operations to improve growth, profitability and free your time, let’s connect! We can show you how we help our amazing clients and what we can do for you and your business. Learn more at CPAOnFire.com.

David Lizerbram’s Legal Tip

Letters of Intent – What Buyers and Sellers Need to Know

What’s up Fire Nation! David Lizerbram here and I’m excited to be back with another legal tip for you!

I’ve been practicing law for 22 years and have loads of free content over at LizerbramLaw.com. This month’s legal tip is all about letters of intent.

Whether you’re looking to sell your business or acquire a new one, the letter of intent (LOI) is a critical early step in the transaction process. This non-binding document lays the groundwork for the deal, outlining the key terms and conditions that both parties agree to before proceeding to more intensive due diligence and negotiations.

From the purchase price and financing structure to contingencies and exclusivity periods, the LOI serves as a roadmap for the final purchase agreement. It’s an essential tool for ensuring both the buyer and seller are aligned on the essential elements of the transaction.

Some key elements to focus on when reviewing or drafting an LOI include:

Business Purchase vs. Asset Purchase: Will the buyer be purchasing the whole business (such as a corporation or LLC), or some or all of the assets of the business? What about the liabilities of the business – will those go to the buyer along with the sale?

Purchase Price and Structure: The LOI will typically specify the total purchase price, as well as how it will be paid (cash, stock, earnouts, etc.). Will the buyer be paying in cash? Will the seller be financing all or part of the purchase price? Could the purchase price change based on the due diligence process?

Contingencies and Conditions: Outline any conditions the parties must meet before closing, such as securing financing, completing due diligence, or obtaining necessary approvals. Ensure these terms are reasonable.

Exclusivity Period: Many LOIs include a period of exclusivity, during which the seller will agree not to entertain other offers. Sellers should be cautious about granting lengthy exclusivity, as it can limit their negotiating leverage.

Confidentiality and Non-Compete Clauses: The LOI will likely contain provisions restricting the sharing of sensitive information or prohibiting competition post-sale.

Transition Assistance and Consulting: Will the seller assist with the transition of the business after the sale closes? If so, how, and for how long? Will the seller become an employee of the business or sign a consulting agreement?

Termination and Break-Up Fees: Understand what events could trigger the termination of the LOI, as well as any penalties or fees associated with walking away from the deal.

Earnest Money Deposit: This is a sum of money, typically ranging from 1-10% of the total purchase price (although these numbers vary widely), that the buyer will deposit upon execution of the LOI as a show of good faith and to secure their commitment to the transaction.

Not every LOI includes an earnest money deposit. For sellers, an earnest money deposit can provide valuable reassurance that the buyer is serious about the deal. Buyers, on the other hand, will want to carefully consider the appropriate earnest money amount. Too little may not be enough to give the seller confidence, while too much could tie up a significant portion of your capital during due diligence. The goal is to find a balance that demonstrates commitment without being overly burdensome.

Regardless of which side of the transaction you’re on, the earnest money deposit should be clearly outlined in the LOI, including the specific conditions under which it would be refunded or applied towards the final purchase price.

Approaching the letter of intent process with a clear understanding of your goals and priorities is essential.

If you have questions about buying or selling a business, please contact me. I’m always happy to talk with members of Fire Nation!

What Went Down In May

Interview of the Month

Serial Entrepreneur, Chairman of VaynerX and 5x New York Times Best Selling Author Gary Vaynerchuk

3 Value Bombs

- The key is not cash, the key is passion. Authenticity matters because if you’re doing something that is authentic to you, then the audience would know that it’s authentic to them.

- Nowadays, the content itself is the variable, not the number of followers, because the merit of the creative is the game and that level of underpriced attention where there is no cost for distribution.

- The world is selling so much negativity. You have a huge opportunity. If you’re passionate about anything, the opportunity to be great in organic social media to start the process of you living a happier and professional life is now more real.

Day Trading Attention: How to Actually Build Brand and Sales in the New Social Media World. Check out GaryVee’s New book!

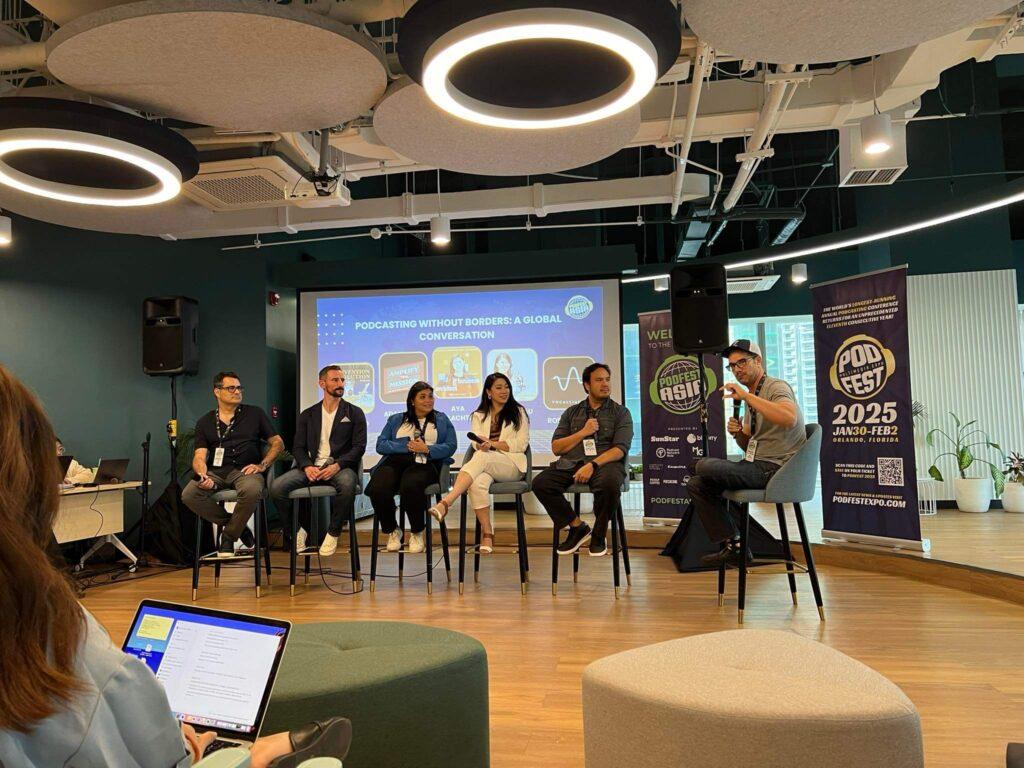

JM attends PodFest Asia!

When I received an email from PodFest about an event happening in Asia, I was excited to learn more. We’ve been friends and fans of the PodFest crew since the beginning, and we’ve attended several of their events ourselves.

What I was most curious about is where exactly in Asia the event would be held since JM, our most senior virtual assistant, lives in the Philippines.

So when I found out the event would be hosted in Manilla, which is very close to where JM lives, I was excited to see if the date would work for her – and it did!

I’ll let JM take over from here to share her experience attending PodFest Asia!

It was an exhilarating experience, especially seeing so many Filipinos enthusiastic about podcasting. The event was well-attended by a diverse group of participants, including seasoned podcasters, aspiring creators, virtual assistants, and individuals eager to expand their professional networks.

The key theme of the conference is how Filipinos can dominate the podcasting scene. As I mentioned to John when he was starting his podcast journey with EOFire, commonly, people here don’t drive as much; even if they own cars, most lack features like Apple CarPlay. And not everyone has a smartphone, and data plans are a luxury for some. This has slowed the adoption and appreciation of audio podcasts. The conference aimed to bridge this gap by highlighting the benefits of podcasting.

One of the most valuable aspects for me was the power of networking. Some attendees have been in the podcast industry for over a decade and have attended multiple PodFest events in the USA, building significant connections.

This networking led to the creation of the first PodFest Asia. I met many newcomers trying to break into the industry and seasoned speakers, one of whom said he has 5 million downloads over 5-6 years.

Thanks to EOFire’s reputation and JLD’s legendary status with 156 million downloads and over 4,000 episodes, I found it easy to engage and was invited to participate in various community events, to be a guest on podcasts, and even had a discussion about joining start-up ventures.

Overall, attending this conference opened up many new opportunities. I am so happy with my role at EOFire, and it’s gratifying to realize how much I’ve learned and can teach others, which was evident from the way other speakers and attendees valued even an hour of my time.

They asked about our secret to keeping up a daily podcast with effective monetization and growing our community… I told them it’s all about “systems + a lot of discipline!”

JM also shared her key insights from the sessions she attended…

Top 10 AI Tools for Creators: The speakers shared their top 10 AI tools, with Capsho ranking high. However, our experience with Capsho showed that its formatting of show notes differed significantly, making it challenging to use. For instance, it struggled with capturing guest call-to-action links accurately, along with other mentioned links we typically include.

Optimizing Workflow: Unlocking the Power of Descript for Podcast Editing: I learned about the powerful features of Descript, such as filler removal, gap correction, and mic bleed reduction. Despite being a fantastic tool, it still has limitations typical of AI tools, necessitating a human touch for optimal results.

Basics of Podcast Monetization (Turn Your Listeners into Paying Clients): Presented by two former Filipino VAs turned podcast mentors, this session highlighted their client’s successful monetization journey through program redesign. They now coach Filipino podcasters on starting and monetizing podcasts, having launched over 150 shows with 3.5 million downloads in 5 years.

Beyond Audio: The Power of Video Podcasting: With video consumption on the rise, especially in the Philippines, leveraging video podcasting allows content repurposing for platforms like TikTok and Reels. The session showcased how combining video and audio formats led to increased listens, subscribers, and community growth.

Southeast Asia Soundscapes: Diving Deep into the Podcasting Phenomenon: Spotify’s podcast partner manager shared insights on Spotify’s decision to introduce video podcasts, Filipino podcast shows’ progress on charts, and the vast potential of podcasting in the Philippines.

How to Win in the Local Podcasting Scene in the Philippines / Charting the Course: The Evolution of Podcast Networks in Southeast Asia: This panel discussion explored podcasters’ motivations for starting podcasts, ranging from regaining fame to pursuing passions like teaching or discussing professional insights amidst the pandemic.

The Legal Landscape: Navigating IP and Trademarks for Podcasters: Despite legal complexities in the Philippines, speakers advised securing intellectual property rights and guest release contracts before publishing content.

Cracking the Code: YouTube Fundamentals for Content Creators: A renowned vlogger and artist shared insights on a viral channel unrelated to his fame, focusing on ants after several years of consistent content creation.

Podcasting Without Borders: A Global Conversation / Overcoming the Odds with Wally Green: Wally Green shared his inspiring life journey, from humble beginnings to discovering his passion in ping pong, demonstrating the power of resilience and pursuing one’s calling.

Photos from the PodFest Asia 2024

JM, we’re so happy you were able to attend PodFest Asia and that you had a good experience along with so many great takeaways! Thanks for sharing!

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

May 2024 Income Breakdown*

Product/Service Income: $191,073

TOTAL Journal Sales: $1,681 | Total Journals Sold: 47

The Freedom Journal: Accomplish your #1 goal in 100 days!

- Total: $818 (25 Freedom Journals + 0 Digital Packs sold)

The Mastery Journal: Master Productivity, Discipline and Focus in 100 days!

- Total: $623 (16 Mastery Journals + 0 Digital Packs sold)

The Podcast Journal: Idea to Launch in 50 Days!

- Total: $240 (6 Digital Packs sold)

Podcasters’ Paradise: The #1 Podcasting community in the world!

- Recurring: $3,701 (26 recurring)

- New members: $1,497 (1 new member)

- Total: $5,198

Real Revenue: Turn your BIG IDEA into Real Revenue

- Total: $0

Podcast Sponsorships: $184,170

Podcast Launch: Audiobook: $20 | eBook: $4

Free Courses that contribute to the above revenue:

Your Big Idea: Discover your big idea in under an hour!

Free Podcast Course: Create and launch your own podcast!

Funnel On Fire: Create a funnel that converts!

Affiliate Income: $3,379

*Affiliate links below – if you click on my affiliate link and sign up for the products and services I trust and recommend, then I will earn a commission.

Resources for Entrepreneurs: $3,019

- Audible: $20

- Bluehost: $0

- Click Funnels: $2,990

- CovertKit: $9

- Coaching referrals: $0 (email me for an introduction to a mentor for overall online business or a Podcast focused mentor!)

Resources for Podcasters: $202

- Podcasting Press: $0

- Splasheo: $0

- Fusebox: $0

- Libsyn: $126 (Use promo code FIRE for the rest of this month & next free!)

- Repurpose House: $54

- UDemy Podcasting Course: $22

Other Resources: $158

- Amazon Associates: $27

- Other: $131

Total Gross Income in May: $194,452

Business Expenses: $9,440

- Advertising: $24

- Affiliate Commissions (Paradise): $0

- Cost of goods sold (Journals): $200

- Fulfillment: $0

- Consulting: $448

- Design & Branding: $0

- Dues & Subscriptions: $73

- Legal & Professional: $0

- Meals & Entertainment: $151

- Merchant / bank fees: $48

- Amazon fees: $936

- PayPal fees: $10

- Office expenses: $50

- Community Refunds: $0

- Promotional: $0

- Travel: $4,200

- Virtual Assistant Fees: $3,300

- Website Fees: $0

Recurring, Subscription-based Expenses: $2,887

- Adobe Creative Cloud: $60

- Accounting: $500

- Boomerang: $90 (team package)

- Authorize.net: $26

- Google: $75

- Cell Phone: $162

- CookieYes: $10

- Chat GPT: $20

- Internet: $68

- Analytics: $70

- eVoice: $15

- Keap CRM: $256

- Insurance: $669

- Libsyn: $209

- Linktree: $6

- Taxes & Licenses: $505

- Patreon: $40

- Shopify: $36

- Xero: $70

Total Expenses in May: $12,327

Payroll to John & Kate: $15,900

In our May 2014 Income Report and our June 2016 Income Report, Josh focuses on how to pay yourself as an entrepreneur. Check them out!

Wondering what we do with all of our net revenue? We share all in our April 2017 Income Report :)

Total Net Profit for May 2024: $182,125

Biggest Lesson Learned

Scheduling time

About six years ago I dove head first into all things time management. I realized there were a lot of things I was doing with my time that I didn’t actually want to be doing.

It sounds funny, but I’m willing to bet if you took a step back and considered this for yourself, you’d come up with the same result.

So I set out to find a way to manage my time differently, which started with treating my time differently.

I realized that I was acting as though time was infinite. I would say yes to things that I didn’t necessarily want to do because I figured “eh, there’s always tomorrow to do this or that… so I can say yes.”

But when that thing I said yes to would come up, I’d feel resentful. Resentful towards myself for saying yes, and even resentful towards the person who had asked me (even though it clearly wasn’t their fault I had said yes.)

After feeling this way all too often, I made a promise to myself that I would only say yes to things that were a complete HELL YES. If I even had one second of doubt about whether I wanted to do something, I would say no.

And guess what? My calendar opened up and I felt completely free for the first time in a long time.

I didn’t have anything scheduled that I didn’t absolutely want to do, and I came to find pretty quickly that saying no is quite empowering.

So what did I do with all my new-found free time?

I started scheduling time for the things that matter most to me.

Before, there were things I really wanted to do that I wasn’t doing, and a long time ago I learned from Amy Porterfield that in order to makes something real, you have to schedule it.

It might sound strange to “schedule” things you want to do, but trust me, it made a world of difference when it came to how I was spending my time and actually getting to do the things that were most important to me.

And I still do this today!

Give it a try – start saying “no” to the things you don’t actually want to do, and start scheduling the things that are most important to you!

Until next month, keep your FIRE burning!

~ Kate & John

Note: we report our income figures as accurately as possible, but in using reports from a combo of Infusionsoft & Xero to track our product and total income / expenses, they suggest the possibility of a 3 – 5% margin of error.