March 2023 Income At-A-Glance

Gross Income for March: $157,349

Total Expenses for March: $18,030

Total Net Profit for March: $139,319

Difference b/t March & February: +$8,181

% of net profit to overall gross revenue: 89%

Why We Publish An Income Report

This monthly income report is created for you, Fire Nation!

By documenting the struggles we encounter and the successes we celebrate as entrepreneurs every single month, we’re able to provide you with support – and a single resource – where we share what’s working, what’s not, and what’s possible.

There’s a lot of hard work that goes into learning and growing as an entrepreneur, especially when you’re just starting out. The most important part of the equation is that you’re able to pass on what you learn to others through teaching, which is what we aim to do here.

Check out all of our monthly income reports – from the very beginning!

Let’s IGNITE!

**We’ll receive a commission on the affiliate links below. If you click on my affiliate link and sign up for the products and services I trust and recommend, then I will earn a commission.

Ron Parisi’s Monthly Tax Tip

Hello, Fire Nation! Ron Parisi from CPA On Fire here with our March 2023 Tax and Accounting tip.

At CPA On Fire, we specialize in working with entrepreneurs to minimize their tax liability while keeping them in line with the ever-changing tax laws.

Our firm has been working with JLD & Kate at Entrepreneurs On Fire for years now, and they’ve included me in these monthly income reports with unlimited access to all their accounts so I can verify that what they report here is complete and accurate.

And because they believe in delivering an insane amount of value to you, my job doesn’t stop at the verification level; I also provide a new tax and accounting tip every month!

Ron’s March Tax Tip: Your calendar of tax planning

This month, I’m discussing your calendar of tax planning: how to optimize your 2023 “Tax Saving Strategy”!

I’m sure by now you have filed your 2022 taxes (or at least filed tax extensions).

That is great; however, tax planning is not something to be “filed away”!

Taxes either are, or will, become one of your largest expenses, and tax planning should be an ongoing priority.

Four Key Items for the right Tax Saving Strategy

1. Meet with your Tax Professional in the May/June 2023 Time Frame

- Review past tax returns (both business and personal).

- Evaluate your Effective Rate and Marginal Rate. Your Effective Rate is the amount of taxes you have paid so far, while your Marginal Rate is how much your tax would be on the next dollar you earn.

- Allow your Tax Professional to do research. When you regroup, work together to look for areas for improvement, and look forward to where your business is headed.

The easy ones may be the opportunities you may have missed, like deductions; the deeper ones could be significant upcoming changes such as retirement, entity changes, R&D credits, the Augusta Rule, etc.

- When you do have a strategy put together, make sure that it is documented in some manner so that it is executable.

2. Push beyond One Year – Aim for 3-to-5 Year Strategy!

- You are an entrepreneur aiming for growth. You need a tax planning strategy that fits your growth plans beyond 2023.

3. Plan for Quarterly meetings with your Tax Professional

- Evaluate the execution of your plan and make needed adjustments in the ever-evolving business environment.

4. Have that “Last Call” with your Tax Professional in December.

- It’s likely your last chance to discuss anything from a tax planning perspective that can be executed in the related tax year.

There you have it, Fire Nation. Go out and make 2023 and your Tax Saving Strategy the best yet!

Those of you in Fire Nation who are entrepreneurs and business owners and are looking to upgrade your financial operations in 2023, check out our website: CPAOnFire.com!

We’ve been able to get our clients amazing results and would love to help you out as well. Book a call through our website and let us show you how we can help your business grow.

David Lizerbram’s Monthly Legal Tip

What to Consider When You’re Selling a Business

What’s up Fire Nation!

David Lizerbram here, and I’m excited to be back with another legal tip for you!

I’ve been practicing law for 21 years and have loads of free content over at LizerbramLaw.com. This month’s legal tip is all about selling a business.

In the past I’ve talked about “What To Consider When You’re Buying a Business”. But, of course, there are two sides to every transaction.

Let’s take a look at the process of selling a business.

This post won’t cover the financial or tax aspects of selling a business.

There are a lot of good resources out there to assist with those issues (my #1 piece of advice here is to hire a good CPA).

Instead, we’re going to look at some of the legal points on the checklist.

As with buying a business, the first question to ask is whether you are selling the assets (and, possibility, liabilities) of the business, or instead, if you’re selling the business entity itself.

Your business may have physical assets – everything from vehicles and equipment to paperclips – as well as intangible assets, such as accounts receivable, brand names, trademarks, patents, leases, computer programs, customer lists, contracts, domain names, phone numbers, or trade secrets.

There are also liabilities to consider, such as accounts payable, warranty obligations, employment liabilities, potential lawsuits, and so on.

Your business also probably exists as some sort of entity, such as an LLC or a corporation, which holds both the assets and liabilities.

So: are you selling the LLC/corporation, with all of the assets and liabilities included?

Or are you selling some or all of the assets/liabilities?

Very often I find that in the case of a business purchase, the seller and buyer aren’t immediately on the same page about what exactly is being bought and sold, so it’s advisable to be very clear about this point upfront.

When selling a business, some other important factors to consider are:

- Market value: Determine the fair market value of the business, taking into account factors such as revenue, expenses, assets, liabilities, and industry trends.

- Legal and financial due diligence: Conduct a thorough review of the business’s legal and financial records to ensure that everything is in order and to identify any potential liabilities. Your attorney can help with the legal side.

- Tax implications: Consider the tax implications of selling the business, including capital gains tax, income tax, and other relevant taxes. This should be discussed with your CPA.

- Transfer of ownership: Plan for the transfer of ownership, including the transfer of assets, liabilities, and employees.

- Business brokers and escrow agents: A business broker and/or an escrow agent can be valuable assets in the process of selling your company. However, in most cases, neither of these parties is strictly on your side. They are there to make sure the deal gets done, without looking out for your specific interests. So it’s always important to make sure you have your own legal representation.

These are just a few of the points to consider when you’re selling a business. If you have legal questions about the process of selling a business, feel free to be in touch with me. I’m always happy to talk with members of Fire Nation!

What Went Down In March

Interview of the Month

7 Figure Sales from Simple YouTube Videos with Owen Video

3 Value Bombs

- Having a vision for the future and being willing to refine it consistently to get where you want to go is essential.

- A revenue strategy is a pathway to 6-figures on YouTube within your first year.

- Focus on your goal, help your viewers experience transformation, and your best content will appear every time you press record.

The Video Marketing School: Get The Exact System for Producing YouTube Content to Scale Brand Visibility, Authority, & Revenue!

Our trip to Japan!

Japan has honestly never been on my radar…

I’ve always been completely blown away and so impressed by Europe, and because you can go to so many different places once you’re there, we’ve never gotten tired of choosing new stops.

So you might be wondering how we ended up in Japan?

Well, it’s kind of a funny story…

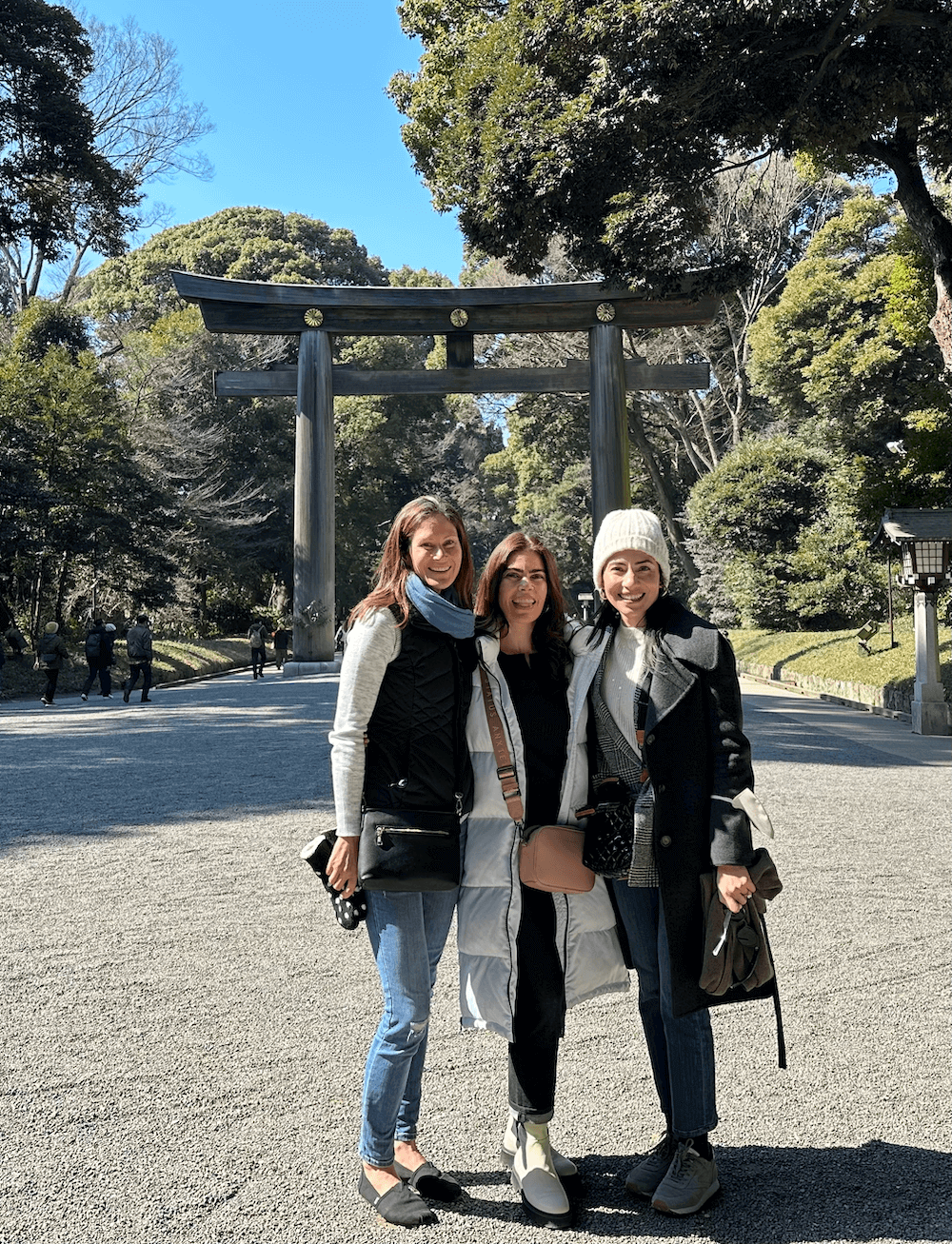

It actually came about because of a mastermind I’m a part of with two other entrepreneurial women, Nicole Baldinu from $100 MBA podcast and WebinarNinja, and Cassandra Sethi, founder of Next Level Wardrobe.

The three of us have been in a mastermind together for 3 years now.

We meet online every month for 1.5 hours to chat business and support one another in our business ventures. Sometimes that’s catching up and laughing; sometimes it’s having really hard convos about hiring and firing team members; and sometimes it’s celebrating our wins together.

We’ve grown such a special relationship over those 3 years, and we’ve been trying to plan a “girls trip” since 2020.

So the fact that we actually made this trip happen – and in Japan no less – was so exciting for all of us!

When we finally found a date range that would work for all 3 of us, it just so happened that Nicole and Omar would be in Japan. I chatted with John, Cass was all in, and we decided to make it happen!

Soooooo… after a lot of planning – and 29 hours of travel – we made it to our first stop: Osaka!

The four of us (myself, John, Omar and Nicole) decided to spend the first week together in Osaka.

We’ve known Omar and Nicole for years now – and we used to be neighbors in San Diego! – so we were excited to see them and spend time together for the first time five years.

While Wiki will tell you Osaka is known for its modern architecture, nightlife, and hearty street food, the things that stood out the most for us included:

- How CLEAN it is!

- How amazing the subway system is (trains come in every direction pretty much every 4 minutes)

- How polite and helpful people are (some Japanese speak very decent English, and those who don’t will speak Japanese until they’ve helped you), and

- It’s COLD! (We woke up to 29 degrees!)

But, we didn’t let the cold hold us back!

Day 1 in Osaka: Osaka Castle, America-mura, Dotonbori

Our first outing was to Osaka Castle.

Dating back to the 16th-century, Osaka Castle is pretty impressive size-wise, but it’s not the “original” (it has undergone several restorations).

Unfortunately nothing inside of the castle is in its original form, so it was more like walking through a museum than anything else. The outside was beautiful, though.

After we made our way to America-mura, a youth-inspired creative pocket with street art, shops, and a lot of interesting design choices. Really funky and fun place to explore!

Last stop of the day was Dotonbori, the biggest “tourist attraction” of Osaka – and for good reason!

Bright neon lights, flashy signs, and more street food in one place than I’ve ever witnessed, this long walk of constant stimulation was a really fun experience.

Day 2: Nara Park, Todai-ji Temple, Osaka Station

Each morning we’d meet up for breakfast at our hotel and have a “family meeting” to discuss what we’d do for the day.

During our family meeting on day 2 Nicole mentioned a park where you can feed deer crackers – and they’ll bow for you! Because this obviously sounds like the cutest thing ever, I immediately voted for feeding bowing deer crackers!

If you don’t believe me, see for yourself in this video: John and the bowing deer.

The location: Nara Park, which is home not only to hundreds of bowing deer, but also the Tōdai-ji temple where Daibutsu, Tōdai-ji’s 50-foot-high bronze Buddha, is on display.

WOW!!

This was a super cool experience. Walking up to this building and coming face to face with such a massive slab of bronze – and trying to imagine how on earth humans managed to create something like that… very impressive.

Our last stop of the day was riding the train to Osaka’s main train station, which is massive. There are 8 floors that span multiple buildings, boast hundreds of shops, and dozens upon dozens of restaurants.

Day 3: Hattori Ryokuchi Park

For day 3 we all agreed to take a short train ride to a well-known park nearby called Hattori Ryokuchi Park.

It’s a little reminiscent of Central Park in NYC with miles of green space, a baseball field, a soccer field, tennis courts, a cemetery, and an Open Air Museum of Old Japanese Farm Houses.

The Farm Houses were a big draw because it sounded like a cool thing to check out. They’ve essentially taken old farm houses from all different parts of Japan and situated them in an outdoor space where you can walk around and see the differences, plus get a feel for what living in a farm house is like.

It was definitely cool to walk around the farm houses, but the highlight of the afternoon was stumbling upon an old Japanese tea house amongst the farm houses that just so happened to open in 10 minutes from that very moment in time… and only had room to serve 15 people each day. We felt like it was meant to be!

Getting to experience a traditional tea ceremony inside of a tea house with 3 Japanese women was great!

Day 4: Osaka aquarium

With a full day of rain in the forecast, we opted for the Osaka Aquarium, which we wouldn’t recommend.

We followed up our aquarium visit with a walk around a few neighboring parks, then came back to the hotel for an afternoon snooze before visiting our very first cat cafe!

Being a cat lover – and missing Gus like crazy – getting some snuggle times with furry friends was a treat. And what a concept!

We followed up the cat cafe with a little traditional happy hour stroll to several little restaurants that serve up Japan’s version of tapas: fried or grilled meat, and fried or grilled vegetables on a skewer. Yum!

Day 5: Hiroshima

We went back and forth about visiting Hiroshima from Osaka because of the distance and cost.

The train ride was 1.5 hours each way on the bullet train, and being the bullet train, our roundtrip tickets were about $160 per person. Seemed like a lot of travel time and money for a day trip.

But when it came down to it, I knew I’d regret not going.

And I’m so glad we decided to go.

The museum itself was incredibly well done. It was full immersion with a 55-point audio tour, videos, images, artifacts, and timelines.

After walking through, listening to the heartbreak and what the city of Hiroshima – and Japan as a whole – went through, I couldn’t help but wonder why this didn’t hold a much more significant place in our history books.

It also made me realize how lucky we are to have these travel experiences. The places we’ve been, the cultures we’ve gotten to learn more about, and the history we’ve come face-to-face with over the past 10 years has opened up such a deep perspective.

The peace memorial and surrounding area was really beautiful, too. Also, mind blowing that this building survived the bomb – and still stands today just beyond the museum and peace memorial.

After the museum we enjoyed a lunch along the river and a long stroll around the city, and then returned to the train station for our ride back to Osaka.

Our last day in Osaka was a quickie! We didn’t get back from Hiroshima until close to 7pm, and since we hadn’t really experienced the Dotonbori street food yet, we made a repeat visit for octopus balls and crab legs.

The boys had an early start the next morning for their flight to Niseko to start their skiing and snowboarding adventure, so we decided to head back to the hotel for a good nights sleep.

Day 6: “The Split”

On day 6 we split!

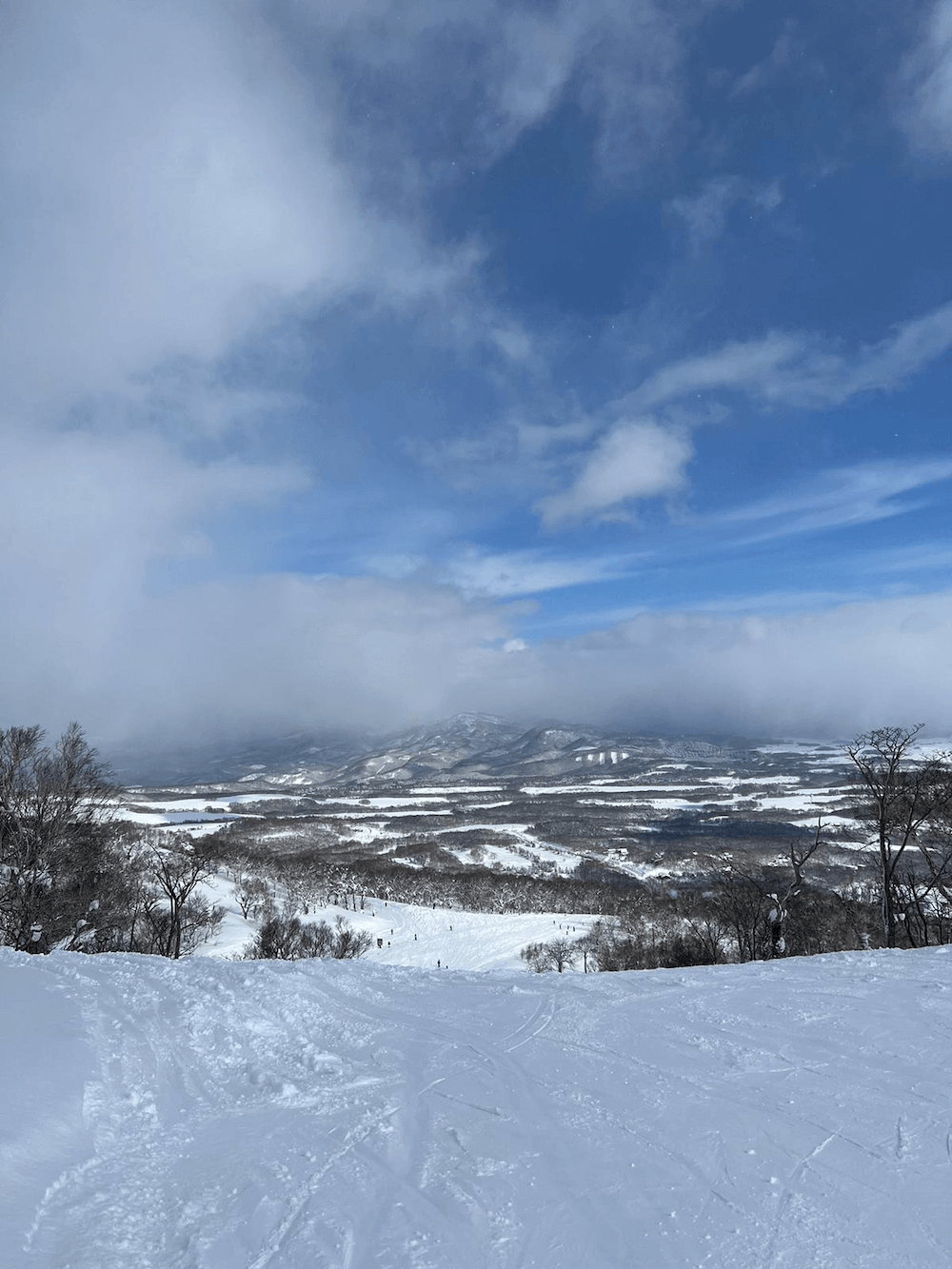

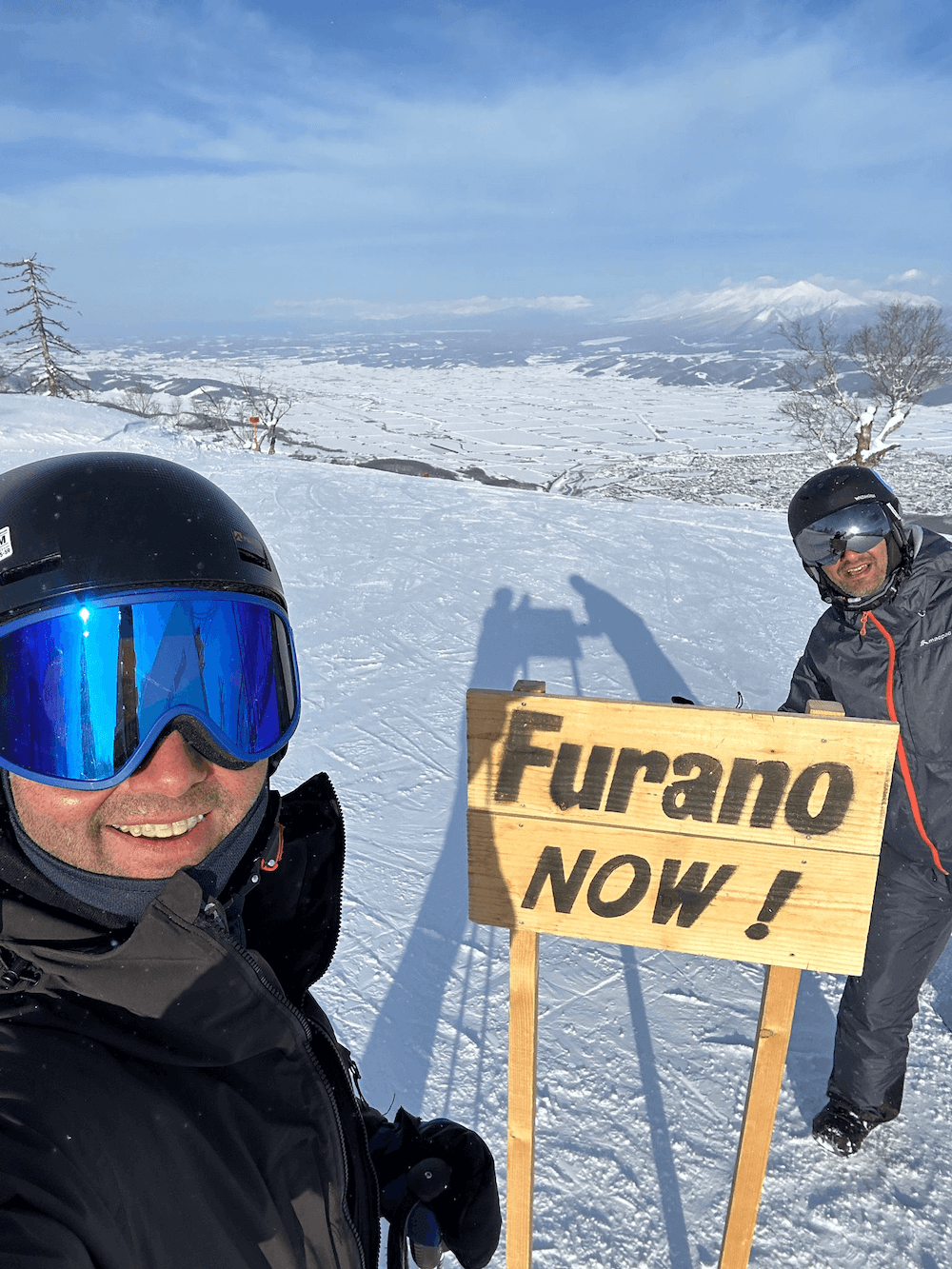

John and Omar hit the slopes up north (3 days in Niseko first, then 3 days in Furano), while Nicole and I made our way to Tokyo via the Shinkansen (bullet train) to meet up with Cass.

Nicole and I didn’t arrive in Tokyo until around 3pm, so we didn’t have a ton of daylight. We hopped in a cab, checked into our place, and then decided to hit the town in Shibuya.

Maybe you’ve heard of the “Shibuya Scramble”? That’s the famous intersection in Japan where at every second of every day there is an insane amount of traffic – both vehicular and pedestrian – going in every which direction.

Nicole had insider knowledge about the views of the Scramble from the 2nd floor of a nearby Starbucks, and since you never have to convince me to go into a Starbucks, we decided it was a perfect time to check it out.

Here’s a quick little time-lapse video from that 2nd floor of that Starbucks; pretty crazy! This literally happens every 1.5 minutes or so, 24/7.

Day 8 – 13: Tokyo with the girls!

Over the next several days – after welcoming Cass to Tokyo – we explored so many amazing pockets of greatness, including:

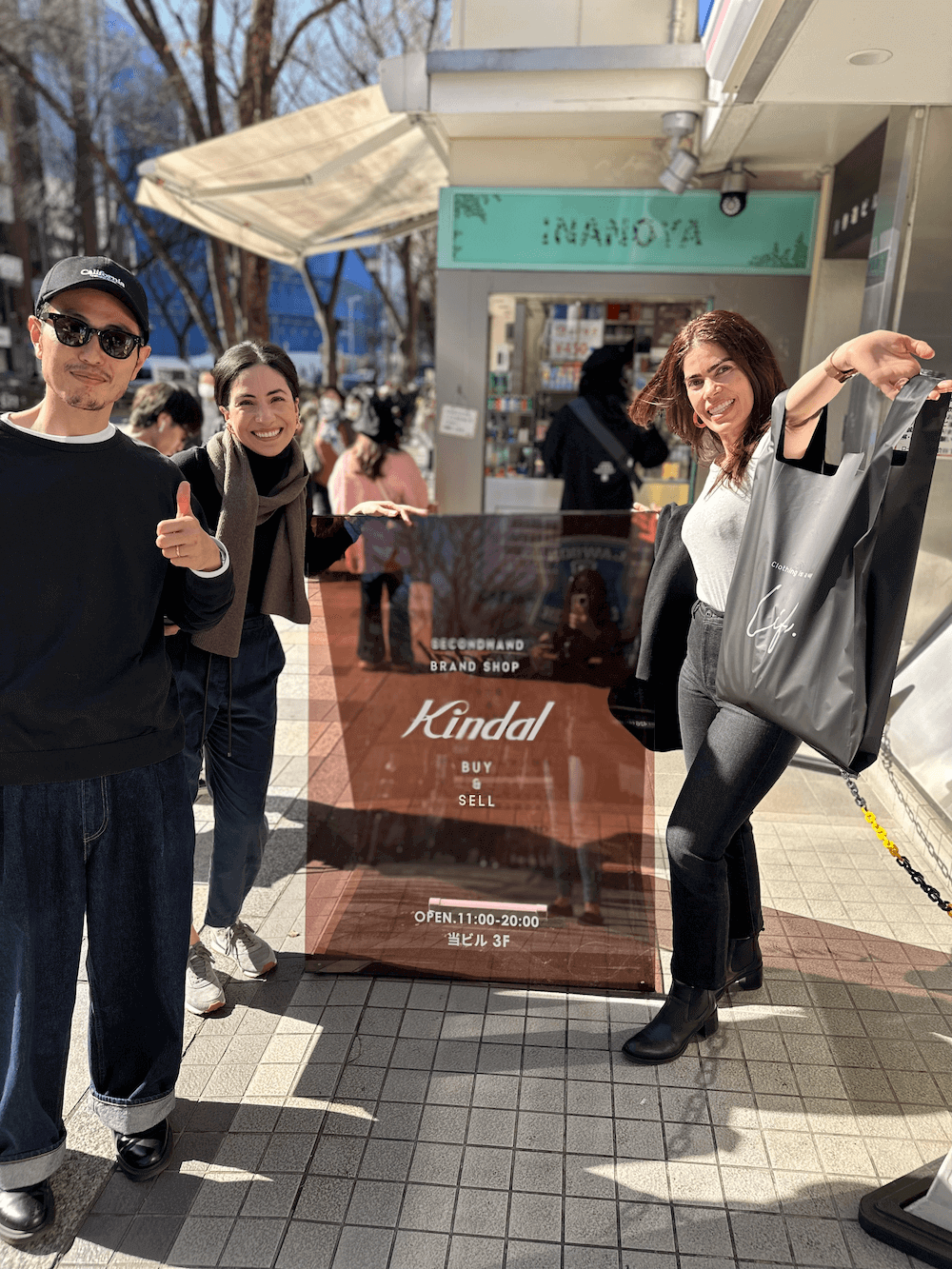

- Harajuku, filled with endless boutiques, cafes, and fun eateries

- Meiji-jingu Shrine

- Yoyogi Park

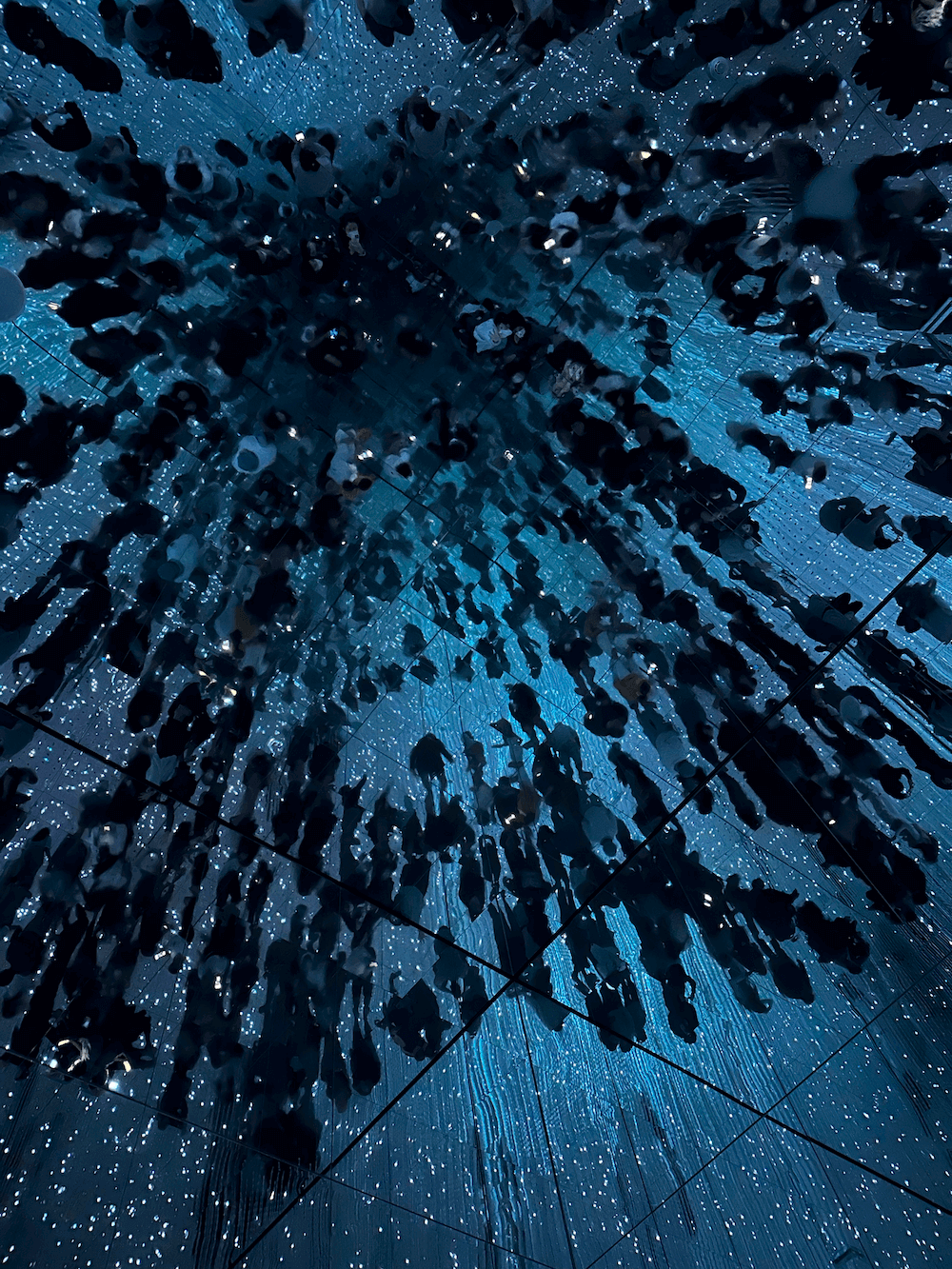

- TeamLab

The Shrines and parks are incredible throughout Tokyo. So many beautiful things to see in every direction… and you’re just steps from the bustling city (but would never know it!)

And TeamLab was such an awesome experience. It’s an interactive art exhibit set up in different spaces, each completely unique. We really enjoyed walking through the exhibits!

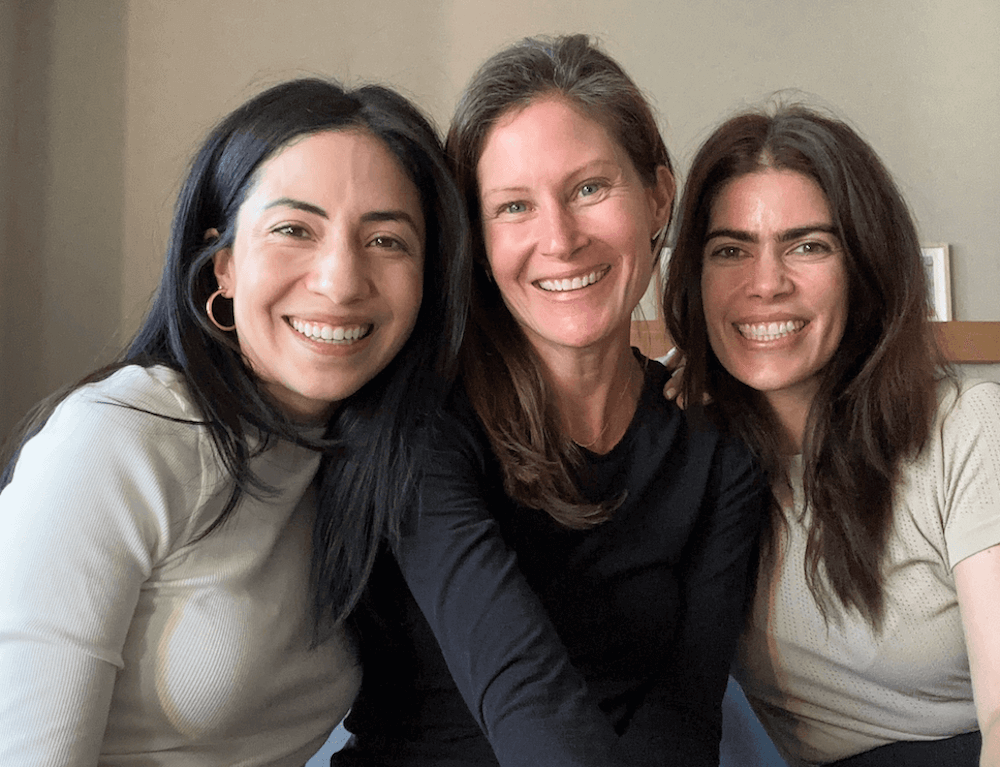

And, we got to have our very first ever mastermind IN PERSON!

As I mentioned earlier, what brought the 3 of us together in Japan in the first place was our mastermind, and so we didn’t think the trip would be complete without an actual in-person mastermind session!

We spent about 4 hours in the coziness of our apartment sharing laughs, wins, struggles, and brainstorming ways to go bigger in our businesses and lives in 2023.

It was such a cool experience to be able to do this in person after having done it online for 3 straight years!

We wrapped up our time together on our final day with an AirBNB Experiences: Meeting a personal stylist! We recapped the entire thing on a 3-way episode that we got to record in person together in Tokyo.

You can check out that episode right here on the Nicole & Kate Can Relate podcast!

Day 14: Reunited!

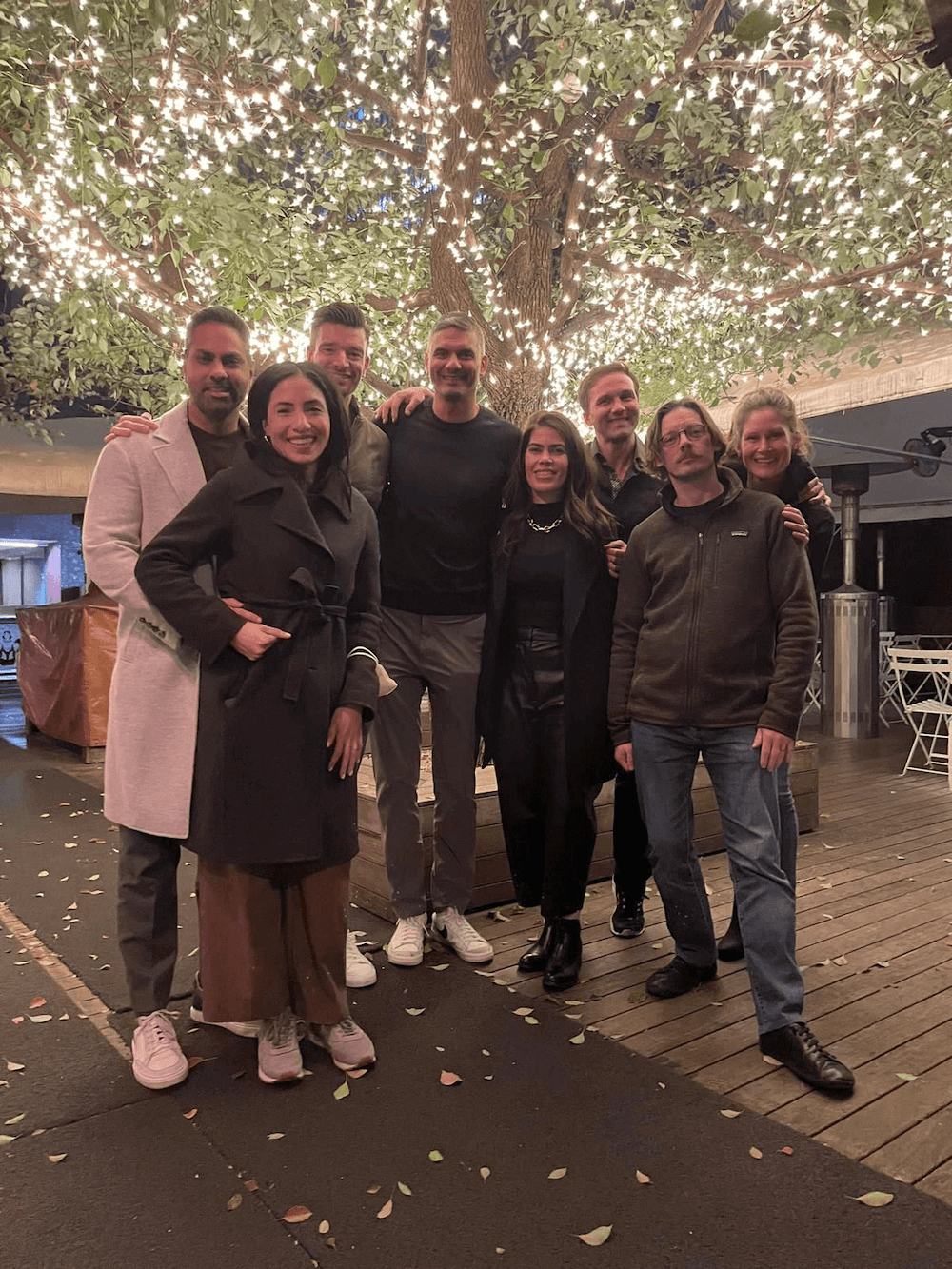

As we settled into our new hotels we were all really excited to meet up with the guys again, hear about skiing and the snow, and get ready for one last hurrah: a dinner and night out with all 6 of us + 2 locals (friends of Nicole & Omar’s), Andy and Andy.

But before I get to our last hurrah, here’s a mini skiing and snowboarding recap…

As I mentioned before, John and Omar made their way North to hit two ski slopes: 3 days in Niseko, then 3 days in Furano.

In John’s words, it was the best snow he’s ever skied! 🤩

They got a pretty good dump before and during their time on the mountain, and judging by the Instagram stories, it was nothing short of a winter wonderland.

I have to admit: while I was so excited to be spending the week with the girls in Tokyo, I couldn’t help but be jealous… I would have loved to experience a few days of skiing in Japan as well. But hey, there’s always next time!

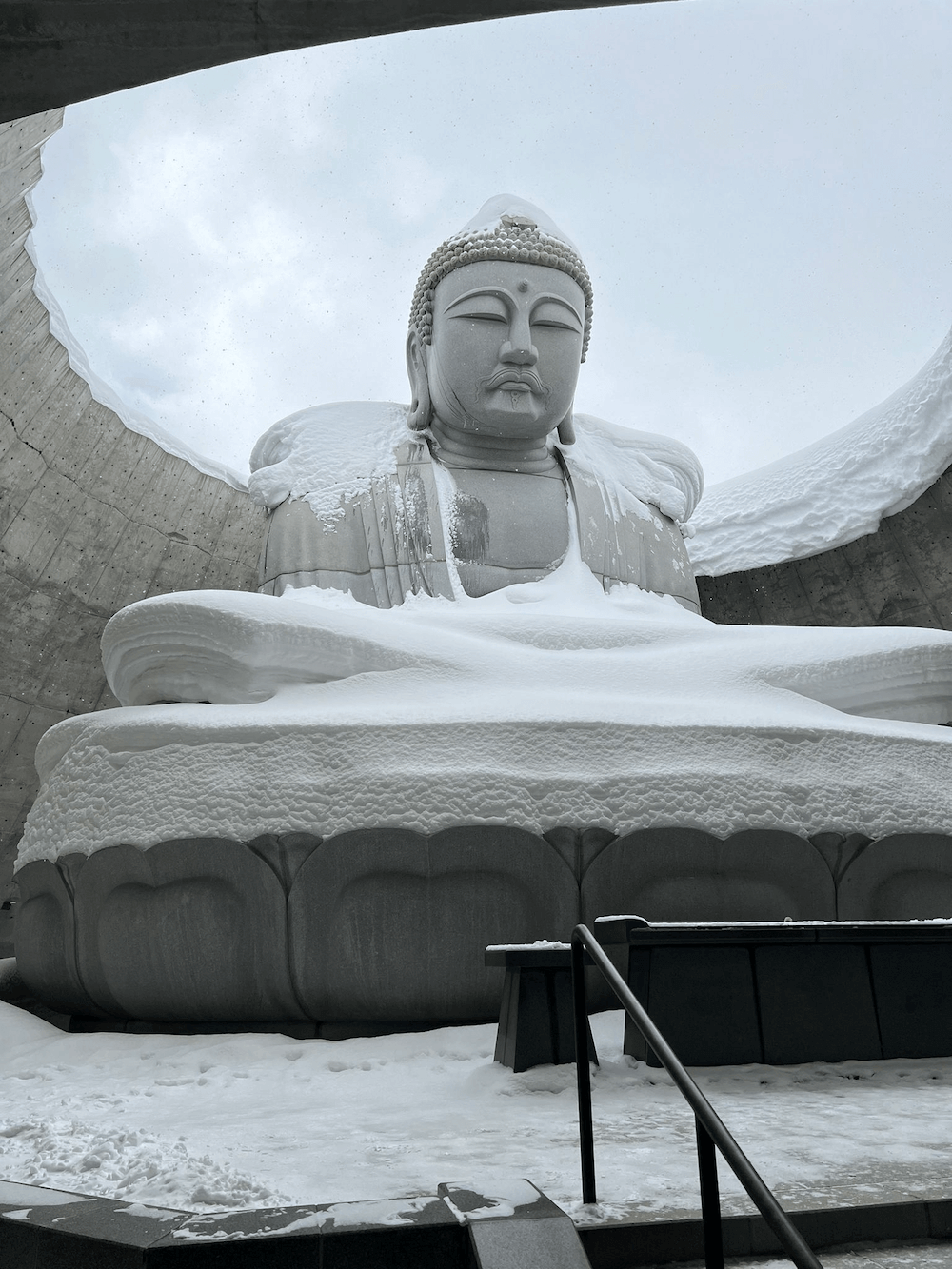

In between mountains (it was about a 4 hour drive from the first to the second), John and Omar stopped off at the “Stonehenge of Japan”.

In my opinion, it’s even more majestic and beautiful with all the snow on the ground. They said it was such a fantastic experience.

Furano was their last stop, and I have no doubt they made the most of it!

So next, we all got ready for that one last hurrah I mentioned, and then met at the top of a shopping center near the restaurant we were going to in order to start the night out right with a cocktail. It was perfect timing with the sun going down and such a beautiful setting.

Then, we met up with the Andy’s at a Mediterranean restaurant (their recommendation) and enjoyed an amazing prix fixe dinner.

Day 15 – 18: And then there were two!

John and I spend a very enjoyable last couple of days in Tokyo together visiting a lot of parks – and a really cool audio walking tour.

John did some research and downloaded an audio walking tour of a town called Nihombashi. This is where you’ll find the exact spot where all the distances in Japan are measured from, and the starting point for travelers and merchants going “out into the city” hundreds (and thousands) of years ago.

It’s also where Google will “map” you if you type in Tokyo (fun fact)

After lunch we hit the parks! And one that I had attempted to go to with Cass and Nicole, but didn’t quite make happen (it was a garden, so you had to pay entrance and it closed at 4) was the Shinjuku Gardens.

I’m so glad John and I were able to make it happen, because the park was absolutely beautiful!

We also rounded out the evening by visiting the Imperial Palace (couldn’t go inside since it was already closed) and I took John on a stroll through Yoyogi park (the one I had visited with Cass and Nicole earlier that week).

All in all our time in Japan was incredible. It’s a place that has never been on my radar, but now one I think is a must-visit for everyone.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

March 2023 Income Breakdown*

Product/Service Income: $131,471

TOTAL Journal Sales: $2,450 | Total Journals Sold: 67

The Freedom Journal: Accomplish your #1 goal in 100 days!

- Total: $1,295 (32 Freedom Journals + 2 Digital Packs sold)

The Mastery Journal: Master Productivity, Discipline and Focus in 100 days!

- Total: $875 (24 Mastery Journals + 2 Digital Packs sold)

The Podcast Journal: Idea to Launch in 50 Days!

- Total: $280 (7 Digital Packs sold)

Podcasters’ Paradise: The #1 Podcasting community in the world!

- Recurring: $4,636 (59 recurring)

- New members: $4,388 (4 new members)

- Total: $9,024

Real Revenue: Turn your BIG IDEA into Real Revenue

- Total: $0

Podcast Sponsorships: $119,924

Podcast Launch: Audiobook: $48 | eBook: $25

Free Courses that contribute to the above revenue:

Your Big Idea: Discover your big idea in under an hour!

Free Podcast Course: Create and launch your own podcast!

Funnel On Fire: Create a funnel that converts!

Affiliate Income: $25,878

*Affiliate links below – if you click on my affiliate link and sign up for the products and services I trust and recommend, then I will earn a commission.

Resources for Entrepreneurs: $4,866

- Audible: $44

- Bluehost: $0

- Click Funnels: $4,803

- CovertKit: $19

- Coaching referrals: $0 (email me for an introduction to a mentor for overall online business or a Podcast focused mentor!)

Resources for Podcasters: $241

- Podcasting Press: $0

- Splasheo: $60

- Fusebox: $0

- Libsyn: $42 (Use promo code FIRE for the rest of this month & next free!)

- Repurpose House: $105

- UDemy Podcasting Course: $34

Other Resources: $20,771

- Clay Clark Event: $20,274

- Amazon Associates: $81

- Other: $416

Total Gross Income in March: $157,349

Business Expenses: $14,838

- Advertising: $49

- Affiliate Commissions (Paradise): $23

- Cost of goods sold (Journals): $343

- Fulfillment: $0

- Consulting: $79

- Charitable Contributions: $100

- Design & Branding: $0

- Dues & Subscriptions: $161

- Legal & Professional: $0

- Meals & Entertainment: $696

- Merchant / bank fees: $1,557

- Amazon fees: $717

- PayPal fees: $25

- Office expenses: $279

- Community Refunds: $794

- Promotional: $0

- Travel: $6,065

- Virtual Assistant Fees: $3,875

- Website Fees: $75

Recurring, Subscription-based Expenses: $3,192

- Adobe Creative Cloud: $110

- Accounting: $468

- Boomerang: $90 (team package)

- Business Insider: $13

- Authorize.net: $36

- Google: $60

- Cell Phone: $191

- CookieYes: $10

- Internet: $63

- eVoice: $12

- Infusionsoft CRM: $274

- Insurance: $669

- Libsyn: $226

- Linktree: $6

- Microsoft: $78 (annual fee)

- OnceHub: $162 (annual fee)

- Taxes & Licenses: $523

- Patreon: $40

- Shopify: $36

- Zoom: $55

- Xero: $70

Total Expenses in March: $18,030

Payroll to John & Kate: $15,900

In our May 2014 Income Report and our June 2016 Income Report, Josh focuses on how to pay yourself as an entrepreneur. Check them out!

Wondering what we do with all of our net revenue? We share all in our April 2017 Income Report :)

Total Net Profit for March 2023: $139,319

Biggest Lesson Learned

The power of reflection and recaps

I’m such a huge fan of reflection. I feel there’s so much to be learned when we look at where we’ve been and how our actions have positively – or in some cases negatively – impacted where we are now.

There’s so much growth in that space.

We can identify things that are working really well for us and choose to double down on those things.

We can also identify things that aren’t working that well for us and choose to pivot and to spend our time differently.

I thought about reflection and recaps most recently after we returned from our trip to Japan.

The trip was incredible, and we’ve shared a ton about it with you right here in this income report. We’ve definitely been excited to share our travels with you – just like we’re always excited to share what’s been going on at the EOFire studios each month in these reports.

But we’ve also been doubly transparent and let you know that’s not the only reason why we publish these income reports. There’s another reason why, and it’s to hold ourselves accountable to reflecting and recapping where we’ve been, and where we are now.

It also serves an incredible timeline! Imagine being able to look back at your business growth, your personal growth, your leadership growth, all the missteps and lessons learned along your journey. That’s invaluable.

This isn’t the first time we’ve encouraged this: you don’t have to publish a monthly income report for your business, of course. But that doesn’t mean you can’t still follow a similar format internally. Something for yourself, for your team, for your business.

Answering just a few simple questions can go a LONG way.

- What happened in your business over the past month?

- Where did you spend a majority of your time?

- What ROI do you have to show for it?

- What were some of your biggest wins?

- What were some decisions you made that you’re now rethinking?

- Are there pivots you can make moving forward to improve the operations of your business – and maybe your own productivity? If yes, what are they?

Accountability is huge. Start using reflection and recapping each month to your advantage, and you can thank us later ;)

Until next month, keep your FIRE burning!

~ Kate & John

Note: we report our income figures as accurately as possible, but in using reports from a combo of Infusionsoft & Xero to track our product and total income / expenses, they suggest the possibility of a 3 – 5% margin of error.