October 2022 Income At-A-Glance

Gross Income for October: $180,856

Total Expenses for October: $20,252

Total Net Profit for October: $160,604

Difference b/t October & September: +$1,098

% of net profit to overall gross revenue: 89%

Why We Publish An Income Report

This monthly income report is created for you, Fire Nation!

By documenting the struggles we encounter and the successes we celebrate as entrepreneurs every single month, we’re able to provide you with support – and a single resource – where we share what’s working, what’s not, and what’s possible.

There’s a lot of hard work that goes into learning and growing as an entrepreneur, especially when you’re just starting out. The most important part of the equation is that you’re able to pass on what you learn to others through teaching, which is what we aim to do here.

Check out all of our monthly income reports – from the very beginning!

Let’s IGNITE!

**We’ll receive a commission on the affiliate links below. If you click on my affiliate link and sign up for the products and services I trust and recommend, then I will earn a commission.

Ron Parisi’s Monthly Tax Tip

Hello Fire Nation! Ron Parisi from CPA On Fire here for our October 2022 Tax and Accounting tip.

This month, we’re talking about “Research & Development Tax Credits”.

At CPA On Fire, we specialize in working with entrepreneurs to minimize their tax liability while keeping them in line with the ever-changing tax laws.

Our firm has been working with JLD & Kate at Entrepreneurs On Fire for years now, and they’ve included me in these monthly income reports with unlimited access to all their accounts so I can verify that what they report here is complete and accurate.

And because they believe in delivering an insane amount of value to you, my job doesn’t stop at the verification level; I also provide a new tax and accounting tip every month!

Ron’s October Tax Tip: Understanding Research & Development Tax Credits (the R&D Tax Credit)

This month’s topic involves a “technical” tax credit opportunity.

Determining whether you qualify for the R&D Tax Credit involves in-depth analysis with a specialist.

However, the purpose of this tax tip is to create a general awareness that this substantial tax credit opportunity – tax “credit” means money in your pocket – may be available for your business.

You could qualify for a credit of 12% to 16% of your business’s “R&D” costs.

The “R&D Tax Credit” is not limited to “scientific” businesses. It is available to businesses of various types, sizes and stages of development.

For tax purposes, “R&D” means research to bring new knowledge. This could include development of new products, business processes, software, tools, etc.

The “R&D Credit” could offset payroll taxes even if your business is in “startup” mode and not yet generating taxable income. Further, it could be applicable to prior years, as well as the current and future years.

If you are interested in evaluating whether your business may qualify for an R&D Tax Credit, we can put you in touch with a specialist. We have facilitated this service for many of our clients, including those who are successful online entrepreneurs.

Those of you in Fire Nation who are entrepreneurs and business owners and are looking to upgrade your financial operations in 2022, check out our website: CPAOnFire.com!

We’ve been able to get our clients amazing results and would love to help you out as well. Book a call through our website and let us show you how we can help your business grow.

What Went Down In October

Interview of the Month

Building an NFT Business in a Bear Market with Anthony Mongiello

3 Value Bombs

- Listening to some feedback and ignoring others is exactly what it’s like running a Web3 business right now.

- It’s not just about connecting digitally or virtually. It’s also about meeting and shaking hands in the real world.

- Be highly engaged with your community. It helps bring ideas to fruition.

Free NFT 101 Course – Struggling To Understand What NFTs Are and Why You Should Care? Sign up for this free NFT course!

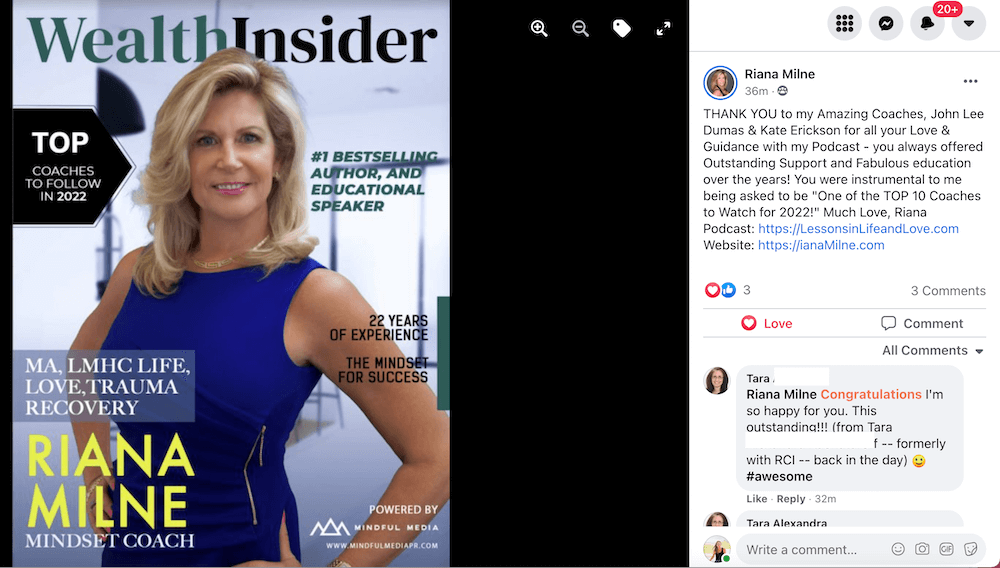

New Membership Options for Podcasters’ Paradise

We did something in October we haven’t done for a while now: we hosted a live Podcast Masterclass!

We had a blast, got to chat with many who were on live, answered some GREAT questions about podcasting, and introduced new membership options for Podcasters’ Paradise.

Podcasters’ Paradise is our premium membership community where we teach people how to create, grow, and monetize their own podcast. And Podcasters’ Paradise has been going for 9 years strong now!

What launched as a major MVP in October 2013 is now a thriving community with everything you need to become a successful podcaster, including:

- A Private Facebook Group for daily support from other podcasters, including us!

- Step by step video tutorials that we’re always updating and adding to

- Templates and document samples to help you lock in sponsorships, reach out to potential guests, and more!

- Vetted resources and recommendations for podcasting services, tools, and software

- And so much more…

With over 4,000 members and counting, Podcasters’ Paradise has created a truly unique community of podcasters who love to support one another, and we’re so proud to be a part of growing the podcasting community as a whole!

So what’s new with the membership options?

We’ve officially done away with our monthly membership, and now you have two options to join:

- Paradise Lite

- Paradise VIP

Both are annual memberships, and both give you immediate access to EVERYTHING inside of Podcasters’ Paradise!

You can learn more about Podcasters’ Paradise and check out our new membership options at PodcastersParadise.com!

Podopolo

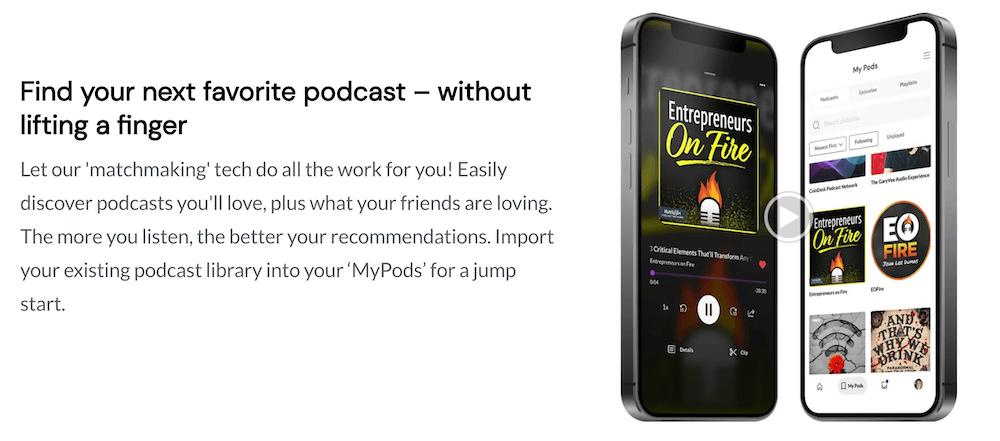

Over the past month we’ve been diving into a new podcasting app that is climbing the ranks as the best podcast app out there.

It’s called Podopolo, and if it sounds familiar, that’s because we recently had CEO and Founder Melinda Wittstock on Entrepreneurs On Fire to talk about it!

Podopolo is a current sponsor of EOFire and what’s different about this app is that it makes listening and discovery a breeze for users – and podcasting profitable for creators.

Sounds pretty great, right?

Well right now you can experience the awesomeness of Podopolo by downloading the app here!

If you’re ready for a more personalized, interactive, and social experience – one that gives you podcast recommendations based on what you’re listening to right now AND that allows you to curate your own playlists – then Podopolo is for you!

If you’re ready for a more personalized, interactive, and social experience – one that gives you podcast recommendations based on what you’re listening to right now AND that allows you to curate your own playlists – then Podopolo is for you!

For the BEST podcast app listening experience around, follow these simple steps!

- Download the App at Podopolo.com

- Mention JLD or EOFire when you sign up for your account

- Follow Entrepreneurs On Fire once you’re in the app

- Fill out this form to share your feedback about Podopolo, and the first 100 submissions will get an EOFire t-shirt – free!

Don’t miss out on being an early adopter with the best podcast app on the market: Podopolo!

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

October 2022 Income Breakdown*

Product/Service Income: $170,917

TOTAL Journal sales: Total Journals Sold 188: $4,556

The Freedom Journal: Accomplish your #1 goal in 100 days!

- Total: $1,816 (115 Freedom Journals + 2 Digital Packs sold)

The Mastery Journal: Master Productivity, Discipline and Focus in 100 days!

- Total: $864 (23 Mastery Journals + 0 Digital Packs sold)

The Podcast Journal: Idea to Launch in 50 Days!

- Total: $1,876 (44 Podcast Journals + 4 Digital Packs sold)

Podcasters’ Paradise: The #1 Podcasting community in the world!

- Recurring: $9,470 (81 recurring)

- New members: $15,428 (26 new members)

- Total: $24,898

Real Revenue: Turn your BIG IDEA into Real Revenue

- Total: $75

Podcast Sponsorships: $141,350

Podcast Launch: Audiobook: $28 | eBook: $10

Free Courses that contribute to the above revenue:

Your Big Idea: Discover your big idea in under an hour!

Free Podcast Course: Create and launch your own podcast!

Funnel On Fire: Create a funnel that converts!

Affiliate Income: $9,939

*Affiliate links below – if you click on my affiliate link and sign up for the products and services I trust and recommend, then I will earn a commission.

Resources for Entrepreneurs: $9,336

- Audible: $16

- Bluehost: $0

- Click Funnels: $6,105

- CovertKit: $15

- Coaching referrals: $3,200 (email me for an introduction to a mentor for overall online business or a Podcast focused mentor!)

Resources for Podcasters: $290

- Podcasting Press: $0

- Splasheo: $50

- Fusebox: $0

- Libsyn: $100 (Use promo code FIRE for the rest of this month & next free!)

- Repurpose House: $110

- UDemy Podcasting Course: $30

Other Resources: $313

- Amazon Associates: $44

- Other: $269

Total Gross Income in October: $180,856

Business Expenses: $16,545

- Advertising: $166

- Affiliate Commissions (Paradise): $166

- Cost of goods sold (Journals): $982

- Fulfillment: $375

- Consulting: $3,099

- Charitable Contributions: $187

- Design & Branding: $

- Dues & Subscriptions: $86

- Legal & Professional: $298

- Meals & Entertainment: $488

- Merchant / bank fees: $641

- Amazon fees: $1,949

- PayPal fees: $323

- Office expenses: $240

- Community Refunds: $194

- Promotional: $300

- Travel: $1,626

- Virtual Assistant Fees: $5,350

- Website Fees: $75

Recurring, Subscription-based Expenses: $3,707

- Adobe Creative Cloud: $100

- Audible: $16

- Accounting: $375

- Boomerang: $50 (team package)

- Business Insider: $13

- Authorize.net: $36

- Google: $49

- Five Below: $11

- Bonjoro: $45

- Cell Phone: $526

- Internet: $143

- eVoice: $12

- Envato: $34

- Infusionsoft CRM: $241

- Insurance: $669

- Libsyn: $223

- Loom: $96 (annual subscription)

- Linktree: $6

- Nitro: $99 (annual subscription)

- PicMonkey: $8

- TaxJar: $19

- Taxes & Licenses: $523

- Patreon: $40

- Shopify: $36

- SumUp: $18

- Zoom: $55

- Vimeo: $199 (annual subscription)

- Xero: $65

Total Expenses in October: $20,252

Payroll to John & Kate: $15,900

In our May 2014 Income Report and our June 2016 Income Report, Josh focuses on how to pay yourself as an entrepreneur. Check them out!

Wondering what we do with all of our net revenue? We share all in our April 2017 Income Report :)

Total Net Profit for October 2022: $160,604

Biggest Lesson Learned

Daily Actions Matter

In late September I launched a 100 day goal challenge for Fire Nation. Completely free. No strings attached. One episode every day for 100 days on my Kate’s Take podcast, and one post every day in our private Facebook Group so we all know we’re in this together.

Many of you have joined me for this challenge, and the results have been so incredible to witness.

Every day we’ve been taking small actions that get us one step closer to our BIG goal – and those daily actions matter… A LOT!

Typically when we set a big goal, we immediately feel overwhelmed. We think, “How the heck am I actually going to accomplish this beastly thing?!” “Where do I even start?!”

Breaking your BIG goal down into micro-goals, and then taking daily actions that will help you accomplish those micro-goals is the key. Having regular check-in’s, being able to share your wins and celebrate milestones, understanding what’s NOT working and being able to correct course immediately… these are all critical steps to accomplishing a BIG goal.

It’s very simple at its core, but it’s not easy to implement because many of us don’t have proper accountability, and we haven’t built up our discipline and focus muscles enough to stay on track with the many distractions and unexpected to-do’s that pop up throughout our days.

If you’re nodding your head right now and thinking this sounds all too familiar, then it’s not too late to join us!

Again, this challenge is completely free, and you can start TODAY.

Head over to EOFire.com/facebook, post your BIG goal in the group, check out the episode that went live that day (I post in the group every day with a prompt and the link to that day’s episode), and let’s close out 2022 having accomplish a BIG, meaningful goal together.

Remember, your daily actions matter, and all it takes is you committing to it in order to start.

Until next month, keep your FIRE burning!

~ Kate & John

Note: we report our income figures as accurately as possible, but in using reports from a combo of Infusionsoft & Xero to track our product and total income / expenses, they suggest the possibility of a 3 – 5% margin of error.