August 2021 Income At-A-Glance

Gross Income for August: $245,799

Total Expenses for August: $21,946

Total Net Profit for August: $223,853

Difference b/t August & July: -$37,820

% of net profit to overall gross revenue: 91%

Why We Publish An Income Report

This monthly income report is created for you, Fire Nation!

By documenting the struggles we encounter and the successes we celebrate as entrepreneurs every single month, we’re able to provide you with support – and a single resource – where we share what’s working, what’s not, and what’s possible.

There’s a lot of hard work that goes into learning and growing as an entrepreneur, especially when you’re just starting out. The most important part of the equation is that you’re able to pass on what you learn to others through teaching, which is what we aim to do here.

Let’s IGNITE!

**We’ll receive a commission on the affiliate links below. If you click on my affiliate link and sign up for the products and services I trust and recommend, then I will earn a commission.

Josh Bauerle’s Monthly Tax Tip

What’s up Fire Nation, my name is Josh Bauerle. I’m a CPA and the Founder of CPA On Fire, where we specialize in working with entrepreneurs to minimize their tax liability while keeping them in line with the ever-changing tax laws.

I’ve been working with JLD & Kate at Entrepreneurs On Fire for years now, and they’ve included me in these monthly income reports with unlimited access to all their accounts so I can verify that what they report here is complete and accurate.

And because they believe in delivering an insane amount of value to you, my job doesn’t stop at the verification level; I also provide a new tax and accounting tip every month!

Josh’s August Tax Tip: The true tax benefit to real estate

Most of us hear about the tax advantages afforded to purchasing real estate often. And while I think those may be overblown to a point, there are certain advantages real estate offers in the way of taxes.

While owning real estate used for either investment or business purposes, you have several benefits on the front end, including:

- Deduction depreciation (basically the cost of the house divided by 27.5) each year

- Having all profits be taxed as passive income instead of active income, plus

- All the items afforded to other business ventures, like deducting expenses.

But the true tax benefit to real estate (and any asset) comes on the back end, when you sell the home. And I recently got to see this first hand when I sold 25 of my 28 rental properties in a single transaction.

The way income from most sources, such as W2 income, self employed income, etc works is that the income is taxed at your ordinary tax rate, plus subject to social security and medicare taxes.

Depending on how high your income is, you could be paying close to 50 percent on that income.

But when selling assets, like real estate, the income is taxed at your capital gains rate. If you have held the asset for less than a year, it is taxed at your ordinary tax rate, but there is still no social security or medicare taxes.

But if you have held the asset for more than a year, you are taxed at 20, 15 or even 0 percent, depending on your total income for the year.

This is a substantial difference for most people.

Let’s look at an example…

Say you bought a rental property for $1M five years ago. The market went crazy and you sold it for $2M this year. Your capital gains would be the $1M profit.

Because you were in the highest tax bracket, your long term capital gain rate would be 20 percent, so your total tax bill on the sale would be $200,000.

Compare that to a scenario where you made $1M at a job, and you would pay a max rate of 37 percent, plus social security and medicare taxes. So the total savings is massive!

But there’s one more component many people miss when discussing the sale of real estate or other assets.

Remember above where we talked about deducting depreciation as a tax advantage?

Well when you sell that asset, you have to pay back the taxes you saved on that depreciation. It’s called depreciation recapture.

You will take the total amount of depreciation you took on the asset over the time you had it and you will pay a tax rate of either 25 percent or your marginal tax rate, whichever is lower.

So in the same scenario as above, let’s say you took $50,000 of depreciation during the five years you owned the home. When you sell, your depreciation recapture would be the $50k times 25 percent, since your marginal rate of 37 percent is higher, and your total tax hit on that would be $12,500.

Even with that annoying depreciation recapture though, your tax hit is still far lower than it would be on ordinary income, which is why selling assets is a far more tax efficient way to make money!

As you can see though, selling an asset has a lot of moving parts on the tax side of things. There are also ways to potentially defer the taxes on real estate sales with things like 1031 exchanges. So it’s always in your best interest to consult a tax professional before you actually make any sales!

As always, please feel free to contact me if you’d like to discuss what would be best for YOUR business. I LOVE chatting with Fire Nation!

What Went Down In August

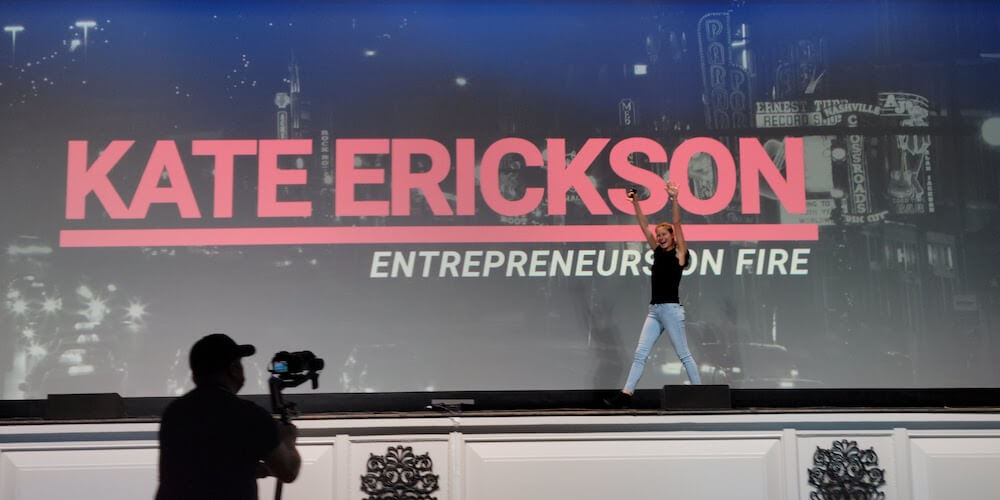

Podcast Movement 2021

Podcast Movement was an absolute blast! It was SO nice to be back at an in-person event, hanging out with some of our closest friends in the podcasting space.

It was also a treat to have Podcast Movement hosted in Nashville – and at the Gaylord Opryland Hotel.

Our time in Nashville started out with a self-guided audio walking tour of downtown Nashville, followed by our Podcasters’ Paradise meet up, and a dinner hosted by Travis Chappell of Guestio on a rooftop in downtown.

It was a fantastic way to kick off the conference!

The next morning started bright and early – with my keynote!

I shared a brand new presentation on the Entrepreneurs On Fire Podcast Workflow. I was very happy with how my presentation turned out, and I’m so grateful for all the preparation and planning I did for it.

photo credit: Mario Fachini

That afternoon John took the stage with with Sam Parr, host of My First Million podcast for a convo on getting your first million downloads. They were great together, and their time on stage gave the audience free range to ask questions.

photo credit: Mario Fachini

We also got to meet and hangout with the HubSpot Podcast Network crew, which was such a treat!

We’ve been with the HubSpot Podcast Network for several months now, but with the pandemic we haven’t had a chance to meet anyone from the network in person. This was an awesome opportunity to get to know the other hosts – and our go-to at HubSpot, Alanah – much better.

photo credit: Mario Fachini

As you can see in the photo, HubSpot had quite the installation going on at the event!

It included 2 live studio recording booths that you could sign up to record in, and John got to record a live interview with Mike Zeller for Entrepreneurs On Fire on-site!

I also got to record an interview with Alicia for her podcast Business Infrastructure that I’m so excited to share!

And last, but certainly not least from our highlights of Podcast Movement: John got to meet – and hangout with – Mark Cuban!

Mark is working with Falon Fatemi on a new app called Fireside, which they took the stage to talk about during the event.

We could go on about how incredible Podcast Movement was, but for now, check out our full Podcast Movement 2021 recap (including my top 5 takeaways and the 3 keys for making the most out of every conference!)

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

August 2021 Income Breakdown*

Product/Service Income: $233,329

TOTAL Journal sales: Total Journals Sold 219 – $7,775

The Freedom Journal: Accomplish your #1 goal in 100 days!

- Total: $2,016 (55 Freedom Journals sold + 1 Digital Pack)

The Mastery Journal: Master Productivity, Discipline and Focus in 100 days!

- Total: $1,352 (43 Mastery Journals sold)

The Podcast Journal: Idea to Launch in 50 Days!

- Total: $4,407 (120 Podcast Journals sold)

Podcasters’ Paradise: The #1 Podcasting community in the world!

- Recurring: $8,870 (102 recurring)

- New members: $7,852 (16 new members)

- Total: $16,722

Real Revenue: Turn your BIG IDEA into Real Revenue

- Total: $300

Podcast Sponsorships: $208,425

The Common Path to Uncommon Success: $1,800

Podcast Launch: Audiobook: $92 | eBook: $15

Free Courses that contribute to the above revenue:

Your Big Idea: Discover your big idea in under an hour!

Free Podcast Course: Create and launch your own podcast!

Funnel On Fire: Create a funnel that converts!

Affiliate Income: $12,470

*Affiliate links below – if you click on my affiliate link and sign up for the products and services I trust and recommend, then I will earn a commission.

Resources for Entrepreneurs: $9,800

- Audible: $27

- Bluehost: $0

- Click Funnels: $9,189

- CovertKit: $35

- Coaching referrals: $549 (email me for an introduction to a mentor for overall online business or a Podcast focused mentor!)

Courses for Entrepreneurs: $1,053

- Tony Robbins & Dean Graziosi: $1,053

Resources for Podcasters: $96

- Podcasting Press: $46

- Splasheo: $50

- Libsyn: $0 (Use promo code FIRE for the rest of this month & next free!)

- UDemy Podcasting Course: $0

Other Resources: $1,521

- Amazon Associates: $160

- Other: $1,361

Total Gross Income in August: $245,799

Business Expenses: $16,999

- Advertising: $29

- Affiliate Commissions (Paradise): $562

- Accounting: $1,034

- Cost of goods sold (Journals): $1,132

- Consulting: $116

- Fulfillment: $1,153

- Design & Branding: $150

- Dues & Subscriptions: $11

- Education: $153

- Legal & Professional: $394

- Meals & Entertainment: $152

- Merchant / bank fees: $1,537

- Amazon fees: $2,882

- PayPal fees: $201

- Office expenses: $330

- Community Refunds: $997

- Promotional: $0

- Travel: $2,909

- Virtual Assistant Fees: $3,100

- Website Fees: $157

Recurring, Subscription-based Expenses: $4,947

- Adobe Creative Cloud: $100

- Boomerang: $50 (team package)

- Authorize.net: $40

- Bonjoro: $45

- Cell Phone: $187

- Carbonite: $79 (annual fee)

- Cyber Security: $3,171 (annual fee)

- Google Suite: $34

- Internet: $40

- eVoice: $10

- Infusionsoft CRM: $241

- Insurance: $89

- Libsyn: $153

- Linktree: $6

- TaxJar: $19

- Taxes & Licenses: $523

- Zoom: $100

- Xero: $60

Total Expenses in August: $21,946

Payroll to John & Kate: $15,900

In our May 2014 Income Report and our June 2016 Income Report, Josh focuses on how to pay yourself as an entrepreneur. Check them out!

Wondering what we do with all of our net revenue? We share all in our April 2017 Income Report :)

Total Net Profit for August 2021: $223,853

Biggest Lesson Learned

Open, honest conversations

Something that has always helped me immensely – especially on my journey as an entrepreneur – is investing time in my relationships. Whether it’s with colleagues, friends or family members, I know how critical strong relationships are, and I put an incredibly high value on my relationships.

I know what I put into my relationships – support, providing feedback or brainstorming when it’s requested, being there to listen when someone needs to talk… – is what I’ll get back.

The power of relationships? It’s hard to put it into words, but I think we can all relate to being in situations where we’re faced with a decision or are experiencing a life event or struggle, and we could really use someone to lean on.

I know no better way to work through these instances than by having someone we know we can have an open, honest conversation with.

Unfortunately, it seems more and more these days we are discouraged from having open and honest conversations. Maybe it’s because we know the other person disagrees with us and we don’t want to create conflict, or maybe it’s a topic we’re simply uncomfortable discussing for fear that we’ll cross a line.

My biggest lesson learned? Open and honest conversations are healthy and can create support and understanding. When we have open and honest conversations and aren’t judgmental, we respect one another’s opinions, and we genuinely listen, we can learn and grow in so many ways.

That’s exactly why my girlfriend Nicole and I launched a podcast that focuses on the importance of candid convos when it comes to learning, growing, and supporting one another.

If you want to check out the type of open and honest conversations I’m talking about, then tune in to Nicole & Kate Can Relate! Each week we share a candid conversation about a life topic we can all relate to, but that isn’t often talked about.

For example, our first episode discussed whether we want to have to children – and what that decision was like for each of us. We also talk about topics like confidence, building a business, and getting older.

We publish once a week on Sunday’s, and we look forward to having you join us for our next convo!

Alright Fire Nation, that’s a wrap!

Until next month, keep your FIRE burning!

~ Kate & John

Note: we report our income figures as accurately as possible, but in using reports from a combo of Infusionsoft & Xero to track our product and total income / expenses, they suggest the possibility of a 3 – 5% margin of error.