June 2020 Income At-A-Glance

Gross Income for June: $171,682

Total Expenses for June: $39,540

Total Net Profit for June: $132,142

Difference b/t June & May: -$68,809

% of net profit to overall gross revenue: 77%

Why We Publish An Income Report

This monthly income report is created for you, Fire Nation!

By documenting the struggles we encounter and the successes we celebrate as entrepreneurs every single month, we’re able to provide you with support – and a single resource – where we share what’s working, what’s not, and what’s possible.

There’s a lot of hard work that goes into learning and growing as an entrepreneur, especially when you’re just starting out. The most important part of the equation is that you’re able to pass on what you learn to others through teaching, which is what we aim to do here.

Let’s IGNITE!

**We’ll receive a commission on the affiliate links below. If you click on my affiliate link and sign up for the products and services I trust and recommend, then I will earn a commission.

Josh Bauerle’s Monthly Tax Tip

What’s up Fire Nation, my name is Josh Bauerle. I’m a CPA and the Founder of CPA On Fire, where we specialize in working with entrepreneurs to minimize their tax liability while keeping them in line with the ever-changing tax laws.

I’ve been working with JLD & Kate at Entrepreneurs On Fire for years now, and they’ve included me in these monthly income reports with unlimited access to all their accounts so I can verify that what they report here is complete and accurate.

And because they believe in delivering an insane amount of value to you, my job doesn’t stop at the verification level; I also provide a new tax and accounting tip every month!

Josh’s June Tax Tip: The Potential Tax Benefits of an S Corporation

We’ve talked about the potential tax benefits of an S Corporation several times on these reports.

Once your profits start getting in the $50,000 a year range or higher, an S Corp can save you thousands – or even tens of thousands – of dollars in taxes.

But one big key to properly maintaining your S Corp according to IRS standards is the need to pay yourself a “reasonable” salary.

And unfortunately it’s something we continue to see a lot of business owners miss.

So this month we want to do a refresher on what constitutes a reasonable salary and how to make sure you are doing it properly.

What constitutes a reasonable salary?

First, the most important thing to understand is that simply writing yourself a check or transferring money from the business to you personally is not paying yourself a salary.

In order for it to count as salary, you have to be withholding, paying and filing payroll taxes. And because these can be so complicated and time consuming, we highly recommend using an actual payroll company to do it – even if you are the only employee on payroll.

Gusto is my go-to payroll service.

From there, the question becomes: What’s “reasonable” for you and your business?

The IRS being the IRS, they are very vague here and we are left to do a little bit of guess work.

But there’s one underlying question that can best determine how much to pay yourself:

How much would you have to pay someone else to replace your role in the business?

The answer to that is the clear cut answer on how much to pay yourself.

Of course it’s not always simple to figure that out!

Many people serve a role in their business that it would be very hard to determine what you would have to pay someone to replace you. In those cases, here’s a few other questions to help determine the proper amount.

- How many hours per week do you work in the business on average?

The more hours you work the higher your pay would have to be.

- What skills are required in the work you do?

- Could a high school graduate learn the role very quickly, or does it require very specific skill set that takes years of training?

The more highly qualified you need to be for the role the higher the pay should be.

- How much money does the business make?

While the IRS doesn’t want you making your salary a simple percentage of profits, the profits do play a role. If the business is losing money you likely don’t need to pay yourself a salary.

If it’s making $1M a year in profits you would likely need a much higher salary than if it’s making $100k in profits.

Generally, the more the business makes, all other things being equal, the higher your salary should be.

Use common sense.

I know, this is IRS level vague, but there’s a lot of common sense involved. You can’t make $100k in the business, pay yourself $5k a year, and call it reasonable. The goal is to avoid red flags, and common sense can go a long ways towards doing that.

We are officially halfway through 2020 (you know, the longest year in world history!), and if you are an S Corp and you aren’t yet paying yourself a reasonable salary, then make sure the second half of the year is spent doing it. Otherwise you are putting all the tax savings of your S Corp in jeopardy!

As always, please feel free to contact me if you’d like to discuss what would be best for YOUR business. I LOVE chatting with Fire Nation!

What Went Down In June

Virtual Mastermind: Legacy Builders

In early June we co-hosted a virtual mastermind led by Nick Unsworth and Bryan Dulaney. What was supposed to be an in-person mastermind for our Knowledge Broker Blueprint crew in San Diego had to be reworked and rescheduled – but we made it happen!

The lineup was incredible, and the attendees were incredibly engaged. What Nick and Bryan put together was unique, exciting, and honestly, very refreshing.

There are a lot of virtual events happening given our current situation with Covid-19, and most that we’ve attended are pre-recorded and haven’t really offered solid engagement and connection opportunities.

This virtual mastermind was different, and here’s how:

- The entire 3 days was 100% LIVE – no pre-recorded sessions

- The presentations were raw – REAL LIFE. Some presented from their backyard on their cell phone, others in their home office

- The chat was super active, there was plenty of time for Q&A’s, and the breakout room option in Zoom allowed for smaller group conversations and connections

If you’re working on putting together a virtual event to take the place of something that was supposed to be live, then we highly recommend doing all of the above. Your attendees will thank you!

The Common Path to Uncommon Success

A couple of weeks ago we sent an email out to ask for YOUR feedback on a book cover design for John’s upcoming book: The Common Path to Uncommon Success.

If you’re interested in following along, be sure to sign up for behind-the-scenes updates and to hear about major milestones!

While the vote was SUPER close, we do have a winner.

But before we reveal what the book cover is going to look like, we want to share the importance of asking for feedback.

Time and time again we’ve turned to you, Fire Nation, to ask for your feedback on different projects, and as a result, we’ve been able to create exactly what you want and need.

The real kicker? 9 times out of 10 the results are NOT what we had predicted. Meaning, you can’t just guess when it comes to creating products, services, or making big decisions about the direction of your content, design, etc.

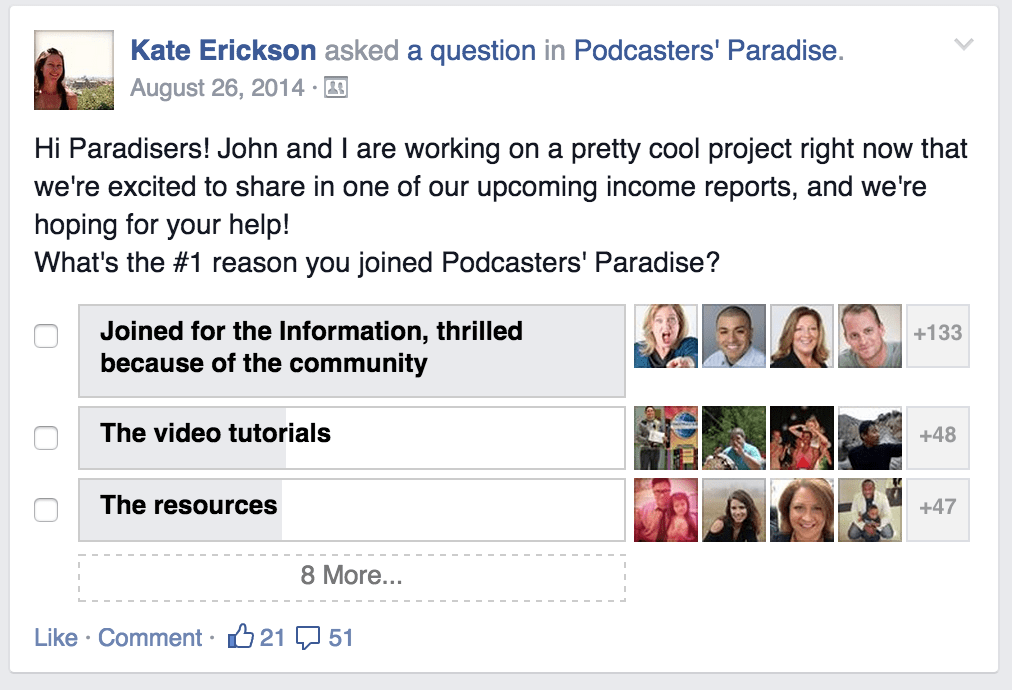

One big example we’ll share here was a poll we ran in Podcasters’ Paradise back in 2014.

We wanted to hear from our members what the #1 reason was for joining Podcasters’ Paradise. We put in a few options (guesses) of what we thought their answers would be, and we left it open for others to create their own answer, too.

Here’s what happened:

We were sure that the video tutorials would be the reason why people joined Podcasters’ Paradise, and arguably, for someone who isn’t yet a member they are the reason.

However, to hear directly from our members how valuable the community aspect truly is helps us massively when it comes to marketing Podcasters’ Paradise.

And the same was true with the book cover for The Common Path to Uncommon Success: we thought for sure one particular cover would be the clear winner, and in fact, it was the complete opposite: it was the LEAST voted for cover out of the 4 options we shared.

So without further ado, here’s the winner – chosen by YOU, Fire Nation!

It took us a while to get there, but we’re super proud of this book cover – especially knowing it was chosen by YOU!

Remember, you can sign up for behind-the-scenes updates and reminders about the book today!

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

June 2020 Income Breakdown*

Product/Service Income: $145,763

TOTAL Journal sales: 441 Journals for a total of $12,772

The Freedom Journal: Accomplish your #1 goal in 100 days!

- Total: $3,375 (134 Freedom Journals sold)

The Mastery Journal: Master Productivity, Discipline and Focus in 100 days!

- Total: $2,516 (110 Mastery Journals sold)

The Podcast Journal: Idea to Launch in 50 Days!

- Total: $6,881 (197 Podcast Journals sold)

Podcasters’ Paradise: The #1 Podcasting community in the world!

- Recurring: $16,343 (164 recurring)

- New members: $8,213 (29 new members)

- Total: $24,556

Real Revenue: Turn your BIG IDEA into Real Revenue

- Total: $300

Podcast Sponsorship: $108,000

Podcast Launch: Audiobook: $104 | eBook: $31

Free Courses that contribute to the above revenue:

Your Big Idea: Discover your big idea in under an hour!

Free Podcast Course: Create and launch your own podcast!

Funnel On Fire: Create a funnel that converts!

Affiliate Income: $25,865

*Affiliate links below – if you click on my affiliate link and sign up for the products and services I trust and recommend, then I will earn a commission.

Resources for Entrepreneurs: $16,674

- Audible: $113

- Click Funnels: $14,501

- Coaching referrals: $2,000 (email me for an introduction to a mentor for overall online business or a Podcast focused mentor!)

- ConvertKit: $60

Courses for Entrepreneurs: $8,062

- Knowledge Broker Blueprint by Tony Robbins: $7,480

- Create Awesome Online Courses by DSG: $582

- Amy Porterfield’s Digital Course Academy: $0

Resources for Podcasters: $504

- Pat Flynn’s Fusebox Podcast Player: $18

- Podcasting Press: $38

- Designrr: $0

- Splasheo: $248

- Tim Paige’s Make My Intro: $0

- Libsyn: $88 (Use promo code FIRE for the rest of this month & next free!)

- UDemy Podcasting Course: $112

Other Resources: $625

- Amazon Associates: $180

- Other: $445

Total Gross Income in June: $171,682

Business Expenses: $33,484

- Advertising: $840

- Affiliate Commissions (Paradise): $1,608

- Accounting: $961

- Cost of goods sold: $2,631

- Fulfillment: $7,152

- Design & Branding: $0

- Dues & Subscriptions: $401

- Education: $287

- Legal & Professional: $2,200

- Meals & Entertainment: $511

- Merchant / bank fees: $2,443

- Amazon fees: $3,571

- PayPal fees: $982

- Office expenses: $239

- Community Refunds: $2,979

- Promotional: $0

- Travel: $3,079

- Virtual Assistant Fees: $3,600

- Website Fees: $0

Recurring, Subscription-based Expenses: $6,056

- Adobe Creative Cloud: $100

- Boomerang: $50 (team package)

- Authorize.net: $70

- Bonjoro: $45

- Cell Phone: $26

- Dropbox: $119 (annual fee)

- Google Suite: $60

- Internet: $100

- eVoice: $10

- Infusionsoft CRM: $241

- Insurance: $648

- Libsyn: $184

- Linktree: $6

- TaxJar: $19

- Taxes & Licenses: $523

- SEO & Marketing: $3,770

- Zoom: $55

- Xero: $30

Total Expenses in June: $39,540

Payroll to John & Kate: $15,900

In our May 2014 Income Report and our June 2016 Income Report, Josh focuses on how to pay yourself as an entrepreneur. Check them out!

Wondering what we do with all of our net revenue? We share all in our April 2017 Income Report :)

Total Net Profit for June 2020: $132,142

Biggest Lesson Learned

Puppy Love is the best!

Honestly, I’ve never been a dog person. I grew up with cats.

So when John asked if I’d ever be interested in getting a dog (about 8 years ago), my answer was pretty concrete: no.

Over the years we’ve experienced so many incredible things together. Living in Portland, Maine near John’s family, living in San Diego near my family, moving to Puerto Rico and making a home of our own, and traveling the world for a quarter each year.

Not to mention getting to grow this business together and our connection with you, Fire Nation!

So the last couple of times John has asked if I’d be interested in getting a dog, my answer has increasingly gotten more positive.

Maybe we are ready for a new chapter?

Well, ready or not, in late March we welcomed a new member to the family: Gus.

Gus is a Goldendoodle with plenty of energy, and he has all the cuddles and love in the world to share.

Gus has given us such an incredible new perspective and is teaching us how to embrace having responsibilities outside of ourselves and our business.

He’s been learning how to swim, how to sit, and he’s fantastic when it comes to treats :)

He’s even been to 2 weeks of puppy training!

Over the past couple of months we’ve had so much fun together – along with our fair share of frustrations, of course! But you really can’t stay frustrated with this guy for very long…

Gus just had his last round of puppy vaccines and has more than doubled in size since we picked him up!! He’s on pace to get up to about 50 pounds fully-grown.

We still have a lot to learn about each other, but one thing is for sure: puppy love really is the best :)

Alright Fire Nation, that’s a wrap!

Until next month, keep your FIRE burning!

~ Kate & John

Note: we report our income figures as accurately as possible, but in using reports from a combo of Infusionsoft & Xero to track our product and total income / expenses, they suggest the possibility of a 3 – 5% margin of error.