June 2018 Income At-A-Glance

Gross Income for June: $165,644

Total Expenses for June: $31,359

Total Net Profit for June: $134,285

Difference b/t June & May: +$20,765

Why We Publish An Income Report

This monthly income report is created for you, Fire Nation!

By documenting the struggles we encounter and the successes we celebrate as entrepreneurs every single month, we’re able to provide you with support – and a single resource – where we share what’s working, what’s not, and what’s possible.

There’s a lot of hard work that goes into learning and growing as an entrepreneur, especially when you’re just starting out. The most important part of the equation is that you’re able to pass on what you learn to others through teaching, which is what we aim to do here.

Let’s IGNITE!

**We’ll receive a commission on the affiliate links below. If you click on my affiliate link and sign up for the products and services I trust and recommend, then I will earn a commission.

Josh Bauerle’s Monthly Tax Tip

What’s up Fire Nation, my name is Josh Bauerle. I’m a CPA and the Founder of CPA On Fire, where we specialize in working with entrepreneurs to minimize their tax liability while keeping them in line with the ever-changing tax laws.

I’ve been working with JLD & Kate at Entrepreneurs On Fire for years now, and they’ve included me in these monthly income reports with unlimited access to all their accounts so I can verify that what they report here is complete and accurate.

And because they believe in delivering an insane amount of value to you, my job doesn’t stop at the verification level; I also provide a new tax and accounting tip every month!

Josh’s June Tax Tip: Paying taxes on prize money

Well, Fire Nation, the time has come for me to give up this whole tax gig… It’s been a fun ride, but I recently found out I’m going to be a big-time TV star and there just won’t be time for accounting and taxes!

OK, OK that’s only part true… While my family and I will be on a TV show soon revolving around the purchase of our new home (will provide details when I’m allowed!), I won’t exactly be a TV star and I definitely won’t be giving up the tax business.

But they are giving us a little bit of money to be on the show, and this got me thinking about a tax issue I see often around prize money.

While our payment for being on the show isn’t technically prize money, it’s a very tricky part of the tax code we see trip people up often; what happens if you win a prize?

If you’re a US citizen or resident, the unfortunate answer is: you will pay taxes on it.

While I think a lot of people know that’s the case when they receive a cash prize – like winning the lottery (and taxes are typically withheld automatically on large cash prizes) – it definitely seems to throw people for a loop when they find out their non-cash prize will also be hit with taxes.

Here’s an example: A few years ago a good friend of mine won an all-expenses paid trip for four to London to watch an NFL football game, mingle with NFL stars while there, and have an overall amazing time.

I remember warning him that he would be hit with taxes for the trip, but he wasn’t too worried about it.

A few months later, when he went to file his taxes, he realized that amazing prize was costing him over $8,000 in taxes!

Turns out the NFL placed a fair market value on the trip of over $30,000, which meant the tax bill would be treated the same as if he had received $30,000 cash.

John himself had first-hand experience with this as well when he won a car on The Price is Right (if you haven’t watched this video yet, do yourself a favor and watch it now!)

The following year he had to pay taxes on the “fair market value” of the car, even though within just a few months he sold the car for $3,000 less than the value the company determined to be market value.

So this is a short and simple tip this month: if you win a prize, you will pay taxes on that prize.

Even if the prize is not cash, you will still pay taxes on that prize based on what the issuers determine the fair market value to be.

And if the prize is over a $600 value, the issuer will almost certainly be sending a 1099 to the IRS to show that you received it, so there’s no getting around claiming it.

Prizes are great, Fire Nation, but be sure you understand – and are prepare for – the tax bill that comes with them.

One more note for the other side of the equation: you may have noticed that a lot of entrepreneurs give away prizes as a part of their business marketing.

If you’re doing this, you could have an obligation to issue a 1099 to the recipient. Whether you do or not depends on many factors, so be sure to consult with your CPA if you are issuing prizes valued at more than $600.

As always, please feel free to contact me if you’d like to discuss what would be best for YOUR business. I LOVE chatting with Fire Nation!

What Went Down In June

Travel! A Wedding, Maine, San Diego, & More!

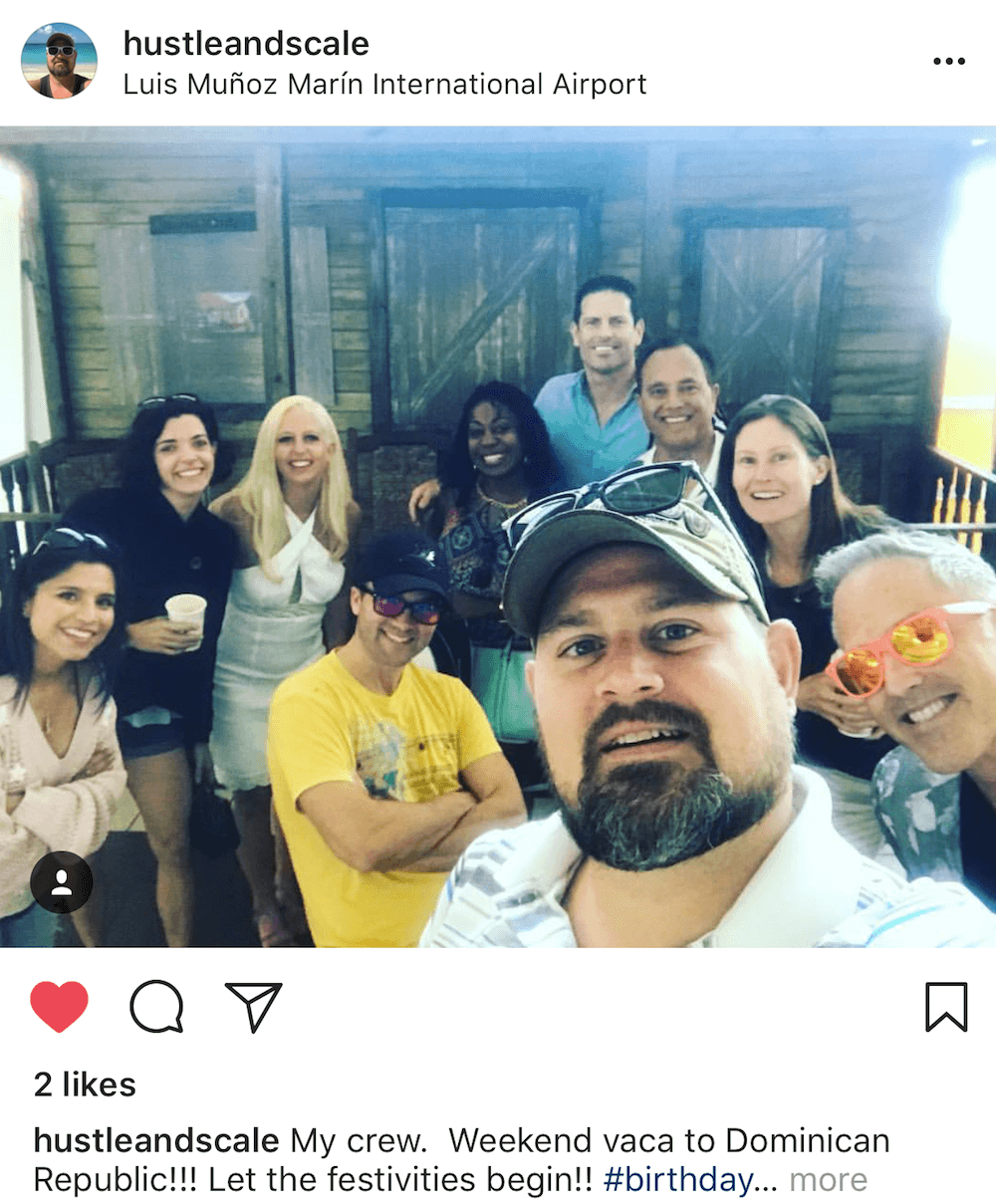

We kicked off June with a surprise birthday party for one of our good friends here in Palmas Del Mar, Mark Wade from Hustle & Scale.

After a quick and crazy weekend in Dominican Republic with an incredible crew of entrepreneurs and friends, we were headed to New Jersey for John’s best friend’s wedding.

A beautiful view, a killer best man speech from JLD, and a lot of dancing later, we were splitting ways and headed to opposite sides of the country: Maine and California.

As you can imagine, June was a pretty crazy travel month!

While in Maine, John spent a long weekend at Moosehead Lake for Father’s Day and took advantage of being in the great outdoors Bar Harbor with his personal trainer, Jeff.

All the while I was jumping from Las Vegas, to Big Sur for a camping trip, and then back to sunny San Diego.

When we found our way back to each other again, we were meeting in Denver for Social Media Day.

Social Media Day Denver

Social Media Day Denver was a blast!

Not only did we get to hang with our good friends Greg and Sarah (and their cute son, Cole), but we also got to explore almost everything Denver has to offer.

We ate at some really incredible restaurants; experienced a little night-time fun at a food truck venue; got to check out Greg’s co-working space, Industry; and we got to swing by Red Rocks Amphitheater for a tour of an absolutely breathtaking place!

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

June 2018 Income Breakdown*

Product/Service Income: $127,514

TOTAL Journal sales: 437 Journals for a total of $14,900

The Freedom Journal: Accomplish your #1 goal in 100 days!

- TheFreedomJournal.com: $925 (12 Hardcovers & 14 Digital Packs)

- Amazon: $8,112 (227 Freedom Journals sold!)

- Total: $9,037

The Mastery Journal: Master Productivity, Discipline and Focus in 100 days!

- TheMasteryJournal.com: $715 (15 Hardcovers & 7 Digital Packs)

- Amazon: $5,148 (162 Mastery Journals sold!)

- Total: $5,863

Podcasters’ Paradise: The #1 Podcasting community in the world!

- Recurring: $24,827 (200 monthly, 1 annual)

- New members: $9,170 (19 new members)

- Podcast Launch Formula: $43,810 (50 new members)

- Total: $77,807

Podcast Sponsorship Income: $29,500

Podcast Websites: $5,000

Podcast Launch: Audiobook: $260 | eBook: $47

Free Courses that result in the above revenue:

Your Big Idea: Discover your big idea in under an hour!

Free Podcast Course: Create and launch your own podcast!

Funnel On Fire: Create a funnel that converts!

Affiliate Income: $38,130

*Affiliate links below – if you click on my affiliate link and sign up for the products and services I trust and recommend, then I will earn a commission.

Resources for Entrepreneurs: $26,113

- Audible: $307

- BlueHost: $300 Step-by-step guide and 23 WordPress tutorials included! Disclaimer: This is my affiliate link and I will receive a commission if you sign up through my link

- Click Funnels: $21,786

- Coaching referrals: $3,042 (email me for an introduction to a mentor for overall online business or a Podcast focused mentor!)

- ConvertKit: $154

- Disclaimer Template: $342 (legal disclaimers for your website)

- Fizzle: $182

Courses for Entrepreneurs: $7,579

- Create Awesome Online Courses by DSG: $5,639

- Webinars that Convert by Amy Porterfield: $1,870

- 10k Readers by Josh Turner: $70

- ASK by Ryan Levesque: $0

- Virtual Staff Finder by Chris Ducker: $0

Resources for Podcasters: $2,575

- Pat Flynn’s Fusebox Podcast Player: $35

- Podcasting Press: $390

- Tim Paige’s Make My Intro: $250

- Libsyn: $1,845 (Use promo code FIRE for the rest of this month & next free!)

- UDemy Podcasting Course: $55

Other Resources: $1,863

- Amazon Associates: $390

- Other: $1,473

Total Gross Income in June: $165,644

Business Expenses: $28,716

- Advertising: $1,157

- Affiliate Commissions (Paradise): $1,421

- Accounting: $980

- Cost of goods sold: $1,915

- Consulting: $3,200

- Design & Branding: $1,980

- Education: $158

- Legal & Professional: $35

- Meals & Entertainment: $496

- Merchant / bank fees: $2,123

- Amazon fees: $5,631

- PayPal fees: $371

- Shopify fees: $208

- Office expenses: $185

- Payroll Tax Expenses / Fees: $212

- Paradise Refunds: $1,460

- Promotional: $0

- Total Launch Package fees: $0

- The Freedom & Mastery Journal: $0

- Travel: $2,358

- Virtual Assistant Fees: $2,848

- Website Fees: $1,978

Recurring, Subscription-based Expenses: $2,643

- Adobe Creative Cloud: $100

- Boomerang: $60 (team package)

- Brandisty: $24

- Bonjoro: $45

- Dropbox: $99 (annual fee)

- Authorize.net: $70

- Cell Phone: $205

- Internet: $89

- eVoice: $10

- Infusionsoft CRM: $309

- Insurance: $551

- Libsyn: $241

- Chatroll: $49

- Shopify: $214

- TaxJar: $19

- Text Expander: $20 (annual fee)

- Taxes & Licenses: $523

- Zoom: $15

Total Expenses in June: $31,359

Payroll to John & Kate: $15,900

In our May 2014 Income Report and our June 2016 Income Report, Josh focuses on how to pay yourself as an entrepreneur. Check them out!

Wondering what we do with all of our net revenue? We share all in our April 2017 Income Report :)

Total Net Profit for June 2018: $134,285

Biggest Lesson Learned

All in due time

As you can tell, June was a packed month, and with the 2nd half of 2018 upon us, our travel schedule isn’t slowing down any.

In fact, we’re gearing up for a 65-day Euro adventure starting in September! …we’re only getting started :)

But what stood out about our travels in June as it relates to running Entrepreneurs On Fire was our somewhat anxiousness over launching our newest free course: 3 Hours to Your BIG Idea.

With a total of only 3 full days at our home in Puerto Rico the entire month of June, in retrospect, it was crazy of us to think we could pull off this launch.

Nonetheless, we tried!

It wasn’t until we were sitting in our hotel room in New Jersey – about 24 hours till the wedding – when we realized it wasn’t the right time to launch.

Not only were we about to go our separate ways for multiple mini-trips, but several of those mini-trips involved stops in places where one (or both) of us weren’t going to have Internet access.

The decision to hold the launch of 3 Hours to Your BIG Idea was a great one, and I’m surprised that we were even considering this launch given our schedules in June. It wouldn’t be fair to us, or to you, our audience.

Just a reminder that everything will happen as it should – all in due time.

Alright Fire Nation, that’s a wrap!

Until next month, keep your FIRE burning!

~ Kate & John

Note: we report our income figures as accurately as possible, but in using reports from a combo of Infusionsoft & Xero to track our product and total income / expenses, they suggest the possibility of a 3 – 5% margin of error.