May 2018 Income At-A-Glance

Gross Income for May: $153,375

Total Expenses for May: $39,855

Total Net Profit for May: $113,520

Difference b/t May & April: $44,174

Why We Publish An Income Report

This monthly income report is created for you, Fire Nation!

By documenting the struggles we encounter and the successes we celebrate as entrepreneurs every single month, we’re able to provide you with support – and a single resource – where we share what’s working, what’s not, and what’s possible.

There’s a lot of hard work that goes into learning and growing as an entrepreneur, especially when you’re just starting out. The most important part of the equation is that you’re able to pass on what you learn to others through teaching, which is what we aim to do here.

Let’s IGNITE!

**We’ll receive a commission on the affiliate links below. If you click on my affiliate link and sign up for the products and services I trust and recommend, then I will earn a commission.

Josh Bauerle’s Monthly Tax Tip

What’s up Fire Nation, my name is Josh Bauerle. I’m a CPA and the Founder of CPA On Fire, where we specialize in working with entrepreneurs to minimize their tax liability while keeping them in line with the ever-changing tax laws.

I’ve been working with JLD & Kate at Entrepreneurs On Fire for years now, and they’ve included me in these monthly income reports with unlimited access to all their accounts so I can verify that what they report here is complete and accurate.

And because they believe in delivering an insane amount of value to you, my job doesn’t stop at the verification level; I also provide a new tax and accounting tip every month!

Josh’s May Tax Tip: Meals and Entertainment Tax Deduction

A few months ago we took a broad look at the new tax laws put in place by President Trump and the current administration. Overall there are several changes that will have a positive impact on the bottom line of entrepreneurs.

But this month we want to drill down and look at one particular area that may negatively impact several entrepreneurs, including EOFire: meals and entertainment.

As we’ve discussed in several prior income reports, meals and entertainment have been a great way entrepreneurs can get creative to save money on taxes.

I even used an example of how I was able to write off 50% of my Cleveland Indians World Series tickets as a business expense a few years ago.

But under the new tax plan, these rules are changing significantly.

Here’s how…

First, let’s start with what hasn’t changed.

Under the old rules, any time you had a business related meal, or a meal while out of town for business, you were able to deduct 50% of the cost of that meal as a business expense.

So when John takes me out to dinner at Puerto Rico’s finest restaurant to discuss his taxes, he can write 50% of the total cost off.

When John comes here to the great state of Ohio to talk taxes, all his meals during the full trip are 50% deductible.

None of that has changed under the new plan.

What has changed here under the new plan is the entertainment portion of the deduction.

Under the old rules, if John took me out for a round of golf prior to our business dinner, he could deduct 50% of that cost as well.

Under the new plan, the deduction for entertainment has been eliminated completely.

So when my Indians return to the World Series this year, I won’t be able to justify the cost of my tickets as a tax deduction.

Bummer!

Another area of the meals and entertainment deduction that has changed is the fully deductible meals.

For the majority of business related meals, the IRS limits the deduction to 50% of the price you pay.

But for a limited portion of business meals, the IRS allowed you to take 100% of the full cost.

This typically came into play when purchasing meals for an event, like a holiday party, employee gathering, etc.

Under the new plan, that 100% deduction is almost entirely gone. The only exception remaining is for meals that are included as part of the ticket for an event.

So if you sell tickets to a marketing event, and as part of that cost meals are included, those meals remain within that 100% deduction rule.

But your holiday parties and employee gatherings are a no go – it’s back to 50% deductions.

The IRS still offers a ton of of ways to get creative and turn a lot of “personal” expenses into business deductions. Unfortunately, under the new tax laws, meals – and especially entertainment – are now much more limited.

But by planning properly and making sure you’re in line with the new laws, you can still get a tax benefit from meals that can be justified as business related!

As always, please feel free to contact me if you’d like to discuss what would be best for YOUR business. I LOVE chatting with Fire Nation!

David Lizerbram’s Legal Tip

How to Comply With the New GDPR Privacy Law

Are you wondering why your email inbox has been filling up with privacy policy updates from every company you’ve ever heard of?

The answer is: GDPR.

If you have an email list or a website, you need to know about GDPR and how to be in compliance.

The General Data Protection Regulation (GDPR), an EU privacy law, became enforceable on May 25, 2018. This applies to all parties who use the Personal Data of EU citizens – even if the company is based in the U.S. And the fines for noncompliance can be severe. This is a general overview of how GDPR may affect you.

What Is “Personal Data”?

Personal Data means any information relating to an identified or identifiable individual. This can be understood to include names, addresses, email addresses, IP addresses, and much more.

Anyone who collects, changes, transmits, erases, or otherwise uses or stores the personal data of EU citizens must comply with GDPR. So, for example, if your email list includes EU citizens, you have to comply with GDPR.

Under GDPR, in order to use Personal Data, you need a legal basis to do so. The most common legal basis is “consent.” This consent must be both specific and verifiable.

So if someone asks how their info is on your list, you have to be able to show exactly how and when they provided consent. If you don’t have those records, you should delete their info from your list.

Obtaining Consent

When someone is added to your mailing list in the future, you must obtain consent – and there are specific rules about how that consent should be obtained.

- Consent to the use of Personal Data has to be specific to distinct purposes.

- Silence, pre-ticked boxes or inactivity does not constitute consent; people must explicitly opt-in to the storage, use, and management of their Personal Data.

- Separate consent must be obtained for different processing activities. You must be clear about how the Personal Data will be used when you obtain consent.

Here are a few guidelines to follow:

- A positive opt-in is required;

- It must be separate from other terms & conditions; and

- It must include a simple way to withdraw consent.

For example, once someone opts-in, they may receive a confirming email with a simple way to withdraw consent to particular uses of their Personal Data.

Privacy Policies

If you collect any kind of data through your website, you should have a privacy policy. Those policies will need to be updated to comply with GDPR. If you have questions about this, please feel free to reach out to me directly, I’d be happy to help.

Penalties for Non-Compliance

The fines for non-compliance with GDPR are up to 20 million euros, or in the case of a company, up to 4% of their total global turnover (meaning total annual revenue) in the previous fiscal year, whichever is higher.

The bottom line is that entrepreneurs are going to have to be much more aware of their privacy policies and ensure that any Personal Data (especially pertaining to EU citizens) was obtained with proper consent.

If you have a legal question that you’d like me to cover on a future Income Report shoot me an email with your request! I’ll be sure to give you a shout-out when I join John & Kate to talk about your legal questions!

*Bonus* Download David’s FREE Checklist on Intellectual Property for Entrepreneurs!

What Went Down In May

3 Hours to Your Big Idea

When we get a big idea here to Entrepreneurs On Fire we go ALL IN.

What started out as Sprint 30 and then evolved into 10 Days to a Dollar has now become 3 Hours to YOUR BIG Idea.

We’ve been head-down focused on creating our next free course: 3 Hours to Your BIG Idea for several weeks now, and we can’t wait to share it with you!

If you’re struggling to find that ONE idea you feel confident about going ALL IN on, or if you have multiple ideas and you can’t seem to make progress on any one of them, then this free course if for YOU.

Unlike our other free courses that have been delivered over a certain number of days and via email and video, 3 Hours to Your BIG Idea will be ALL YOURS from the second you optin.

We teamed up with our favorite course platform, Thinkific, and a rockstar developer (Rob) from Themeific, to create what we think is the PERFECT free course page. The best and easiest user experience for you was our main focus, and we cannot wait for you to dive in!

Be sure to sign up to be the first to hear once 3 Hours to Your BIG Idea launches, and you’ll be just 3 hours away from Your BIG Idea!

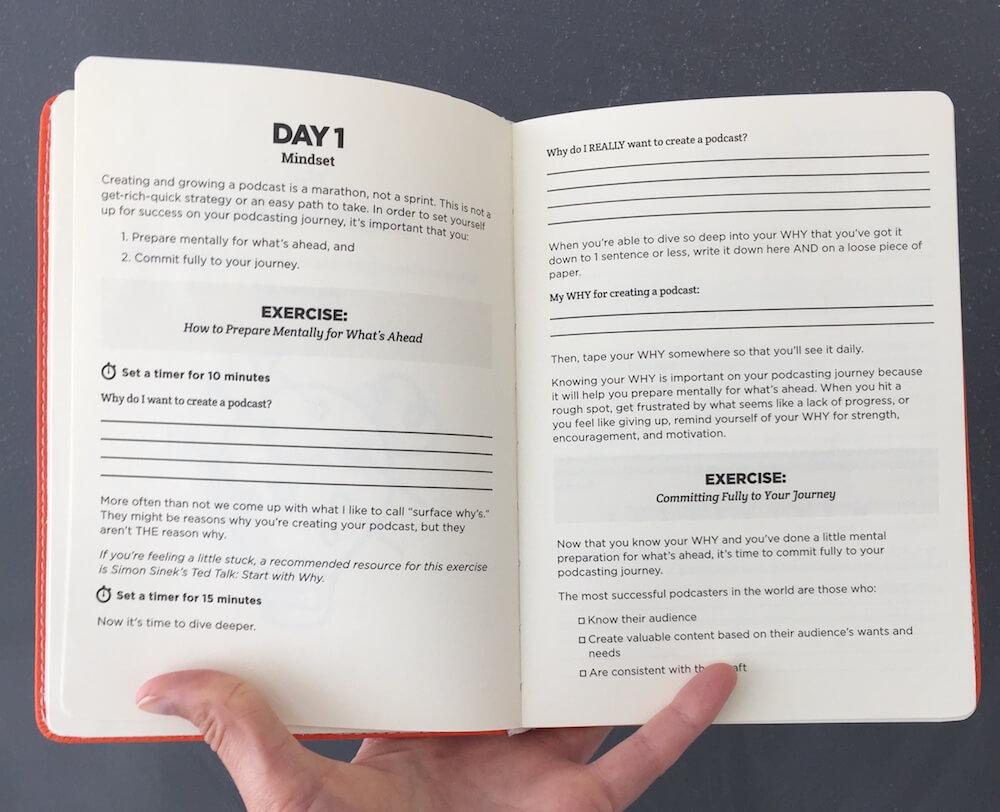

The Podcast Journal arrives!

In May we received our first sample copy of The Podcast Journal from Richie & Co in China!

If you haven’t heard about The Podcast Journal, it’s our third physical journal that will guide you step-by-step from Idea to Launch in 50 Days.

We’d been anticipating the day our sample copy would arrive for months and couldn’t wait to get it in our hands, especially because the look and feel of this journal is significantly different than The Freedom and Mastery Journals.

I saw the FedEx truck pull up, and I knew what was in that box…

John and I opened it together in the kitchen, and in synch said the same thing: this isn’t going to work…

WHAT?!

It was shock to me, too.

After close inspection, we found 99% of the Journal looking perfect:

Unfortunately, the 1% that wasn’t perfect is arguably the most important part: the cover.

We sent Richie & Co a note immediately, and they agreed: the cover just wasn’t legible the way they had stamped it.

You can imagine the panic in my mind…

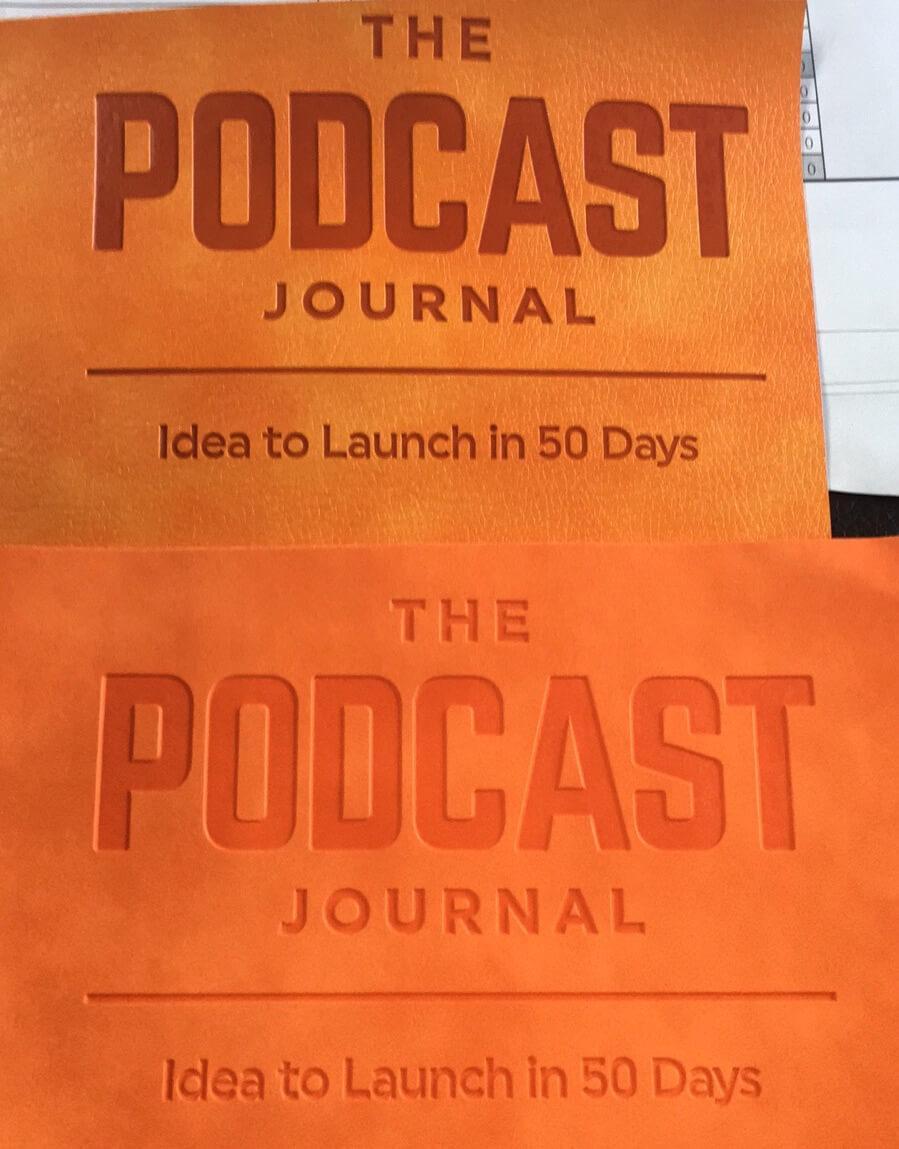

But after researching other options, we came up with a great alternative: instead of just stamping the cover, we’d have them treat it with a color so that it wasn’t just an indent, but a colored indent.

The difference is striking (see below, with the first iteration on the bottom, and the second on top), and we’re anxious to have this final version in our hands!

To learn more about The Podcast Journal and join our behind-the-scenes interest list where you’ll be the first to hear about the status, visit ThePodcastJournal.com!

Team Fire transitions to 5

May brought with it a unique set of challenges, including the EOFire Team going through a pretty major transition: letting one of our team members go.

Claire, who had been with the EOFire Team for nearly 3 years, managed our social media, but like many other things in our business that have shifted along with our recent switch from daily to twice per week, so do the tasks.

As a result of Entrepreneurs On Fire going twice per week, we made the tough decision to bring our team down to 5, and also to re-evaluate how each of our team members is working, including us!

To check out how Team Fire is set up, what each of our virtual team members is responsible for, and to learn more about how to build and grow your own team, meet Team Fire here!

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

May 2018 Income Breakdown*

Product/Service Income: $93,722

TOTAL Journal sales: 375 Journals for a total of $13,522

The Freedom Journal: Accomplish your #1 goal in 100 days!

- TheFreedomJournal.com: $1,368 (24 Hardcovers & 12 Digital Packs sold!)

- Amazon: $9,282 (268 Freedom Journals sold!)

- Total: $10,650

The Mastery Journal: Master Productivity, Discipline and Focus in 100 days!

- TheMasteryJournal.com: $668 (11 Hardcovers & 7 Digital Packs sold!)

- Amazon: $2,184 (72 Mastery Journals sold!)

- Total: $2,872

Podcasters’ Paradise: The #1 Podcasting community in the world!

- Recurring: $24,330 (205 monthly)

- New members: $9,595 (33 new members)

- Total: $33,925

Podcast Sponsorship Income: $41,000

Podcast Websites: $5,000

Podcast Launch: Audiobook: $248 | eBook: $27

Free Courses that result in the above revenue:

Your Big Idea: Discover your big idea in under an hour!

Free Podcast Course: Create and launch your own podcast!

Funnel On Fire: Create a funnel that converts!

Affiliate Income: $59,653

*Affiliate links below – if you click on my affiliate link and sign up for the products and services I trust and recommend, then I will earn a commission.

Resources for Entrepreneurs: $35,993

- Audible: $751

- BlueHost: $300 Step-by-step guide and 23 WordPress tutorials included! Disclaimer: This is my affiliate link and I will receive a commission if you sign up through my link

- Click Funnels: $29,403

- Coaching referrals: $1,444 (email me for an introduction to a mentor for overall online business or a Podcast focused mentor!)

- Mentorship: $3,750

- ConvertKit: $110

- Disclaimer Template: $49 (legal disclaimers for your website)

- Fizzle: $186

Courses for Entrepreneurs: $19,119

- Create Awesome Online Courses by DSG: $5,383

- Webinars that Convert by Amy Porterfield: $727

- Copywriting Academy by Ray Edwards: $0

- 10k Readers by Josh Turner: $118

- The Amazing Seller by Scott Voelker: $0

- Self-Publishing School by Chandler Bolt: $780

- ASK by Ryan Levesque: $0

- Virtual Staff Finder by Chris Ducker: $100

- 30 Day Agency by Dan Henry: $12,011

Resources for Podcasters: $1,471

- Pat Flynn’s Fusebox Podcast Player: $0

- Podcasting Press: $114

- Tim Paige’s Make My Intro: $250

- Libsyn: $1,107 (Use promo code FIRE for the rest of this month & next free!)

- UDemy Podcasting Course: $0

Other Resources: $3,070

- Amazon Associates: $499

- Other: $2,571

Total Gross Income in May: $153,375

Business Expenses: $37,284

- Advertising: $1,445

- Affiliate Commissions (Paradise): $1,187

- Accounting: $980

- Cost of goods sold: $1,515

- Consulting: $5,443

- Design & Branding: $1,980

- Education: $143

- Legal & Professional: $366

- Meals & Entertainment: $173

- Merchant / bank fees: $932

- Amazon fees: $3,325

- PayPal fees: $537

- Office expenses: $248

- Payroll Tax Expenses / Fees: $1,428

- Paradise Refunds: $390

- Promotional: $70

- Total Launch Package fees: $0

- Sponsorships: $8,000

- The Freedom & Mastery Journal: $0

- Travel: $4,046

- Virtual Assistant Fees: $3,634

- Website Fees: $1,442

Recurring, Subscription-based Expenses: $2,571

- Adobe Creative Cloud: $100

- Boomerang: $60 (team package)

- Brandisty: $24

- Bonjoro: $25

- Authorize.net: $70

- Cell Phone: $202

- Internet: $80

- eVoice: $10

- Infusionsoft CRM: $396

- Insurance: $551

- Libsyn: $233

- Chatroll: $49

- Shopify: $214

- TaxJar: $19

- Taxes & Licenses: $523

- Zoom: $15

Total Expenses in May: $39,855

Payroll to John & Kate: $15,900

In our May 2014 Income Report and our June 2016 Income Report, Josh focuses on how to pay yourself as an entrepreneur. Check them out!

Wondering what we do with all of our net revenue? We share all in our April 2017 Income Report :)

Total Net Profit for May 2018: $113,520

Biggest Lesson Learned

The importance of project plans and support

It’s great to talk about and remind yourself of the acronym FOCUS: follow one course until success. It’s a critical practice if you want to scale and grow your business.

However, sometimes it can be REALLY HARD. Like when you’re trying to manage multiple big projects simultaneously, and because of competing deadlines and some poor planning along the way, you don’t have much of a choice but to buckle down and figure out a way to make it happen.

Have you ever felt this way?

My guess is YES, because I felt this way pretty much the entire month of May.

This is a bold statement, but I’d venture to say that May was one of the most stressful months of my entrepreneurial life. I was juggling multiple projects with multiple players involved, which meant that I didn’t have full control – and that’s a pretty uncomfortable place for me to be.

In the midst of working on managing projects for:

- The Podcast Journal production

- GDPR (General Data Protection Regulation)

- 3 Hours to Your BIG Idea

- Real Revenue

- The Content Creation Course

- Podcast Movement preparation

…we were also hosting company.

In a nutshell: we were over-booked, not as productive as we could have been, out of our routine, and as a result everything was suffering.

To boot, if you hadn’t noticed, our April 2018 Income Report was one of the lowest net incomes we’ve reported in 5 years.

Sometimes it’s easy to get off track – distracted by opportunities, overwhelmed by too many projects, and exhausted because of how you’ve set your schedule up. But the important thing to focus on is knowing that only YOU are capable of getting yourself back on track.

FOCUS, create a plan you can follow, and start taking the actions you know can get you there.

p.s. If you’re still battling GDPR language and trying to confirm you’re compliant, be sure to check out Disclaimer Templates.

Alright Fire Nation, that’s a wrap!

Until next month, keep your FIRE burning!

~ Kate & John

Note: we report our income figures as accurately as possible, but in using reports from a combo of Infusionsoft & Xero to track our product and total income / expenses, they suggest the possibility of a 3 – 5% margin of error.