September 2017 Income At-A-Glance

Gross Income for September: $207,349

Total Expenses for September: $44,835

Total Net Profit for September: $162,514

Difference b/t September & August: -$7,017

Free and amazing trainings!

Free Podcast Course: Learn how to create and launch your podcast!

Your Big Idea: Discover Your Big Idea in less than an hour!

Entrepreneurs On Fire: September 2017 Income Report

Why We Publish An Income Report

This monthly income report is created for you, Fire Nation!

By documenting the struggles we encounter and the successes we celebrate as entrepreneurs every single month, we’re able to provide you with support – and a single resource – where we share what’s working, what’s not, and what’s possible.

There’s a lot of hard work that goes into learning and growing as an entrepreneur, especially when you’re just starting out. The most important part of the equation is that you’re able to pass on what you learn to others through teaching, which is what we aim to do here.

Let’s IGNITE!

**We’ll receive a commission on the affiliate links below. If you click on my affiliate link and sign up for the products and services I trust and recommend, then I will earn a commission.

Josh Bauerle’s Monthly Tax Tip

How to deduct medical related expenses

What’s up Fire Nation, my name is Josh Bauerle. I’m a CPA and the Founder of CPA On Fire, where we specialize in working with entrepreneurs to minimize their tax liability while keeping them in line with the ever-changing tax laws.

I’ve been working with JLD & Kate at Entrepreneurs On Fire for years now, and they’ve included me in these monthly income reports with unlimited access to all their accounts so I can verify that what they report here is complete and accurate.

And because they believe in delivering an insane amount of value to you, my job doesn’t stop at the verification level; I also provide a new tax and accounting tip every month!

Last month we discussed medical related expenses and I had to give a lot of bad news about just how deductible (or nondeductible) those medical expenses actually are on your taxes.

Unfortunately, for most people, medical expenses won’t be deductible at all, and for the few who can deduct them, it will likely be a small portion of the actual amounts paid.

This month, I’m going to give a bit better news. There are a few ways to make medical expenses more deductible, and these tips are even more applicable to self-employed people.

Here are two ways to drastically increase the amount of medical related expenses you can deduct on your taxes.

1. Self-Employed Health Insurance Deduction

We talk a lot about how the tax code favors entrepreneurs, and the health insurance deduction is a great example of that.

For those employed in a traditional job that have to pick up private health insurance, in order to deduct the premiums they are limited by what we discussed last month.

First, they have to itemize and second, even if they do itemize, those costs are still reduced by 10 percent of your adjusted gross income.

For those who are self-employed, the rules are much more favorable.

If you are self-employed and are not eligible for a group plan through your spouses job, you are able to deduct the entire amount of your health insurance premiums without itemizing and without the 10% income limitation.

Anyone who has had to purchase private insurance and seen the costs involved knows this is a huge advantage.

For those with a family, it could easily be a $10,000 or more tax deduction that employees in similar situations are not able to take.

And you don’t need to have the health insurance plan run through your business to count. It can just be a regular, private health insurance plan. As long as you are self-employed and don’t have any group plan available to you, you will qualify.

Leveraging HSA’s

The self-employed health insurance deduction is great for deducting the health insurance premiums, but what about actual medical expenses? Is there a way to make some of those tax deductible without the crazy itemized and ten percent of income limitations?

Believe it or not, the answer is actually yes – if you can get a health insurance plan that allows an HSA as a part of it.

A health savings account, or HSA, allows you to put up to $3,400 for an individual or $6,750 for a family into a savings account that is used specifically for medical related expenses.

The benefit?

Every dollar you put in there is a write-off on your tax return.

This is essentially a shortcut for being able to deduct between $3,400 and $6,750 of those medical expenses on your taxes without those pesky limitations the IRS likes to put on you.

One word of caution on this one: once you put the money in the HSA, do not take it out for non-medical related reasons. Doing so can subject you to similar penalties to taking out retirement income early.

It can get ugly and expensive. This deduction is solely for being able to deduct medical expenses.

As with many things tax related, there are ways to make medical expenses significantly more deductible, it just takes some planning and strategy.

I highly recommend working with both your health insurance professional and CPA to make sure you are maximizing your ability to deduct medical expenses, especially if you are self-employed!

As always, please feel free to contact me if you’d like to discuss what would be best for YOUR business. I LOVE chatting with Fire Nation!

David Lizerbram’s Legal Tip

Best Practices for Online Brands

If you’re doing business online, you should take a few steps to make sure that you’re establishing ownership of your brand.

Just because your brand is based online rather than in a physical location doesn’t mean that the rules don’t apply.

Start by recognizing that your brand name is legally considered a “trademark.” So the rules and advice for trademarks also apply to your online brand.

Do Your Due Diligence

Under U.S. law, if a competitor is using the same (or a similar) brand, or trademark, and they started before you did, then they’re considered the “Senior User” and their rights are superior. This means that you should carefully search to be sure that the brand name is unique and nobody else is using it for similar services or products.

Just searching the U.S. Trademark website is not enough – although it’s a good start.

A more thorough search is a better idea. Some people have the resources to do this due diligence on their own, while others hire a trademark lawyer to do the search for them.

Protect Your Brand

OK, you’ve found that your new brand is unique and nobody else has a legal claim on it.

What now?

There are four steps you should take:

1. Get your brand out there!

Since trademark rights are acquired through use in commerce, the sooner and more publicly you start using it, the faster you will acquire those rights.

Lots of people think the opposite is true – that they have to keep their brand name a secret. If you get that advice, ignore it. As long as you’ve determined that your preferred brand is available, it’s usually best to publicize it as soon as possible.

2. File to register your brand with the trademark office.

Again, this is something that some people do on their own, or through some online services, but studies show that trademark applications that are filed by attorneys are more likely to go through and become registered trademarks.

Do your research, talk to multiple attorneys, and find the one who’s the best fit for you and your business.

3. Secure your brand name for all the different social media accounts that you might want to use.

When a new social media services debuts, act quickly and grab your brand name before somebody else does!

4. Get as many domain names as you can.

Think of how someone might misspell your brand, and get those domain names, too – you can just redirect them to your site.

In my experience, lots of entrepreneurs skip this last step. They get MyBrand.com but not variations on the words in their brand name. Then someone else comes along, grabs a domain name with a slightly different spelling, and starts causing trouble.

The cost to get the domain name back can turn into thousands of dollars, when the entrepreneur could have gotten the alternate domain names for next to nothing if they’d been proactive about it!

So, to summarize, always do your due diligence and follow the few simple steps above to protect your online brand. If you do, you’ll be well on your way to creating valuable intellectual property that you can own and benefit from for years to come.

If you have a legal question that you’d like me to cover on a future Income Report shoot me an email with your request! I’ll be sure to give you a shout-out when I join John & Kate to talk about your legal questions!

*Bonus* Download David’s FREE Checklist on Intellectual Property for Entrepreneurs!

What Went Down In September

Entrepreneurs On Fire Celebrates 5 Years!

For four years straight we’ve been celebrating Entrepreneurs On Fire’s birthday in Maine, but year five brought a new kind of party – this time, in Puerto Rico.

We’ve talked about our community in Puerto Rico many times on these income reports since settling in. We’ve made some amazing friends and truly created a community in Palmas Del Mar. We even refer to ourselves as the Palmas Power Couples :)

As is common with most weekends in Palmas, someone hosts some type of get together – a brunch, a Friday night couple’s game night, a Sunday bbq… We’re never at a loss for things to do!

The weekend of September 2nd was really no different: Mark and Krista, Founders of American Posture Institute, were hosting a BBQ at their place on Saturday afternoon at twelve thirty.

Because a lot of people in Puerto Rico are, well… on “Puerto Rico time”, John and I didn’t really think twice about leaving our place around twelve forty-five and showing up at 1pm.

As we drove into the gate and up to Mark and Krista’s house, we saw Mark standing outside.

John and I both thought to ourselves that this was a little strange: Mark greeting us outside?

But maybe he was just waiting for someone who didn’t know exactly where they lived…

So we get out of the car and start sun-screening up, and Mark was being a little pushy – like “come on guys, let’s do this!”

Again, didn’t really think too much of it; Mark is an excitable guy ;)

So we follow Mark inside, and walking through their living room we notice a huge picture of John on their TV – you know, the one with his hair and arms on fire.

Hhmmmm… okay, that’s definitely odd. We know our Palmas crew are fans of the show, but this was definitely a little out of place.

So we continue to follow Mark out back where the pool and BBQ area is, and we walk outside and notice a few streamers and some pictures hanging all around their awnings. Now Krista is super creative and loves to decorate, so again, we just thought “oh cute – Krista really did an awesome job with the decorations!”

As we continued walking out and into the BBQ area, we suddenly saw 20 of our closest friends from our Palmas crew standing there, decked out head to toe in orange, yelling out “Surprise! Happy 5-year anniversary!”

John and I were both SO SHOCKED!

The crew did such an amazing job of hiding it; we had NO IDEA!

We are so incredibly grateful for the friends we’ve met since moving to Palmas Del Mar; they’re thoughtful, giving, and they keep us on our toes! And they’re A LOT of fun to be around :)

A huge shout out to the Palmas Power Couples for bringing the heat and helping us celebrate 5 years with Entrepreneurs On Fire!

Hurricane Irma misses; Maria hits Puerto Rico

It was actually at the BBQ we all started talking about and tracking Hurricane Irma, which was about 3-4 days off the East coast of Puerto Rico.

With a few Puerto Rico veterans in the house feeling pretty confident that Irma wasn’t going to hit PR, everyone had full intention of staying put. And stay put they did.

However, that same night I was faced with a really tough decision.

It was September 2, and on September 8 I had a flight out of PR to San Diego to visit my family before heading to Austin to speak at an event.

That would be just 2 days post-Irma, and I was pretty nervous about my flight on the 8th getting canceled – and potentially being stuck in PR – if I didn’t get out of there ahead of Irma.

So I booked one of the last flights that would leave PR before Irma hit: Tuesday afternoon, Sept 5th.

With a worry in my gut that I’ve never felt before, I boarded a plane to FL where I’d connect to San Diego. All I could think about was John being there by himself.

Luckily, the Palmas crew had other plans for Wednesday, September 6th: a Hurricane Party at Ted and Arleen’s place :)

I found a lot of comfort in the fact that John would be with everyone, and Irma came and went without too much damage done in our community. A couple of fallen street signs and some downed trees, but nowhere near the type of damage that could have been had Irma hit PR head on.

Judging from the first image below, you can see Puerto Rico wasn’t directly in Irma’s path, but you can see in the second image that PR certainly didn’t go untouched either.

There was a lot of damage done to the capital, San Juan, and sure enough, the same day I few out of PR, my flight on September 8th was canceled.

![]()

As Irma passed, the island of Puerto Rico let out a huge sigh of relief. There was of a course major concern for the islands behind us that had just been massively impacted, and a lot of thoughts and prayers being sent ahead to FL and the East Coast.

Within days members of our Palmas crew were at Sam’s Club and Costco purchasing food, water and supplies to ship out to the islands around us. With a little loving help from a neighboring island, PR was doing what it could to restore some type of normalcy around it.

But right on the heels of Irma we caught wind of another hurricane that could be danger for PR: Hurricane Jose.

Luckily, within a couple of days, the threat of Jose hitting PR didn’t exist.

But it wasn’t 48 hours later we heard about Hurricane Maria.

Not only had Maria picked up speed incredibly quickly – going from a Cat 1 to a Cat 5 within a day – but she was tracking further South than Irma, a fact that didn’t bode well for PR.

The response to the news of Hurricane Maria was drastically different from that of Irma. Veteran Puerto Ricans were rushing to the store and stocking up on supplies, and unlike Irma, over half of our crew was scrambling to find a flight off the island.

While John was seriously considering staying in PR, the path of Maria only got scarier. By Sunday, September 17th there were zero flights off the island that weren’t already full.

Hurricane Maria was starting to get VERY real.

And on Monday morning, I got a call from John. Our friends Ginni and Tony had sent their two kids in a chartered jet with another family from Palmas, leaving 1 plane ticket available for whoever wanted it.

By Monday evening, after a lot of phone time with Jet Blue and some very close calls, John had a ticket for a flight Tuesday evening, September 19th, at 5:30pm.

Just about 3pm that day I heard the airport would be closing at 7pm.

John was literally one of the last flights off the island ahead of Maria.

As you can see from the images below, there was absolutely no doubt that Maria would hit PR. It was just a matter of where.

In the last image below, that star represents our community.

Hurricane Maria hit within 10 miles of Palmas Del Mar.

![]()

The next 72 hours were terrible.

We knew exactly who had stayed in Palmas, and we hadn’t heard from any of them.

It wasn’t until Friday afternoon – more than 50 hours after Maria hit – that we finally got a phone call from Ted & Arleen confirming they were safe, but that Palmas was in very bad shape.

It was a breathe of fresh air to hear from them, but in a very strange way. The news they were sharing, the experience, and their surroundings didn’t sound real.

Even once we saw pictures of our community and home from those who were actually there on the ground (not the news, or CNN, or the Internet), it was still hard to come to terms with what Puerto Rico is going through right now.

This is an image looking down our street. The last time we saw it, it was lined with beautiful, fluffy green trees.

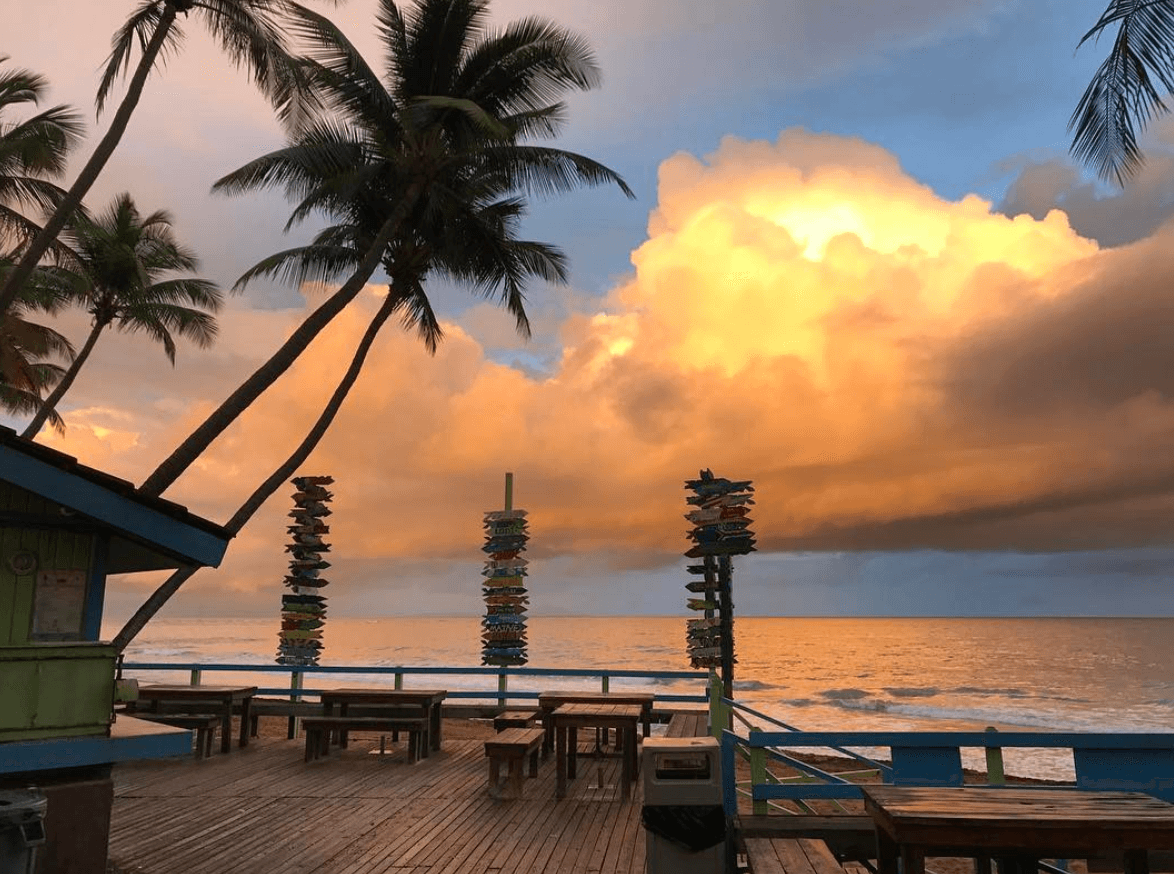

Below is an image of one of our favorite restaurants, not a quarter mile from our house, La Pescaderia. Luckily the main part of the restaurant was boarded up, but the entire property still sustained terrible damage.

Our favorite beach bar, Beach Bohio, was completely washed away.

Photo credit, Travis Chappell

We’re very blessed that everyone in the community made it through Maria without injury, and we continue to send our thoughts and love down to the island every day.

My flight back to Puerto Rico has been canceled twice now, leaving us unaware of when we’ll even be able to make it back to our home.

Most of Puerto Rico, including our community of Palmas Del Mar, continues to be without power, without water, without access to gas and diesel, and without the supply chain that can help breathe life back into a devastated area.

Thankfully we finally have more regular contact with our friends in Palmas. While they have to drive 40-50 minutes for service to call, they’ve been incredibly awesome about doing so.

We’re also incredibly grateful to everyone who has reached out and offered to help. Thank you!

The relief efforts are underway, but unfortunately the infrastructure isn’t present to support those efforts. We wish we had a better way to help, but right now what Puerto Rico needs is trucks with gas, clear roads, and drivers who can haul supplies throughout the island.

If Maria has done one thing for us, it’s put everything in perspective.

Screw U Live 2017

Amidst Maria I was prepping for a weekend in Austin for our great friends Jill & Josh Stanton’s live event: Screw U Live.

The event is put on for their community, Screw U, and this year it brought together nearly 100 incredible entrepreneurs who are working towards – or who recently have – screwed their 9 to 5.

Because of Hurricane Maria, John was able to join us, which was a great treat!

The 2-day event featured seven speakers, including Jill & Josh, and to say value was dropped would be an understatement!

Perhaps the biggest takeaway of the weekend was the power of community and knowing you’re not alone.

The opening keynote following Jill & Josh’s talk was James Wedmore, who took the group through some incredible exercises to help determine what their business will look like when it’s done being built.

He also asked a very critical question to help attendees breakthrough the doubts and the imposter syndrome that gets all of us at one time or another:

How does a company like that look and act?

If you take the time to sit down and really map out what your business looks like when it’s done being built, and then ask yourself how a company like that looks and acts, you’ll be surprised at what you come up with.

The final step James covered: now that you know, ACT like it.

I took a few notes throughout the event, and I’m excited to share some of those right here in our income report, including the 4 biggest lessons Jill & Josh shared from their 4 years in business.

4 Lessons in 4 Years

1. Surround yourself with people who get it

Because let’s be real: the people you surround yourself with lift you up, encourage creativity, and affect your behavior.

2. Invest in yourself

Invest in yourself and others will invest in you.

Investing in yourself builds confidence, increases competence, and helps you build connections.

3. Comparison is a killer

Compare yourself to others and they will compare you.

When you compare yourself to others who are “ahead of you” in business, you end up copying and copying ends in bad results.

Be unique.

4. Momentum is the lifeblood of entrepreneurs

Momentum breeds invention!

A huge shout out to Jill & Josh Stanton of Screw the 9 to 5 for bringing the heat, creating a space for entrepreneurs to connect and thrive together, and for hosting one hell of an event!

If you’re looking for a supportive, upbeat community to help support you on your journey to screwin’ the 9 to 5 and building the business of your dreams, check out Screw U!

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

September 2017 Income Breakdown*

Product/Service Income: $121,907

TOTAL Journal sales: 696 Journals for a total of $26,365

The Freedom Journal: Accomplish your #1 goal in 100 days!

- TheFreedomJournal.com: $3,418 (77 Hardcovers & 19 Digital Packs sold!)

- Amazon: $10,452 (275 Freedom Journals sold!)

- Total: $13,870

The Mastery Journal: Master Productivity, Discipline and Focus in 100 days!

- TheMasteryJournal.com: $4,656 (106 Hardcovers & 11 Digital Packs sold!)

- Amazon: $7,839 (208 Mastery Journals sold!)

- Total: $12,495

Podcasters’ Paradise: The #1 Podcasting community in the world!

- Recurring: $18,593 (193 monthly)

- New members: $7,575 (38 new members)

- Total: $26,168

Podcast Sponsorship Income: $64,000

Podcast Websites: $5,000

Skills On Fire: $62

Podcast Launch: Audiobook: $268 | eBook: $44

Free Courses that result in the above revenue:

Your Big Idea: Discover your big idea in under an hour!

Free Podcast Course: Create and launch your own podcast!

Funnel On Fire: Create a funnel that converts!

Affiliate Income: $85,442

*Affiliate links below – if you click on my affiliate link and sign up for the products and services I trust and recommend, then I will earn a commission.

Resources for Entrepreneurs: $57,041

- Audible: $449

- BlueHost: $1,200 Step-by-step guide and 23 WordPress tutorials included! Disclaimer: This is my affiliate link and I will receive a commission if you sign up through my link

- Click Funnels: $38,774

- Coaching referrals: $0 (email me for an introduction to a mentor for overall online business or a Podcast focused mentor!)

- Mentorship: $15,000

- ConvertKit: $142

- Disclaimer Template: $198 (legal disclaimers for your website)

- Fizzle: $186

- LeadPages: $824

- SamCart: $0

- Thinkific: $268

- Virtual Staff Finder: $0

Courses for Entrepreneurs: $25,672

- Create Awesome Online Courses by DSG: $13,990

- Webinars that convert by Amy Porterfield: $4,123

- Zero to Launch by Ramit Sethi: $0

- 10k Readers by Josh Turner: $94

- The Amazing Seller by Scott Voelker: $742

- 10k Subscribers by Bryan Harris: $98

- Copywriting Academy by Ray Edwards: $884

- Podcast Guest Mastery by Richie Norton: $0

- ASK by Ryan Levesque: $5,741

Resources for Podcasters: $1,965

- Pat Flynn’s Fusebox Podcast Player: $115

- Podcasting Press: $20

- Libsyn: $1,690 (Use promo code FIRE for the rest of this month & next free!)

- UDemy Podcasting Course: $109

Other Resources: $764

- Amazon Associates: $674

- Other: $90

Total Gross Income in September: $207,349

Business Expenses: $40,461

- Advertising: $997

- Affiliate Commissions (Paradise): $1,643

- Accounting: $350

- Cost of goods sold: $3,715

- Design & Branding: $2,155

- Education: $149

- Legal & Professional: $0

- Marketing: $20

- Meals & Entertainment: $1,428

- Merchant / bank fees: $1,526

- Amazon fees: $6,512

- Shopify fees: $91

- Stripe fees: $3

- PayPal fees: $409

- Office expenses: $275

- Payroll Tax Expenses / Fees: $1,454

- Paradise Refunds: $1,545

- Total Launch Package fees: $0

- Promotional: $36

- Sponsorships: $9,000

- The Freedom & Mastery Journal: $0

- Travel: $1,814

- Virtual Assistant Fees: $5,293

- Website Fees: $1,566

Recurring, Subscription-based Expenses: $4,374

- Adobe Creative Cloud: $100

- Boomerang: $70 (team package)

- Brandisty: $24

- Authorize.net: $91

- Cell Phone: $165 (Thank you, ShrinkABill!)

- eCamm Call Recorder: $39 (1-time download)

- Google: $45

- Internet: $300

- eVoice: $10

- Infusionsoft CRM: $396

- Insurance: $551

- Libsyn: $271

- Manychat: $64

- Chatroll: $49

- PureChat: $20

- ScheduleOnce: $9

- Screenflow: $39 (1-time upgrade)

- Skype: $3

- Shopify: $176

- TaxJar: $19

- Workflowy: $5

- WPEngine: $49

- MeetEdgar: $49

- Taxes & Licenses: $300

- Quiz Funnel: $1,500 (1-time setup)

- Zapier: $15

- Zoom: $15

Total Expenses in September: $44,835

Payroll to John & Kate: $15,900

In our May 2014 Income Report and our June 2016 Income Report, Josh focuses on how to pay yourself as an entrepreneur. Check them out!

Wondering what we do with all of our net revenue? We share all in our April 2017 Income Report :)

Total Net Profit for September 2017: $162,514

Biggest Lesson Learned

This too shall pass

As I sit here on my friends couch in NYC, I’m reflecting upon this quote.

When things in life are going INCREDIBLE, it’s important to remember This Too Shall Pass, and enjoy the moment.

When things are going TERRIBLE, it’s important to remember This Too Shall Pass, and not dwell on the negative.

Currently, much of our home in Puerto Rico is destroyed courtesy of hurricane Maria, and I could dwell on that reality.

Instead, I choose the mindset of This Too Shall Pass, and I know there will be a day where our place in PR is beautiful once again.

What is going great in your life Fire Nation?

ENJOY that.

What is going poorly?

Don’t DWELL on that.

Below is one picture of the devastation hurricane Maria wreaked upon my home…

I look forward to posting another photo months from now when our home is whole once again.

Remember, This Too Shall Pass.

Alright Fire Nation, that’s a wrap!

Until next month, keep your FIRE burning!

~ Kate & John

Note: we report our income figures as accurately as possible, but in using reports from a combo of Infusionsoft & Xero to track our product and total income / expenses, they suggest the possibility of a 3 – 5% margin of error.

Click here for all of EOFire’s Income Reports

This post was written by Kate Erickson, Content Creator and Implementer at EOFire.