February 2017 Income At-A-Glance

Gross Income for February: $247,651

Total Expenses for February: $55,845

Total Net Profit for February: $191,806

Difference b/t February & January: +$75,379

Why We Publish An Income Report

This monthly income report is created for you, Fire Nation!

By documenting the struggles we encounter and the successes we celebrate as entrepreneurs every single month, we’re able to provide you with support – and a single resource – where we share what’s working, what’s not, and what’s possible.

There’s a lot of hard work that goes into learning and growing as an entrepreneur, especially when you’re just starting out. The most important part of the equation is that you’re able to pass on what you learn to others through teaching, which is what we aim to do here at EOFire.

Let’s IGNITE!

**We’ll receive a commission on the affiliate links below. If you click on my affiliate link and sign up for the products and services I trust and recommend, then I will earn a commission.

CPA On Fire’s Monthly Tax Tip

What’s up Fire Nation, my name is Josh Bauerle. I’m a CPA and the Founder of CPA On Fire, where we specialize in working with entrepreneurs to minimize their tax liability while keeping them in line with the ever-changing tax laws.

I’ve been working with EOFire for years now, and John and Kate have included me in these monthly income reports with unlimited access to all their accounts so I can verify that what they report here is complete and accurate.

And because they believe in delivering an insane amount of value to you, my job doesn’t stop at the verification level; I’ll also be providing tax and accounting tips to you along the way!

Josh’s February Tax Tip: Tax Time FAQ’s, part I

Alright Fire Nation, as you can imagine I get asked a TON of tax questions this time of year.

So for the next few months we’re going to do something a little different: I’m going to be answering the most frequently asked questions I’ve been getting from my clients this tax season! Let’s dive right in…

1. Should I file separately from my spouse?

When you are married, you have two filing options:

- Married filing jointly and

- Married filing separately

I’m constantly asked if it makes sense to file separately from your spouse, and while it seems to make sense on paper, it doesn’t always make sense in real life.

You file separately, split up your income, enter lower tax brackets and pay a little less on taxes, yes. BUT it’s not quite that simple.

Filing separate can cause you to lose several deductions or change the way they are taken, and as a result you will likely end up paying far more in taxes separately.

For 95% of married couples, they will be far better off filing jointly than separately.

Typically, the only time it makes sense to file separately is if you have a large amount of expenses that are tied to income limitations, such as medical or job related expenses.

So how do you know for sure which way is best?

Hire a great tax preparer to walk you through the options!

2. Should I purchase my vehicle through my business?

A business owner is looking to buy a new car, and they figure they can get some serious tax savings buy purchasing and deducting the cost in their business – and maybe even get a little fancier of a car with those tax savings!

Again, this appears to make sense.

We talk here all the time about turning personal expenses into business expenses.

BUT, you want to operate with caution here. If your car is not being used almost entirely in the business, then you do not want to purchase it through the business.

Why?

Because if you purchase it as a business vehicle and use it a good chunk of the time for personal use, then you are opening yourself up to having to pay taxes on the personal use of the vehicle.

The much safer option here is to just buy it personally and then reimburse yourself from the business for the business use.

And NO, putting a business advertisement on your car doesn’t make it 100% business use!

3. Can I deduct athletic club, gym or golf club memberships in my business?

Let’s say you get a golf club membership and are frequently taking clients and other business contacts golfing at the club.

Or maybe you buy a gym membership because keeping in shape is paramount to your business.

Seems like the costs should be deductible, right?

Unfortunately they aren’t.

The IRS has determined that gym, club or golf membership fees are not deductible in your business, even if you use it for business reasons a good chunk of the time.

You can, however, deduct the specific costs associated with a business outing at the clubs.

So if you have a client out for a round of golf, the costs involved, such as green fees, cart rental, lunch, etc. would be deductible as meals and entertainment.

As always, your tax situation is unique to you and you should always seek advice related to your specific situation. But these general guidelines will give you an idea around what to expect with the most frequently asked tax questions.

Next month we will tackle three more! If you have any specific questions you would like us to tackle, then send them on over!

And as always, please feel free to contact me if you’d like to discuss what would be best for YOUR business. I LOVE chatting with Fire Nation!

Our Kahuna Accounting Monthly Tax Tip

Frank Lunn is Founder/CEO of Kahuna Accounting, the accounting service we use here at EOFire! They’re a virtual entrepreneur accounting team assisting Entrepreneurial Victory Achievers to Achieve Entrepreneurial Victory!

Frank’s February Accounting Tip: A “Frank” Conversation

For best effect, read to yourself in the voice of a storyteller…

Meet Frank.

Frank is an entrepreneur.

Frank started a company.

Frank worked hard and had a great team.

Frank and his team built a successful business.

Frank sold his company and made several million dollars for himself and his team.

Frank was happy!

Frank loves entrepreneurs and wanted to help them be more successful.

So, Frank built a new team assisting entrepreneurs with outsourced accounting to accelerate success and build wealth.

Although not an accountant, Frank discovered accounting was more important than he ever imagined. Frank learned about accounting as a foundation for wealth.

Frank was still happy!

Somewhere along the way Frank discovered something alarming, though…

Although he made millions in his exit, he realized he left several million dollars on the table – unclaimed. Frank was still happy, yet also a bit sad for what he wished he had known back then.

To be fair, Frank didn’t have Josh Bauerle as his CPA strategist, or EOFire as resources.

And now, Frank’s new mission is assisting entrepreneurs to NOT be sad.

So let me be ‘Frank’ with you…

Although an entrepreneur for more than two decades, building a company with revenue over 20 million dollars per year, I didn’t understand bookkeeping and accounting as the foundation for profitability and the value of my exit.

I understood bookkeeping basics – P&L, balance sheets, cash flow, and basic components of business valuation – but not how basic accounting was the foundation of my wealth.

Good accounting is good business… Just being Frank.

Visiting Kahuna Accounting to see how Kahuna’s team can help YOU get your accounting in order.

What Went Down In February

The Mastery Journal Crushes it on Kickstarter!

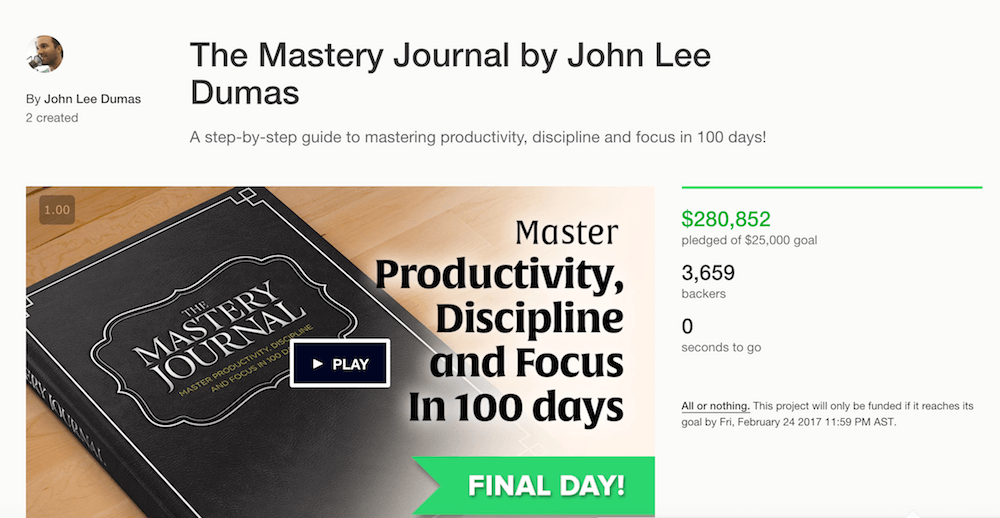

Well, we did it! The Mastery Journal campaign on Kickstarter officially wrapped at midnight on Friday, February 24th, and we were blown away by the support we received throughout the entire 33 days.

THANK YOU Fire Nation!

Final tally: 3,659 backers and $280,852 total revenue pledged!

Plus, we personally wrote a $10k check to Pencils of Promise on behalf of Fire Nation and everyone who pledged to The Mastery Journal campaign.

Looking back at the many milestones and accomplishments along the way has been quite a treat.

Everything from forming our internal team, to sending final files to print, to receiving the first hardcover, to launching on Kickstarter has been a somewhat familiar journey.

However, we have experienced our fair share of new lessons over the past several months; even though we launched The Freedom Journal on Kickstarter, too, The Mastery Journal launch was a whole new experience.

Before we dive into The Mastery Journal campaign in review, did you miss The Mastery Journal on Kickstarter?

If so, you can click here to check it out!

The Mastery Journal campaign in review

We talked a bit about launch day in our January Income Report and the importance of never taking your foot off the gas.

We also covered what our “Launch Day Blitz” looked like, including our own interview on EOFire, the multiple emails we sent out to our segmented lists, and the multiple guest podcasting and guest posting opportunities that all went live on launch day, Monday, January 23rd.

Now that we can see the whole picture, we have a few new lessons to share…

1. Launch Day Blitz’s DO work

Creating buzz is important given the level of noise in the online world.

You can’t assume that a few Tweets and a post or two on Facebook are going to get the word out about what it is you’re creating – whether that be a blog, a podcast, a product or a service.

If you’re going to take the time to create something you’re proud of, then be prepared to shout it from the online rooftops! It’s up to YOU to let people know it exists, and oftentimes people are so busy that even though you may think you’ve done a good job of promoting, people still don’t know about it.

By enlisting some of our great friends to help us spread the word about The Mastery Journal campaign, we were able to end our first day live on Kickstarter ON FIRE!

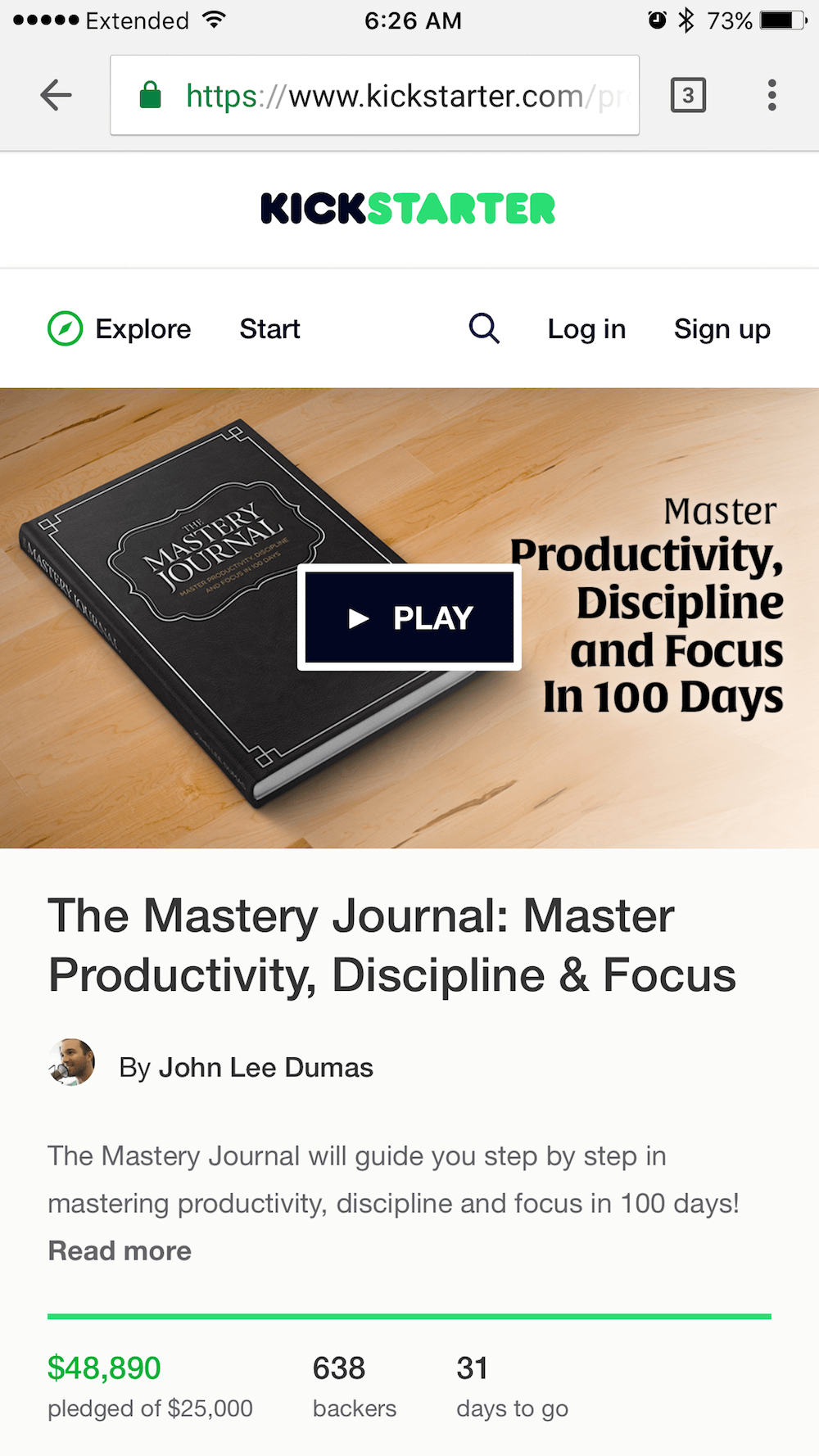

Here’s a screenshot I took from my phone when I woke up on Tuesday morning – just about 24 hours after The Mastery Journal went live on Kickstarter:

Along with the momentum we received from our own following – meaning, those who had already raised their hand and told us they were interested in hearing more about The Mastery Journal – we also received incredible visibility from those outside of our reach.

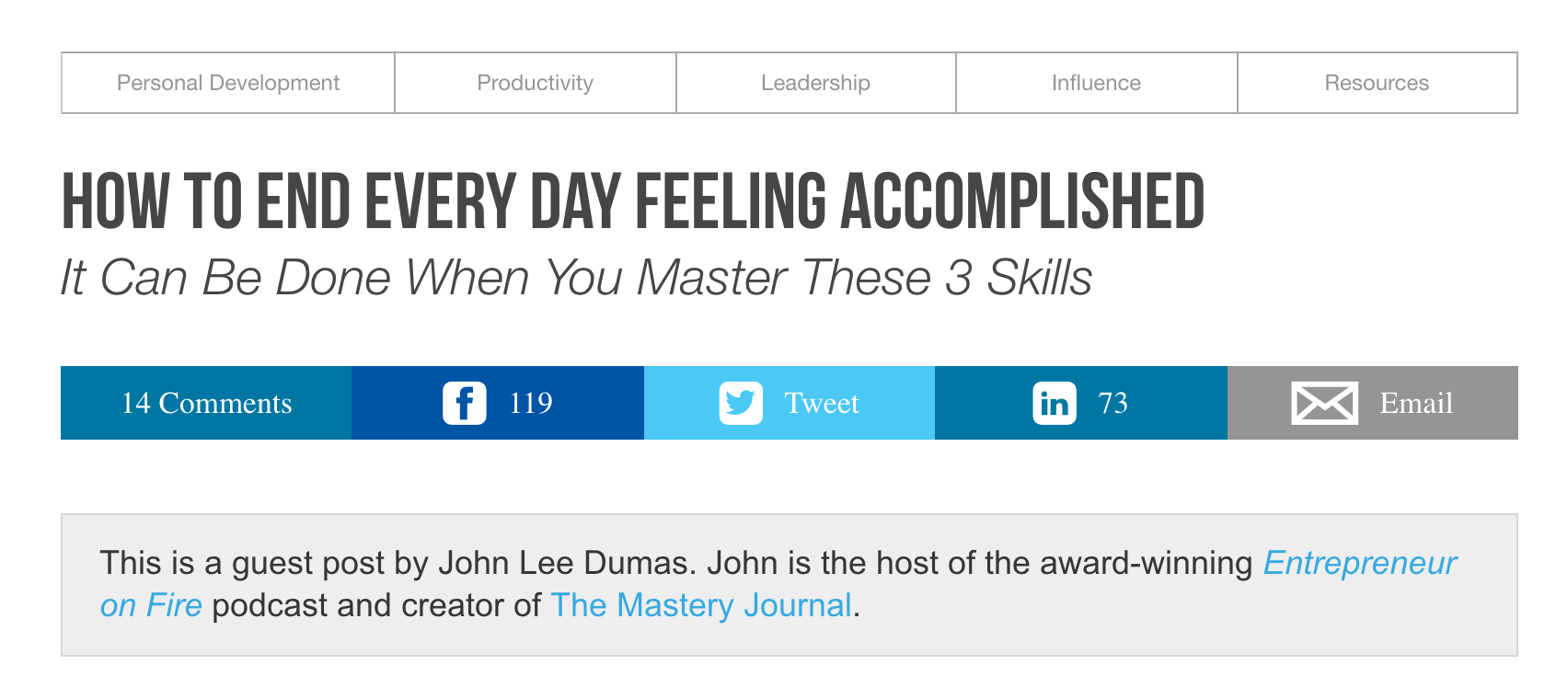

Check out this screenshot of the social shares from our guest post that went live on MichaelHyatt.com at the end of week 1 on Friday, January 27th:

This screenshot was taken the same day the post went live, and if you check out the increase in engagement at the time we’re writing this post, you’ll see that the comments are now over 40, the Facebook shares over 400, and the LinkedIn shares nearly 500.

And this is just one of well over 30 posts and podcast episodes that went live throughout The Mastery Journal campaign on sites like Forbes.com, Mixergy.com, ChrisDucker.com, 100MBA.net, TheCheeryChef.com, on Jeff Goins’ site, and many more…

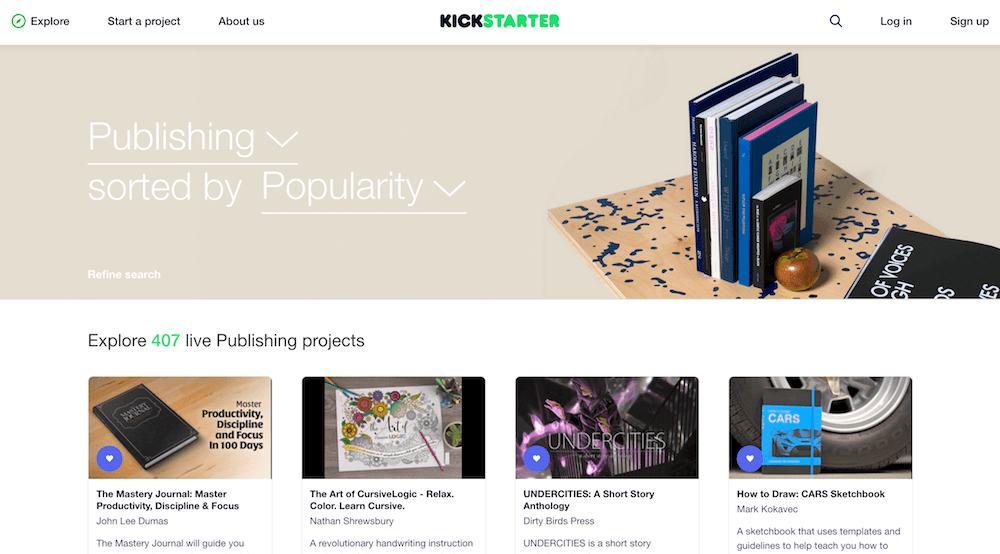

All of this combined grabbed the attention of Kickstarter, too!

Just about 48 hours into the campaign Kickstarter named us a “Project We Love“, which resulted in us ranking incredibly high in search within the platform.

We hit #1 under Publishing when looking at listings by popularity!

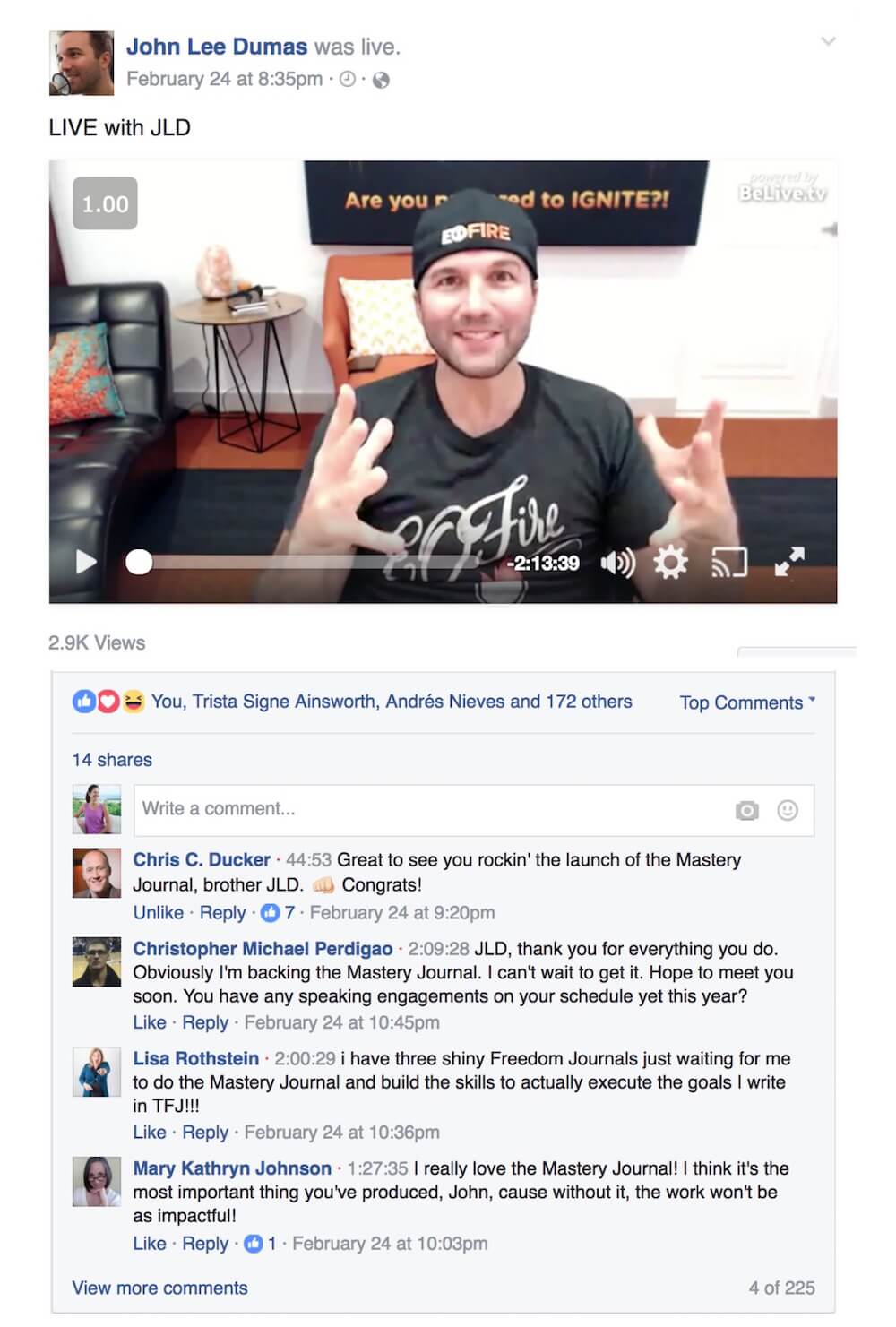

2. Facebook Live vs. Kickstarter Live, and the power of engagement

Last year when we wrapped The Freedom Journal campaign on Kickstarter we did a mini-marathon on Blab.im. We invited Fire Nation and those who had backed the Kickstarter campaign to join us live for four hours straight to close out the campaign strong.

Questions, brainstorming, feedback – it was simply a way for us to offer up our time to hangout and chat about all things goal setting.

The final four hours of The Freedom Journal campaign were massive. Not only did we have someone snag the last Day w/ JLD for an additional $10k in pledges, but we got to ENGAGE with those who were in this with us.

Since Blab is no more, this year we decided to go with Facebook Live to close out The Mastery Journal campaign.

Why not Kickstarter Live?

We were really excited to check out Kickstarter Live when we first found out it would be available during The Mastery Journal campaign, but after testing it out a few times – with a decent amount of success – we realized something we teach often: you need to go where your audience is.

In order to engage and connect with Fire Nation, we needed to go to a place we knew they’d be hanging out at, and that wasn’t on Kickstarter.

While we didn’t have anyone snag the last Day w/ JLD this time around, the Facebook Live did create some incredible engagement and a strong connection with our audience and those who had backed The Mastery Journal campaign.

As you can see below, John went live for over two hours and welcomed over 1,000 viewers live, not to mention stop-in’s from Chris Ducker, Michael Hyatt, Sally Hogshead, Michael O’Neal, Aaron Walker, and many other top-notch entrepreneurs who have supported the campaign since day one.

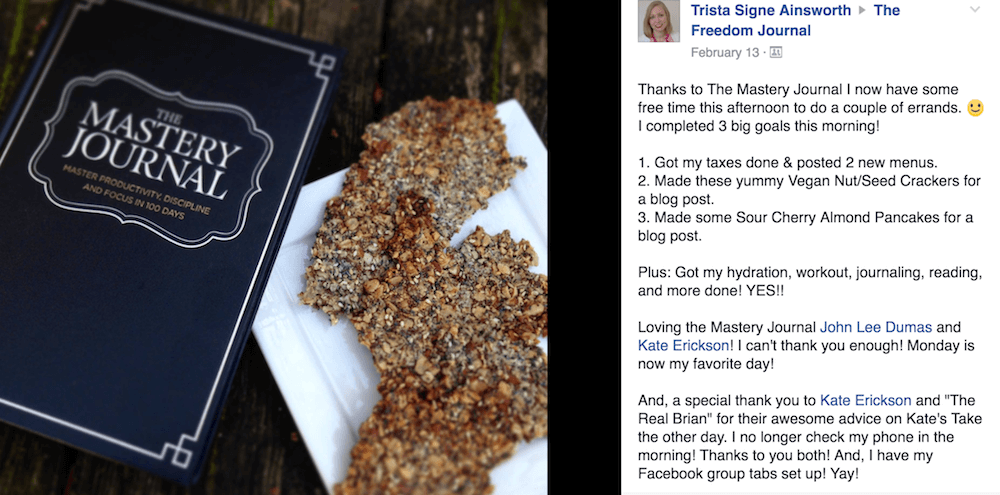

3. Street Team Success: Digital vs. Hardcover

When we first came up with the idea to create the Street Team for The Mastery Journal campaign, we decided our ‘Thank You’ would be free access to The Complete Digital Pack.

But when we got word the ship had docked and that we’d have access to The Mastery Journal earlier than expected, we took a sharp left: we decided to up our ‘Thank You’ and offer to mail a hardcover copy of The Mastery Journal to those who went all-in with us during our 33 day launch.

What resulted was not only incredible gratitude, but also some really amazing stories from members of the Street Team who wasted no time diving straight into their Mastery Journal.

On February 13th, just days after receiving her Mastery Journal, Trista Signe Ainsworth of The Cheery Chef posted this in our Private Facebook Group:

With the help of our own team, the Street Team, the numerous individuals who helped us spread the word about The Mastery Journal via guest posts and podcasts throughout the campaign, and the thousands who supported the campaign by backing The Mastery Journal, we finished day 33 STRONG!

We hope the lessons we’ve shared about launching a physical product on Kickstarter in our January Income Report, here in our February Income Report, and in the massive recap we shared about our experience with The Freedom Journal will serve you on your journey!

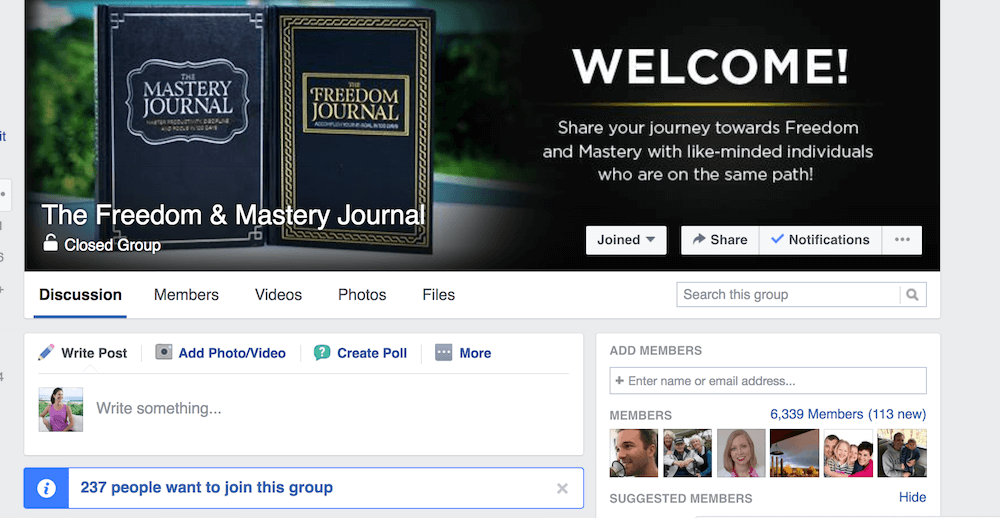

Post Campaign

So now what?

Well, we’re FIRED UP to get The Mastery Journal campaign fulfilled as quickly as possible so that everyone who backed the Kickstarter campaign will be able to start their journey to Mastery in March.

But there are a few things you should know about how Kickstarter handles the backend once a campaign wraps:

- The creator must put together a survey that asks backers for their address

- The cards on file will be run; if they’re expired or declined, the backer will be notified to update

- Digital Packs are on us to deliver

Luckily, John’s level of productivity, discipline and focus when it comes to most things in life is HIGH, and with the help of the best virtual team around we’re nearly finished fulfilling the entire campaign!

This has resulted in a few things we didn’t expect right off the bat, like a huge rush to our Private Facebook group!

Since the campaign wrapped, we’ve been quite busy accepting new members into The Freedom & Mastery Journal group, and we can’t wait to hear about their journeys!

…What’s next?

A question we’ve been getting a lot, which started before The Mastery Journal campaign had even wrapped, is what’s next?

Our immediate answer: fulfilling the Kickstarter campaign so everyone who backed The Mastery Journal will have their physical copy as quickly as possible. Again, we’re hoping to fulfill the campaign in early March.

Then, next steps are to get TheMasteryJournal.com live (a Shopify site where we’ll open up sales post-Kickstarter).

Finally, to get The Mastery Journal listed on Amazon.

And then…

How to Finally Win

Hi! JLD here :-)

Once we wrap up fulfillment for The Mastery Journal campaign, my next project is to write my first traditionally published book, How To Finally Win: Create your dream life one step at a time.

I wasn’t sure if I was ever going to write a book, but now I know I have a book in me and I hope it will help Entrepreneurs around the world create their dream life just as Kate and I have created ours.

Sign up here to be added to our ‘behind the scenes’ newsletter, and besides getting the first chapter of the book free, you’ll also receive updates, gifts, and sneak peeks along my journey of writing this book!

IGNITE!

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

February 2017 Income Breakdown*

Product/Service Income: $156,496

The Freedom Journal: Accomplish your #1 goal in 100 days!

- TheFreedomJournal.com: $22,657 (377 Freedom Journals & 154 Digital Packs sold!)

- Amazon: $40,528 (991 Freedom Journals sold!)

- Total: $63,185

Podcasters’ Paradise: The #1 Podcasting community in the world!

- Recurring: $16,072 (2 annual, 199 monthly)

- New members: $16,575 (53 new members)

- Total: $32,647

Podcast Sponsorship Income: $53,833

Podcast Websites: $5,000

WebinarOnFire: $1,344 Learn how to Create & Present Webinars that Convert! (Note – Feb 2019: Webinar On Fire is no longer available; we recommend Amy Porterfield’s Digital Course Academy for webinar training!)

Skills On Fire: $99

The Fire Path: $198

Podcast Launch: Audiobook: $148 | eBook: $42

Free Courses that result in the above revenue:

Your Big Idea: Discover your big idea in under an hour!

Free Podcast Course: Create and launch your own podcast!

Funnel On Fire: Create a funnel that converts!

Affiliate Income: $91,155

*Affiliate links below – if you click on my affiliate link and sign up for the products and services I trust and recommend, then I will earn a commission.

Resources for Entrepreneurs: $73,098

- Audible: $172

- AWeber: $104

- BlueHost: $600 Step-by-step guide and 23 WordPress tutorials included! Disclaimer: This is my affiliate link and I will receive a commission if you sign up through my link

- Click Funnels: $64,892

- Coaching referrals: $4,775 (email me for an introduction to a mentor for overall online business or a Podcast focused mentor!)

- Disclaimer Template: $44 (legal disclaimers for your website)

- Easy Webinar: $438

- Fizzle: $837

- LeadPages: $1,088

- SamCart: $148

Courses for Entrepreneurs: $15,371

- DSG’s Create Awesome Online Courses: $8,245

- Eben Pagan’s Launch Blueprint: $635

- Michael Hyatt’s Best Year Ever: $4,234

- Nick Stephenson’s First 10k Readers: $306

- Tribe: Create Recurring Revenue: $1,432

- Bryan Harris’ 10k Subscribers: $519

Resources for Podcasters: $915

- Libsyn: $730

- Pat Flynn’s Fusebox Podcast Player: $120

- UDemy Podcasting Course: $65

Other Resources: $1,771

- Amazon Associates: $1,227

- Other: $544

Total Gross Income in February: $247,651

Business Expenses: $53,500

- Advertising: $3,184

- Affiliate Commissions (Paradise): $2,062

- Accounting: $350

- Cost of goods sold: $8,166

- Design & Branding: $1,980

- Education: $45

- Legal & Professional: $

- Meals & Entertainment: $796

- Merchant / bank fees: $1,383

- Amazon fees: $11,191

- Shopify fees: $359

- Stripe fees: $6

- PayPal fees: $631

- Office expenses: $478

- Payroll Tax Expenses / Fees: $1,689

- Promotional / events: $210

- Paradise Refunds: $1,280

- WebinarOnFire Refunds: $0 (invoice total)

- Sponsorships: $5,500

- Show notes: $408

- Travel: $207

- The Freedom & Mastery Journal: $7,031

- Virtual Assistant Fees: $3,407

- Website Fees: $3,137

Recurring, Subscription-based Expenses: $2,345

- Adobe Creative Cloud: $100

- Boomerang: $80 (team package)

- Brandisty: $24

- Authorize.net: $91

- Cell Phone: $209

- CCBill: $20

- FastSpring: $40 (one-time fee)

- Feedblitz: $15

- Google Storage: $9.99

- Go2MyPC: $12

- Internet: $300

- eVoice: $9.95

- Infusionsoft CRM: $359

- Insurance: $551

- Libsyn: $203

- Chatroll: $49

- PureChat: $20

- ScheduleOnce: $9

- Skype: $2.99

- Shopify: $20

- TaxJar: $19

- Workflowy: $4.99

- MeetEdgar: $49

- Wistia: $25

- WPCurve: $29

- Zapier: $15

- Taxes & Licenses: $77

Total Expenses in February: $55,845

Payroll to John, Kate & PR Team: $17,140

In our May 2014 Income Report and our June 2016 Income Report, Josh focuses on how to pay yourself as an entrepreneur. Check them out!

Total Net Profit for February 2017: $191,806

Biggest Lesson Learned

Step back, breathe

It’s easy to get overwhelmed, worked up, emotionally entangled, frustrated and any other number of emotions when you’re running your own business.

You have a huge responsibility!

But sometimes what’s required – amongst the range of intense emotions we come in contact with on a daily basis – is to take a step back and breathe.

Fitting since breathe was one of my three words for 2017, right?

February taught us a lot of lessons – both personally and professionally – when it comes to taking a step back. Whether it was the excitement of The Mastery Journal Kickstarter campaign, the pressure of multiple big projects coming due, or realizing over and over again what it means to be the owner of a 5,000 square foot home, we took several moments to step back and breathe.

You can control your responses to situations, but sometimes it requires that you give yourself space from the situation, and that’s okay.

Take that space; the result, overtime and with practice, will be that you’ll no longer allow that range of emotions to dictate how you respond to the sometimes tough, sometimes overwhelming, and sometimes frustrating situations that equal life.

Alright Fire Nation, that’s a wrap!

Until next month, keep your FIRE burning!

~ Kate & John

Note: we report our income figures as accurately as possible, but in using reports from a combo of Infusionsoft & Xero to track our product and total income / expenses, they suggest the possibility of a 3 – 5% margin of error.

Click here for all of EOFire’s Income Reports

This post was written by Kate Erickson, Content Creator and Implementer at EOFire.