January 2017 Income At-A-Glance

Gross Income for January: $182,662

Total Expenses for January: $66,235

Total Net Profit for January: $116,427

Difference b/t January & December: -$28,671

Why We Publish An Income Report

This monthly income report is created for you, Fire Nation!

By documenting the struggles we encounter and the successes we celebrate as entrepreneurs every single month, we’re able to provide you with support – and a single resource – where we share what’s working, what’s not, and what’s possible.

There’s a lot of hard work that goes into learning and growing as an entrepreneur, especially when you’re just starting out. The most important part of the equation is that you’re able to pass on what you learn to others through teaching, which is what we aim to do here at EOFire.

Let’s IGNITE!

**We’ll receive a commission on the affiliate links below. If you click on my affiliate link and sign up for the products and services I trust and recommend, then I will earn a commission.

CPA On Fire’s Monthly Tax Tip

What’s up Fire Nation, my name is Josh Bauerle. I’m a CPA and the Founder of CPA On Fire, where we specialize in working with entrepreneurs to minimize their tax liability while keeping them in line with the ever-changing tax laws.

I’ve been working with EOFire for years now, and John and Kate have included me in these monthly income reports with unlimited access to all their accounts so I can verify that what they report here is complete and accurate.

And because they believe in delivering an insane amount of value to you, my job doesn’t stop at the verification level; I’ll also be providing tax and accounting tips to you along the way!

Josh’s January Tax Tip: Prep for Filing Your Taxes

My inbox is overflowing, my calendar is full, and my dreams are filled with income statements, balance sheets, W2’s and 1099’s.

There’s only one explanation… It’s tax season!

And while I know studies have shown that CPA’s are the only professionals people fear seeing more than dentists, it doesn’t have to be that way.

So this month, as we head into the heart of tax season, I’m going to give you some tips to make sure you have everything in order and ready for your annual tax filings.

1. Record Your Entire Gross Income

It doesn’t matter if some of the income you received went straight to another person or business as an affiliate payment.

It doesn’t even matter if you never actually saw the income yourself, because your merchant or third party seller took their fees before handing over your share.

You still have to include ALL of the income made from your sales of products or services.

You can then deduct those fees or affiliate payments out as separate expenses. It may not seem like a huge deal since the end result is the same, but it is.

Not claiming your full gross income is actually the #1 reason people are audited, so in order to make sure you avoid this, double check your gross income number against the 1099’s you receive from merchants and clients/customers.

2. Categorize Your Expenses

The #1 mistake I see businesses make with their accounting records is assuming they can just record all of their expenses as one lump sum number, like they do with their income.

It makes sense in theory; your income is reported as one lump sum, why shouldn’t your expenses be?

Unfortunately the IRS is going to make things a little more difficult here. They don’t just want to know how much money you spent, they want to know how you spent it.

In order to show them this, you’ll have to take all of your expenses throughout the year, separate them into various categories (think office expenses, advertising, travel, affiliate payments, contractors, etc) and then total them for the year.

3. Make Sure You Collect and Give Your Tax Preparer All Tax Documents

You may have recorded 100% of your gross income as we described here in tip #1, but if you don’t report a 1099 you received, even though the income from it is recorded in your gross income, the IRS will assume you didn’t report the income and send you a nice love letter.

You need to make sure you collect and give your tax preparer all 1099’s, W2’s, 1098’s, and any other official tax document you receive. Sometimes simply reporting the numbers isn’t enough – there are a few items that actually require the tax form they come on.

Your safest bet here is to talk with a professional tax preparer who can guide you through exactly what tax documents they do and do not need.

I know tax season can be scary.

I know preparing your numbers and documents can be a pain (especially if you didn’t prepare during the year).

But the 3 steps outlined above are not only crucial for filing your taxes, they are things you should be doing all year round to monitor the health of your business. Remember: you can’t improve what you aren’t monitoring.

Here’s to hoping you all made so much money in 2016 that you have a nice, fat tax bill come tax time. Remember, a high tax bill is a problem only the successful have to deal with!

As always, please feel free to contact me if you’d like to discuss what would be best for YOUR business. I LOVE chatting with Fire Nation!

Our Legal Advisor’s Monthly Tax Tip

David’s January Legal Tip: Rules for Using Images Online

Whether your business has a website, a social media presence, or both, at some point you’re going to want to use images.

But what are the actual rules around using images online?

I put together several True or False questions below to help you determine whether you’re in the clear, or you should do a little more research before posting that image.

True or False: If I Find It Online, It’s Free to Use

False! You can find images online all over the place – Google Images, Instagram, your competitor’s websites, you name it.

Those are not free to use.

In most cases, those images will be protected under the copyright law of the U.S. or another country. “Copyright” can be understood simply to mean “you can’t use it without permission.”

Under U.S. law, you can be fined up to $150,000 for using a copyrighted image without permission. Don’t do it.

These rules apply to all kinds of images – photos, drawings, GIFs, memes, emojis… any kind of visual file.

True or False: If Everyone Else is Using an Image, I Can Use It for Free, too

False! Copyright holders don’t have to go after every infringer. You don’t want to be the unlucky one who receives a Cease and Desist letter from their law firm.

True or False: This Also Applies to Memes

True! Memes, no matter how popular, are based on someone else’s copyright. You can get in legal trouble for using a meme on your website or in your social media channels.

True or False: If I’m Not Making Money Off It, I Can Use It

False! The law applies whether or not you’re directly monetizing as a result of the image.

True or False: If I Own the Copyright, I Can Use It Wherever I Want

True! This usually applies to images that you created or that an employee created for you. If you own the image, you can use it whenever or wherever you like.

Note that I said employee – if you paid someone else to create the image, but they’re not an employee of your company, then you need a “Work For Hire Agreement” – which we can discuss on a future Income Report.

True or False: You Can Buy or License the Right to Use an Image

True! If you want to use an image, you have two options:

First, you can buy the copyright. This usually applies when the owner of the image is an individual and the image isn’t very famous or valuable.

Second, and more commonly, you can license the copyright. This means you enter into a contract where you pay for the right to use the image. This is how stock photo websites like iStock operate.

Always be careful to read the terms of the license. Sometimes your license is limited to a certain number or type of uses.

If you have any questions, contact the company to make sure you’re following the rules.

Click here for a free 3-Step Checklist from David on Using Images Online!

What Went Down In January

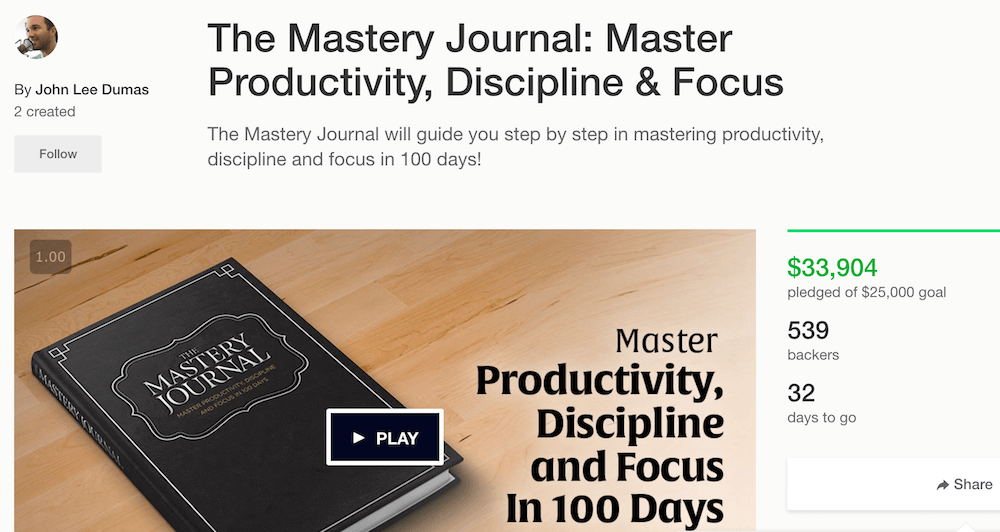

The Mastery Journal Launches on Kickstarter!

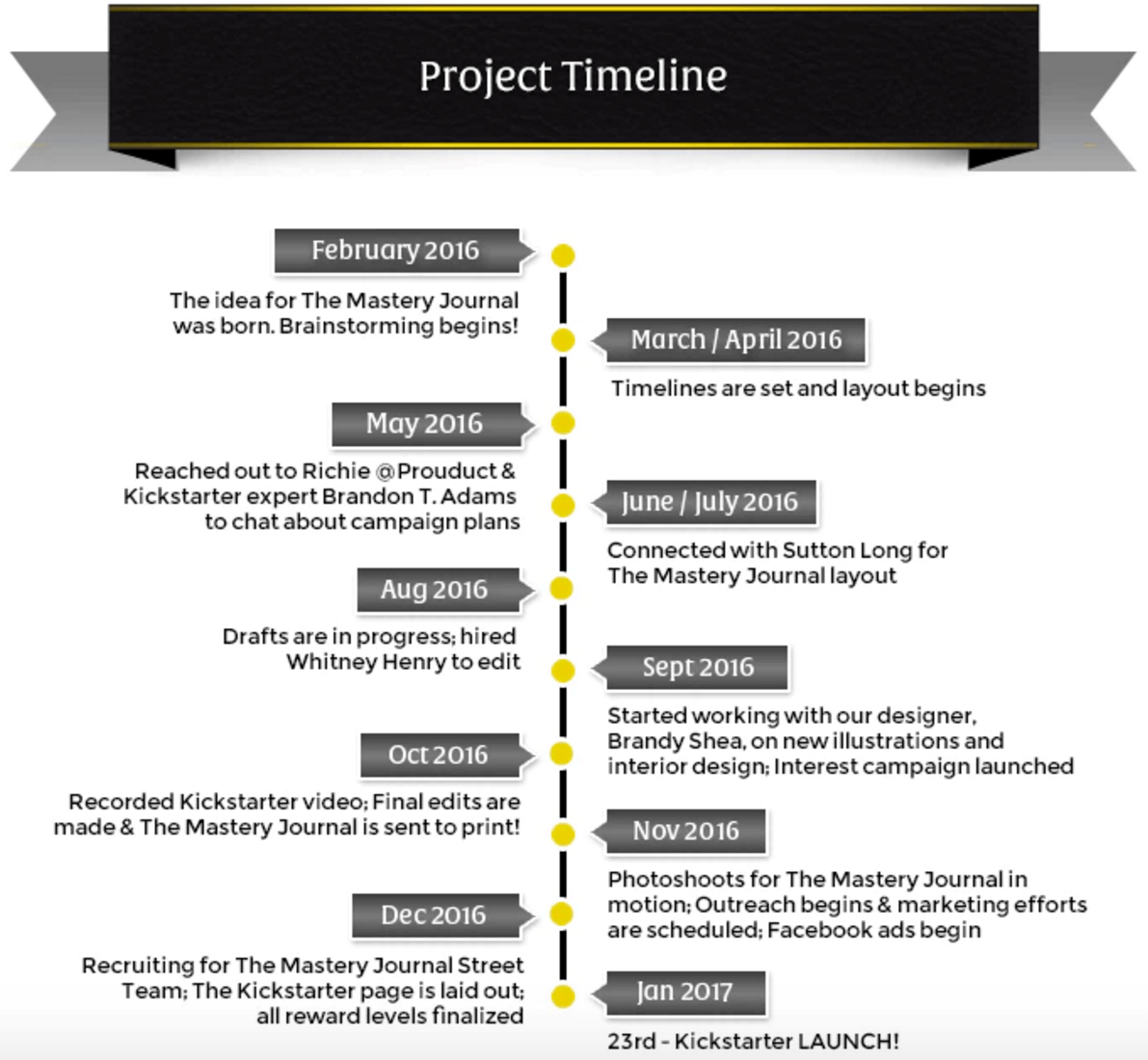

We’ve been prepping for The Mastery Journal launch for almost a year, which is when John first came up with the idea to create it.

There have been a few bumps along the way, but for the most part, we were able to take a TON of the knowledge and experience we gained from launching The Freedom Journal on Kickstarter and apply it directly to this launch.

Here’s a rundown of The Mastery Journal launch: pre, during and post…

Pre launch day

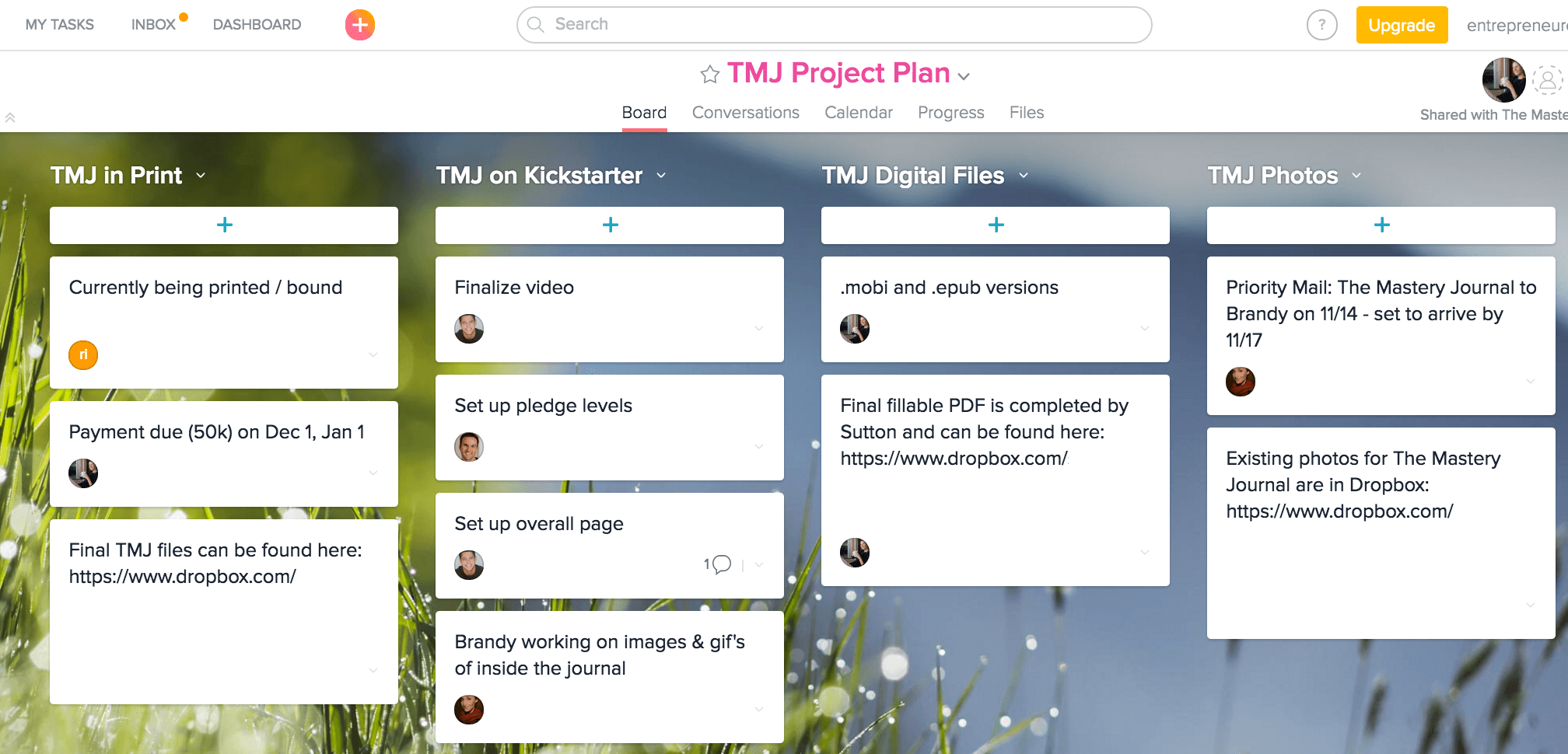

The Mastery Journal Project Plan

With a solid project plan mapped out in Asana, we were able to stay on task and keep track of the several moving pieces and multiple team members who all worked together to make this launch a success.

Quick note: Asana is an incredible project and task management tool that you can use to help you keep track of your own projects and tasks, along with those you’re working on with your team.

I use the FREE version of Asana, and have been for over two years. No affiliate link here – I simply think it’s the best software out there for project management.

Translate our project plan into actual accomplishments, and you’ve got our Project Timeline!

Here’s a look at some of the major milestones and tasks we accomplished leading up to the launch…

Marketing The Mastery Journal

We also decided to do a few things differently this time around leading up to launch when it came to marketing, including:

- John doing all outreach himself

- Enlisting The Mastery Journal Street Team

- Investing in podcast advertising

It’s a bit too early to tell just how impactful these new marketing tactics will be on the campaign as a whole, but we’ll definitely keep you posted!

Launch day

As you can see from the pre-launch section, there was a lot of prep that went into launch day, so when it finally arrived we were more than ready to hit publish!

Our Launch Day Blitz

Here are a few of the main marketing pieces that went live alongside the Kickstarter campaign on January 23rd:

- John & Kate’s interview on EOFire

- Four separate email announcements to:

- The Mastery Journal Campaign

- The Mastery Journal Street Team

- Fire Nation

- The Freedom Journal Kickstarter backers

And we can’t forget all of the outside support we received on launch day!

Thanks to John’s outreach we were able to confirm support from over 600 of his 1,500 past guests, not to mention the podcast interviews that went live on shows like School of Greatness, $100 MBA and the Ziglar Show!

Testing out new strategies and tools

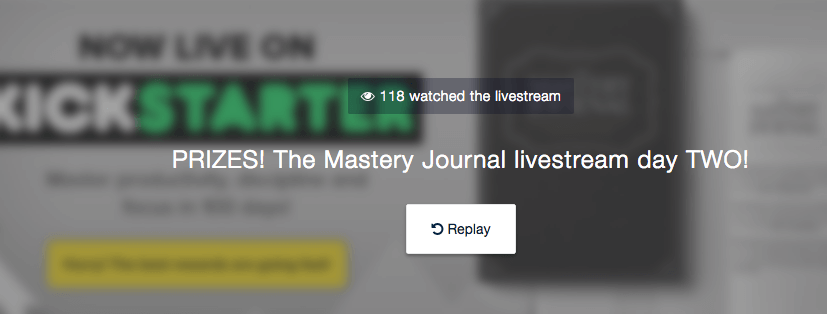

Another cool tool we’ve been able to implement this time around that wasn’t available when we launched The Freedom Journal campaign is Kickstarter Live.

Kickstarter Live allows you to hop on a live-stream video that runs directly on your Kickstarter campaign page! This allows you to give real-time updates, chat with those who are on your Kickstarter page, and also offer up some pretty sweet action-taker opportunities.

Launch day results

Launch day was incredible; we hit our funding goal – and then some – and closed out the day with well over 600 backers and over $36k pledged!

Post launch day

Our #1 tip for anyone interested in running a successful Kickstarter campaign?

Never take your foot off the gas.

Every day post-launch has looked pretty similar to launch day.

John continues to send out emails to The Freedom Journal Kickstarter backers, in addition to The Mastery Journal campaign contacts, and to Fire Nation as a whole.

The results?

- Kickstarter named us a “Project We Love” within the first 3 days,

- We closed out our first week with more than 1,500 backers pledging over $110,000, and

- Together, we’ve partnered with Pencils of Promise again and we’ve already personally written a $10k donation check, with another $10k coming at our next pledge level! BOOM!

Our biggest lessons learned

Even though the campaign was only live for one week in January, we were able to walk away with several lessons learned (and we expect many more to be on the way).

Here are a few of those lessons:

- Compare and despair: The Mastery Journal sales are not at the same level as The Freedom Journal, but the ONLY comparison we should be making is with The Mastery Journal campaign yesterday, and if we WIN that comparison, we WIN!

- The #1 question we get: How is The Mastery Journal different from The Freedom Journal?

- The Freedom Journal sales are WAY UP!

- EOFire interviews with The Freedom Journal crew are resonating BIG TIME!

The Mastery Journal Kickstarter campaign wraps on February 24th, so we’ll have a full recap of the entire campaign in our next income report.

We’ll also be creating another massive Kickstarter post, like the one we created for The Freedom Journal, so that if you’re looking to launch your next idea on Kickstarter you’ll have a head start!

By the way, have you snagged YOUR Mastery Journal yet? There are still a few mastermind spots available for our upcoming Puerto Palooza!

Click here to learn more!

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

January 2017 Income Breakdown*

Product/Service Income: $134,231

The Freedom Journal: Accomplish your #1 goal in 100 days!

- TheFreedomJournal.com: $22,934 (390 Freedom Journals & 165 Digital Packs sold!)

- Amazon: $29,780 (748 Freedom Journals sold!)

- Total: $52,714

Podcasters’ Paradise: The #1 Podcasting community in the world!

- Recurring: $12,961 (6 annual, 181 monthly)

- New members: $17,475 (64 new members)

- Total: $30,436

Podcast Sponsorship Income: $44,333

Podcast Websites: $5,000

WebinarOnFire: $1,344 Learn how to Create & Present Webinars that Convert! (Note – Feb 2019: Webinar On Fire is no longer available; we recommend Amy Porterfield’s Digital Course Academy for webinar training!)

Skills On Fire: $132

The Fire Path: $89

Podcast Launch: Audiobook: $204 | eBook: $68

Free Courses that result in the above revenue:

Your Big Idea: Discover your big idea in under an hour!

Free Podcast Course: Create and launch your own podcast!

Funnel On Fire: Create a funnel that converts!

Affiliate Income: $48,431

*Affiliate links below – if you click on my affiliate link and sign up for the products and services I trust and recommend, then I will earn a commission.

Resources for Entrepreneurs: $30,750

- Audible: $212

- BlueHost: $1,500 Step-by-step guide and 23 WordPress tutorials included! Disclaimer: This is my affiliate link and I will receive a commission if you sign up through my link

- Click Funnels: $22,701

- Coaching referrals: $4,842 (email me for an introduction to a mentor for overall online business or a Podcast focused mentor!)

- Disclaimer Template: $69 (legal disclaimers for your website)

- Fizzle: $244

- LeadPages: $1,082

- Virtual Staff Finder: $100

Courses for Entrepreneurs: $15,511

- Ray Higdon’s 3 Minute Expert: $6,417

- Ramit Sethi: $4,989

- Nick Stephenson’s First 10k Readers: $306

- Nathalie Lussier’s Launch It!: $1,750

- Tribe: Create Recurring Revenue: $1,432

- Bryan Harris’ 10k Subscribers: $617

Resources for Podcasters: $511

- Pat Flynn’s Fusebox Podcast Player: $121

- UDemy Podcasting Course: $50

- Podcasting Press: $340

Other Resources: $1,659

- Amazon Associates: $838

- Other: $821

Total Gross Income in January: $182,662

Business Expenses: $63,975

- Advertising: $11,124 (includes The Mastery Journal launch ads)

- Affiliate Commissions (Paradise): $2,569

- Accounting: $1,752 (on-boarding PR CPA)

- Cost of goods sold: $5,442

- Design & Branding: $2,180

- Legal & Professional: $525

- Meals & Entertainment: $2,079

- Merchant / bank fees: $3,165

- Amazon fees: $7,725

- Shopify fees: $414

- Stripe fees: $8

- PayPal fees: $654

- Office expenses: $264

- Payroll Tax Expenses / Fees: $1,670

- Promotional / events: $125

- Paradise Refunds: $5,701

- WebinarOnFire Refunds: $672 (invoice total)

- Sponsorships: $5,625

- Show notes: $240

- Travel: $1,936

- The Freedom Journal: $6,031

- Virtual Assistant Fees: $2,610

- Website Fees: $1,464

Recurring, Subscription-based Expenses: $2,260

- Adobe Creative Cloud: $100

- Boomerang: $80 (team package)

- Brandisty: $24

- Authorize.net: $91.10

- Cell Phone: $215

- CCBill: $20

- Google Storage: $9.99

- Go2MyPC: $12

- Internet: $300

- eVoice: $9.95

- Infusionsoft CRM: $359

- Insurance: $551

- Libsyn: $125

- Chatroll: $49

- PicMonkey: $33 (annual fee)

- PureChat: $20

- ScheduleOnce: $9

- Skype: $2.99

- Shopify: $20

- Scout: $10

- TaxJar: $19

- Workflowy: $4.99

- MeetEdgar: $49

- Wistia: $25

- WPCurve: $29

- Zapier: $15

- Taxes & Licenses: $77

Total Expenses in January: $66,235

Payroll to John, Kate & PR Team: $17,683

In our May 2014 Income Report and our June 2016 Income Report, Josh focuses on how to pay yourself as an entrepreneur. Check them out!

Total Net Profit for January 2017: $116,427

Biggest Lesson Learned

You’ll never know until you take action

There were a lot of questions, fears and “what if’s” leading up to The Mastery Journal launch.

- Have we done enough to prepare?

- Should we have reached out to more people for support?

- Will people see the value in The Mastery Journal?

For many entrepreneurs, these are the types of questions, fears and “what if’s” that will stop you in your tracks before you’re ever able to make any progress.

But for those who take action – despite the questions, fears and “what if’s” – they get to actually find out. They get to learn, pivot, experience and achieve the goals they set for themselves.

No one else can answer the questions, calm the fears or tell you “what if”; you have to take action to find out.

What’s the worst that could happen?

Alright Fire Nation, that’s a wrap!

Until next month, keep your FIRE burning!

~ Kate & John

Note: we report our income figures as accurately as possible, but in using reports from a combo of Infusionsoft & Xero to track our product and total income / expenses, they suggest the possibility of a 3 – 5% margin of error.

Click here for all of EOFire’s Income Reports

This post was written by Kate Erickson, Content Creator and Implementer at EOFire. Follow Kate on Social: