August 2016 Income At-A-Glance

Gross Income for August: $196,324

Total Expenses for August: $71,812

Total Net Profit for August: $124,512

Difference b/t August & July: $26,813

Free and amazing trainings!

Free Podcast Course: Learn how to create and launch your podcast!

Your Big Idea: Discover Your Big Idea in less than an hour!

EOFire’s August 2016 Income Report

Why We Publish An Income Report

This monthly income report is created for you, Fire Nation!

By documenting the struggles we encounter and the successes we celebrate as entrepreneurs every single month, we’re able to provide you with support – and a single resource – where we share what’s working, what’s not, and what’s possible.

There’s a lot of hard work that goes into learning and growing as an entrepreneur, especially when you’re just starting out. The most important part of the equation is that you’re able to pass on what you learn to others through teaching, which is what we aim to do here at EOFire.

Let’s IGNITE!

**We’ll receive a commission on the affiliate links below. If you click on my affiliate link and sign up for the products and services I trust and recommend, then I will earn a commission.

CPA On Fire’s Monthly Tax Tip

What’s up Fire Nation, my name is Josh Bauerle. I’m a CPA and the Founder of CPA On Fire, where we specialize in working with entrepreneurs to minimize their tax liability while keeping them in line with the ever-changing tax laws.

I’ve been working with EOFire for years now, and John and Kate have included me in these monthly income reports with unlimited access to all their accounts so I can verify that what they report here is complete and accurate.

And because they believe in delivering an insane amount of value to you, my job doesn’t stop at the verification level; I’ll also be providing tax and accounting tips to you along the way!

Josh’s August Tax Tip: Tax deductions on inventory

Hopefully reading these tax tips over the last few years has provided you with a good understanding of how tax deductions work.

At this point, you probably realize that if you spend money to improve your business in some way, you will generally get to deduct some – or all – of that cost against your income.

And now that you’ve thoroughly learned how that process works, I’m going to throw a giant wrench in it!

If you have a business that has inventory – meaning you buy or make some type of physical product to resell to others – the tax deduction works completely different.

Instead of being able to deduct the costs right when you spend the money, inventory doesn’t become a tax deduction until the time it is sold.

Tax deductions on The Freedom Journal: An example

Let’s look at EOFire and The Freedom Journal as an example.

Late in 2015, EOFire spent a lot of money to create The Freedom Journal. But because of the way Kickstarter works, none of those journals technically sold until early 2016.

What this meant was that while EOFire spent a lot of money on a legitimate business expense in 2015, they weren’t able to actually deduct any of that money until 2016.

On a small scale this might not seem like a big deal. How much of a difference can it really make?

But on a larger scale, it can become a major cash flow issue, especially for those who purchase the inventory early for the sole purpose of a tax deduction.

I can’t tell you the number of clients we started working with who came to us thinking they would owe little-to-no taxes because they made a large inventory purchase at year end for the sole purpose of bringing down their taxable profits.

We unfortunately had to give them the bad news that all that unsold inventory is not an expense until it is actually sold, and that they still owe taxes on all those profits, which creatied a large tax bill they had no idea was coming.

An inventory checklist

So is the IRS actually punishing those who hold inventory?

I guess that depends how you look at it; but let’s focus on what’s important: what you can do to ensure you don’t get hit too hard for unsold inventory.

1. Understand the rule

Now that you know exactly what the rule is, your excuses are gone.

You CANNOT, under ANY circumstances, deduct unsold inventory.

Trust me, I’ve heard all the ideas in the book; the fact remains, you cannot do it and making a large inventory purchase at year end to reduce your taxable income will not work.

2. Purchase inventory as needed

I get it – you don’t want to be caught in a situation where you have demand for your product with no way to fill it.

But you also don’t want to get caught with a large quantity of unsold inventory at year end that won’t provide a tax deduction.

So carefully monitor your inventory turnover rate and adjust accordingly, especially at year end.

3. Know the numbers you need

If these rules on inventory make taxes seem even more concerning, fear not – I have a quick and easy way for you to figure out your inventory deduction!

You basically need three numbers:

– Your beginning inventory

What was the total cost of the inventory on hand at the beginning of the year?

– Your total purchases

How much inventory did you purchase during the year?

– Your ending inventory

What was the cost value of your unsold inventory at year end?

If you can get those three numbers to your accountant at year end, they will easily be able to figure out your exact amount of deductible inventory.

Remember that while many people will consider this inventory rule a disadvantage for those with physical products to sell, the truth is, if you understand the rule and plan accordingly it won’t have any real impact on your business!

If you have a question you would like to see covered in a future income report, leave it in the comments section below, or reach out to me directly!

As always, please feel free to contact me if you’d like to discuss what would be best for YOUR business. I LOVE chatting with Fire Nation!

Mentioned in this episode: Kahuna Accounting (our incredible bookkeeping team!)

What Went Down In August

Filming for The Messengers

In late June we receive an email from Chris Krimitsos, founder of the Tampa Bay Business Owners Association, co-founder and host of Podfest Florida, and partner in crime to Katie Krimitsos of Biz Women Rock.

We’ve known Chris and Katie for quite a while and have participated in several online summits and Podfest in the past.

It was a super short and sweet email about a new project they’d been working on with a team of podcasters and film-makers called The Messengers: A Podcast Documentary.

He shared the trailer with us, which you can check out below, and said it plain and simple:

We would love to schedule time to visit you and Kate and have you filmed for the documentary sometime in August.

Needless to say, we accepted, and on Friday, August 5th we met up with the crew right here in Palmas Del Mar for a pre-filming dinner – all 15 of us!

This crew is so insanely inspiring.

The dedication, the hours, the passion, and the straight up HARD WORK that they’re putting into this documentary is incredible, which is why we’re so honored to be a part of it.

Filming lasted all day, and while it was intense at times (imagine having multiple cameras, microphones, and 5-7 people surrounding you at all times – PLUS having to answer some tough questions), we know the end result is going to be POWERFUL.

And of course, we had a ton of fun in the process…

The film is at about 75% funded right now with 11 days to go, so make sure you head over and check out their IndieGoGo campaign and help support what this team is doing to share the power of podcasting.

Mastermind in Puerto Rico

We also welcomed a couple of house guests in August: Michael O’Neal of the Solopreneur Hour Podcast and Greg Hickman of System.ly.

While the primary focus of the trip was to mastermind, we also set aside time for outdoor bbq’s, watching Monica take home the first gold medal for Puerto Rico at the Olympics, a night out at the casino here in Palmas, and a day of exploring in Old San Juan.

Oh, and we luckily to sneak in a guest appearance on the Solopreneur Hour Podcast in our kitchen :)

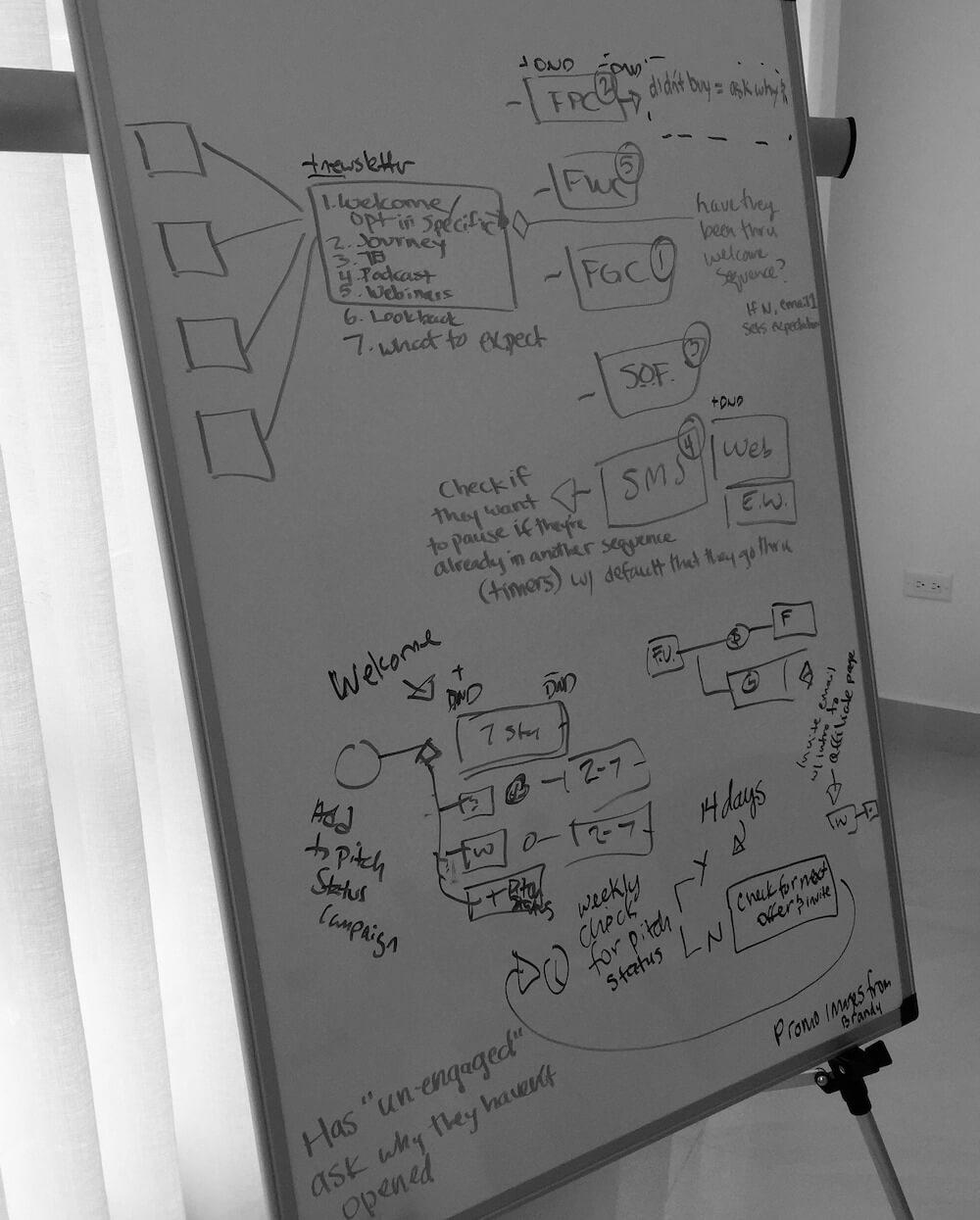

While I didn’t participate in the mastermind day the guys had, I did get to spend a day with Greg brainstorming and re-working how our campaigns, welcome journey, and our overall customer journey works.

Here’s a VERY rough look at what we came up with…

We’re in the process of implementing this all now, and while it’s been a ton of work we know the new EOFire welcome journey will be well worth it.

When you take a step back and put yourself in your prospect or customer’s shoes, you can uncover a lot about what’s missing, and how you could be better introducing them to your business and brand.

SkillsOnFire

In late August I launched SkillsOnFire (2025 update: no longer available), which is where I will be creating short but POWERFUL tutorials to make you DANGEROUS in a number of different areas. Social media, email, time management, morning routines and MUCH more.

Check out the current tutorials here!

Self-Mastery Journal (now The Mastery Journal)

Are you ready to master productivity, discipline, & focus in 100 Days?

My next project is Self-Mastery Journal: Master productivity, discipline, & focus in 100 Days!

I’m INCREDIBLY excited for the launch of Self-Mastery Journal (coming Q1 2017) because this is a project that’s very personal for me.

The Freedom Journal was creating the solution for how to set and accomplish meaningful goals. My EOFire guests thrive with goals, while many of my listeners struggle with goals; The Freedom Journal bridges that gap.

But Self-Mastery Journal is personal.

I believe my strengths are productivity, discipline, & focus.

There is a method to my madness, and in Self-Mastery Journal you WILL learn how to master productivity, discipline, & focus in 100 days.

Straight up, Self-Mastery Journal is going to be work, but if you want to achieve your dreams, it’s time to raise your hand and join me! Allow Self-Mastery Journal to be your guide.

I’ll be sharing my progress, as well as providing gifts and awesomeness along the way, so be sure to sign up for updates at SelfMasteryJournal.com!

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

August 2016 Income Breakdown*

Product/Service Income: $146,250

The Freedom Journal: Accomplish your #1 goal in 100 days!

- Shopify: $20,773 (439 Freedom Journals & 48 Digital Packs sold!)

- Amazon: $12,285 (315 Freedom Journals sold!)

- Total: $33,058

Podcasters’ Paradise: The #1 Podcasting community in the world!

- Recurring: $12,732 (119 monthly)

- New members: $7,404 (23 monthly, 3 annual)

- Total: $20,136

Podcast Sponsorship Income: $87,000

Podcast Websites: $5,000

WebinarOnFire: $672 Learn how to Create & Present Webinars that Convert! (Note – Feb 2019: Webinar On Fire is no longer available; we recommend Amy Porterfield’s Digital Course Academy for webinar training!)

The Fire Path Course: $162 A step-by-step business roadmap

Podcast Launch: Audiobook: $184 | eBook: $38

Free Courses that result in the above revenue:

Your Big Idea: Discover your big idea in under an hour!

Free Podcast Course: Create and launch your own podcast!

Funnel On Fire: Create a funnel that converts!

Affiliate Income: $50,074

*Affiliate links below – if you click on my affiliate link and sign up for the products and services I trust and recommend, then I will earn a commission.

Resources for Entrepreneurs: $16,545

- Audible: $309

- Aweber: $0

- BlueHost: $2,100 Step-by-step guide and 23 WordPress tutorials included! Disclaimer: This is my affiliate link and I will receive a commission if you sign up through my link

- Click Funnels: $10,921

- Coaching referrals: $1,310 (email me for an introduction to a mentor for overall online business or a Podcast focused mentor!)

- Disclaimer Template: $400 (legal disclaimers for your website)

- Fizzle: $395

- Infusionsoft: $0

- LeadPages: $1,063

- Shopify: $47

- WP Curve: $0

Courses for Entrepreneurs: $32,366

- Ryan Levesque’s ASK: $10,928

- David Siteman Garland’s Create Awesome Online Courses: $4,813

- Scott Voelker’s The Amazing Seller: $0

- Ramit Sethi: $3,733

- Self-Publishing School: $9,062

- Nick Stephenson’s First 10k Readers: $94

- Rick Mulready’s Facebook & Instagram Ads Training: $1,164

- Bryan Harris’ 10k Subscribers: $1,205

- Fire Pole Marketing: $0

- Grant Baldwin’s Booked & Paid to Speak: $0

- Ray Higdon’s 3 Minute Expert: $0

- Ray Edwards Copywriting Academy: $257

- Josh Turner’s LinkedIn Academy: $1,110

Resources for Podcasters: $411

- Libsyn: $0 (promo code Fire)

- Pat Flynn’s Fusebox Podcast Player: $72

- UDemy Podcasting Course: $39

- Podcasting Press: $300

- Amber Ludwig-Vilhauer (done for you services): $0

Other Resources: $752

- Amazon Associates: $640

- Other: $112

Total Gross Income in August: $196,324

Business Expenses: $67,467

- Advertising: $2,696

- Affiliate Commissions (Paradise): $4,809

- Accounting: $250

- Cost of goods sold: $4,342

- Design & Branding: $1,980

- Education: $2,112

- Legal & Professional: $25,750

- Meals & Entertainment: $804

- Merchant / bank fees: $4,890

- Amazon fees: $4,764

- Shopify fees: $412

- Stripe fees: $24

- PayPal fees: $460

- Office expenses: $2,580

- Other Business Expenses: $36

- Promotional / events: $323

- Paradise Refunds: $579

- WebinarOnFire Refunds: $2,388 (invoice total)

- Shipwire: $6,000

- Sponsorships: $21,750

- Show notes: $398

- Total Launch Package Fees: $175

- Travel: $834

- Virtual Assistant Fees: $2,530

- Website Fees: $1,581

Recurring, Subscription-based Expenses: $4,345

- Adobe Creative Cloud: $100

- Boomerang: $70

- Brandisty: $24

- Authorize.net: $91.10

- Cell Phone: $280

- Google Storage: $9.99

- Go2MyPC: $12

- Internet: $1,892 (includes 1-time set-up fee)

- eVoice: $9.95

- Infusionsoft CRM: $497

- Insurance: $551

- Libsyn: $320

- Chatroll: $150

- PureChat: $20

- ScheduleOnce: $9

- Skype: $2.99

- Shopify: $29

- TaxJar: $19

- Payroll fee: $77

- Workflowy: $4.99

- MeetEdgar: $49

- Wistia: $25

- WPCurve: $29

- Taxes & Licenses: $77

Total Expenses in August: $71,812

Payroll to John, Kate & PR Team: $24,236

In our May 2014 Income Report and our June 2016 Income Report, Josh focuses on how to pay yourself as an entrepreneur. Check them out!

Total Net Profit for August 2016: $124,512

Biggest Lesson Learned

Take ownership

In August, I learned one of the toughest lessons to date here at EOFire:

NO ONE cares about your business as much as you do, and that means YOU have to take ownership.

- Ownership of what’s happening in your business.

- Ownership of who is working in your business.

- Ownership of how your prospects and customers see and experience your business.

- Ownership of the way your business runs.

- Ownership of how you want your business to run.

- Ownership of the results you see if your business.

- Ownership of the things you want to change in your business.

- TAKE OWNERSHIP.

No one else cares about your business as much as you do. Take ownership.

Alright Fire Nation, that’s a wrap!

Until next month, keep your FIRE burning!

~ Kate & John

Note: we report our income figures as accurately as possible, but in using reports from a combo of Infusionsoft & Xero to track our product and total income / expenses, they suggest the possibility of a 3 – 5% margin of error.