March 2016 Income At-A-Glance

Gross Income for March: $116,100

Total Expenses for March: $52,405

Total Net Profit for March: $63,695

Difference b/t March & February: –$311,766

EOFire’s March 2016 Income Report

Why We Publish An Income Report

This monthly income report is created for you, Fire Nation. By documenting the struggles we encounter and the successes we celebrate as entrepreneurs every single month, we’re able to provide you with support – and a single resource – where we share what’s working, what’s not and what’s possible.

There’s a lot of hard work that goes into learning and growing as an entrepreneur, especially when you’re just starting out. The most important part of the equation is that you’re able to pass on what you learn to others through teaching, which is what we aim to do here at EOFire.

Let’s IGNITE!

**We’ll receive a commission on the affiliate links below. If you click on my affiliate link and sign up for the products and services I trust and recommend, then I will earn a commission.

CPA On Fire

What’s up Fire Nation, my name is Josh Bauerle. I’m a CPA and the Founder of CPA On Fire, where we specialize in working with entrepreneurs to minimize their tax liability while keeping them in line with the ever-changing tax laws.

I’ve been working with EOFire for a while now, and John and Kate have included me in these monthly income reports with unlimited access to all their accounts so I can verify that what they report here is complete and accurate.

And because they believe in delivering an insane amount of value to you, my job doesn’t stop at the verification level; I’ll also be providing tax and accounting tips to you along the way!

Josh’s March Tax Tip: Mistakes Entrepreneurs Make with Their Finances

We’re here, Fire Nation! …The end of another longgg tax season!

This season was by far the busiest for me, but also the best we’ve experienced at CPA On Fire. And after preparing over 250 tax returns so far this year, we’ve uncovered plenty of mistakes entrepreneurs are making.

So this month I put together something special I know can help each and every one of you in preparing to make tax season as seamless as possible for you – and your business.

5 Biggest Mistakes Entrepreneurs Are Making With Their Finances

1. Bad Bookkeeping

If you’ve heard me say it once, you’ve heard me say it a million times: Bookkeeping is so incredibly important! …yet so many of us are getting it so wrong.

If you run a successful business or a business you want to be successful, then top-notch bookkeeping is an absolute essential.

Aside from the obvious benefits of optimizing your taxes, it will also improve your business overall. When you know exactly what your numbers are at all times, you can actively work to improve on those numbers.

I also believe in this so strongly and am so tired of it being done so badly, that I did something I swore I’d never do: I started offering bookkeeping services.

So if you know your bookkeeping needs some work, contact us and let’s make it happen.

2. Operating out of the wrong entity

This is another area you’ve heard me harp on repeatedly, but it’s something we continue to see every year: there are way too many entrepreneurs operating out of the wrong entity, and it’s costing you thousands of dollars in taxes.

So I’m just going to say here what I’ve said in countless other income reports: If you’re making $40,000 or more in your business, and you aren’t operating as an S Corp, chances are you’re throwing away thousands of dollars every single year in taxes!

3. Majoring in minor things

I once heard Jim Rohn say one of the biggest mistakes most people make is majoring in minor things.

What he meant was they spend way too much time, money and other resources focusing on small things that don’t matter. And after doing over 250 tax returns this year, I agree with that sentiment more than ever.

I see far too many entrepreneurs worrying about whether they can deduct the $7 lunch they had, or whether they should lease a brand new car for a tax deduction, and all these other minor details when they should be focusing far more time on the major items…. Things like the bookkeeping, their business entity, making their business more profitable, etc.

4. Continuing to operate a business that isn’t profitable

I’m all about following your passion in entrepreneurship, and I know it takes time to become profitable when you’re just starting a business; but you also have to know when to quit.

Here’s the bottom line: the ultimate goal of a business is to make money, and there are too many of us who continue to try and disguise a venture that loses money year after year after year as a business.

If that’s you, then it’s time to face reality. You no longer have a business, you have a hobby.

It’s time to either make major adjustments or a different line of business.

5. Only talking to a tax professional at tax time

I’ll keep this last one short and simple: if you’re only talking to me when it’s time to file your taxes, don’t expect me to work miracles on your return.

The best businesses, ones like EOFire, are in communication with their CPA all year round. In fact, these businesses are the easiest of all to file taxes for, because by the time tax season rolls around everything is done and in place.

If you haven’t done so in the past, I urge you to talk to your CPA early in the year this year to prepare a strategy for 2016.

So there you have it. Another tax season in the books and these are the 5 biggest mistakes I saw entrepreneurs make in 2015.

We’re still early in 2016, so there’s plenty of time to get on the right track.

If one or more of these 5 things are speaking to you, then don’t hesitate to contact me or another CPA and let’s make 2016 your best tax year yet!

And as always, please feel free to contact me if you’d like to discuss what would be best for YOUR business. I LOVE chatting with Fire Nation!

What Went Down In March

Shopify goes live

This month we published our recap on the blog that talks all about how to CRUSH Kickstarter!

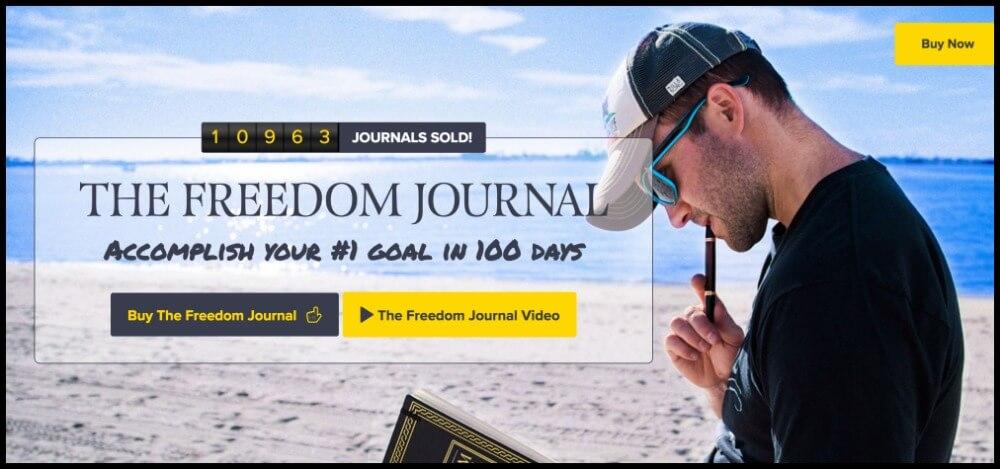

We’re SO excited for you to check it out because we share E-VER-Y-THING that went into taking the idea for The Freedom Journal, creating a plan around it, hiring a team, and launching it on Kickstarter with massive success!

Now that Kickstarter has wrapped, we’re starting to hear this question a lot from Fire Nation: “What’s next?”

We love your enthusiasm! :)

Next: TheFreedomJournal.com

John spent a huge chunk of March making sure that our Shopify site was up and running smoothly.

The Shopify site has allowed us to continue bringing in a steady flow of traffic to TheFreedomJournal.com (previously a redirect to the Kickstarter campaign); PLUS, we’re seeing amazing conversions as a result!

You can check out the way we have it set up by just going to TheFreedomJournal.com (the actual site is built on WordPress, and the shopping cart portion is thanks to Shopify).

Coast to Coast: NYC & Podmastery Part II

John’s month was CRAZY with travel, starting with a trip out to NYC for the Big East Championship games.

Unfortunately, he came home slammed with a horrible flu-like sickness, and was out for over a week (I’ve NEVER seen John that sick before…)

The month wrapped with John and Michael O’Neal teaming up for Podmastery part II in Los Angeles, where they spent an entire day with 15 podcasters doing hot seats and masterminds.

Viva… Puerto Rico!

John and I have had our eyes on Europe for quite some time now… We’ve had the travel bug ever since our 5 country tour back in May 2014, which included stops in Paris, Barcelona, Cinque Terre, Lugano, and Prague.

We’ve even chatted about throwing a business venture into the mix – what started out as an idea for “Travel on Fire” has turned into something that we know has the potential to be really amazing: Cities by Sound.

But in the process of researching what it would like to “take our business on the road”, we realized that keeping our home base in California was going to come with a 13% tax tag – regardless of whether or not we were physically here.

So that turned into research around what other states we might be able to live in that didn’t carry the same 13% tax tag – as you may know, states like Texas, Nevada, Florida, New Hampshire… all have 0% state tax.

Fast forward several months and picture this: John gets a call about an opportunity for us to move to Puerto Rico.

Our love of travel and adventure kicked in immediately: we’ve been in San Diego now for 3 years, and we’ve loved EVERY SECOND OF IT. This is a truly unique city, one that is filled with inspiration, beauty, and Kate’s family (the best part!)

When it came down to making our decision, John commented on how quickly 3 years has gone by, and it really has gone by quickly. But what happens after the next 3 years go by, and the next, and the next?

Suddenly, it’s been 9 years, and we’re still loving San Diego and enjoying life to fullest, but we haven’t traveled, explored, or tried anything new.

There’s nothing wrong with staying some place you love, but travel and experiences are important to us, and if we continue to just “wait” for them to happen, truth is, they may never happen.

You can bet big money on the fact that John and I will be back to San Diego and in Maine A LOT, and we also have high hopes of finding a place in Puerto Rico that will allow our families and friends to visit often.

And who knows, maybe we’ll find the perfect spot for a mastermind gathering? :)

There will be a lot to sort out once we’re in PR:

- What’s the Internet like?

- What is it like to live in the Caribbean?

- Will we like the “seclusion”?

- What if we don’t meet other entrepreneurs who are on the same path as us?

We’ve got all these questions and so many more… and we’ll be excited to share the answers with you once we move on May 1!

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

March 2016 Income Breakdown*

Product/Service Income: $81,756

Podcasters’ Paradise: $30,228.25 (29 new members + 116 recurring) Create, grow, and monetize YOUR Podcast!

WebinarOnFire: $1,319 (invoice total) Create and present a Webinar that converts. (Note – Feb 2019: Webinar On Fire is no longer available; we recommend Amy Porterfield’s Digital Course Academy for webinar training!)

The Freedom Journal: $32,454.75 (80% Shopify)

Podcast Sponsorship Income: $17,500

Podcast Websites: $7,500

The Fire Path Course: $54

Podcast Launch (Audiobook on Audible): $152

Podcast Launch (eBook on Amazon): $48

Free Courses that result in the above revenue:

Your Big Idea: Discover your big idea in under an hour!

Free Podcast Course: Create and launch your own podcast!

Funnel On Fire: Create a funnel that converts!

Affiliate Income: $34,344

*Affiliate links below – if you click on my affiliate link and sign up for the products and services I trust and recommend, then I will earn a commission.

- BlueHost: $1,500 Step-by-step guide and 23 WordPress tutorials included! Disclaimer: This is my affiliate link and I will receive a commission if you sign up through my link

- Coaching referrals: $1,262 (email me for an introduction to a mentor for overall online business or a Podcast focused mentor!)

- David Siteman Garland’s Create Awesome Online Courses: $5,577

- Scott Voelker’s The Amazing Seller: $2,030

- Ramit Sethi: $1,995

- Fizzle: $744

- LeadPages: $1,112

- Click Funnels: $1,627

- Rick Mulready’s Facebook & Instagram Ads Training: $1,309

- Ray Edwards Copy Writing Academy: $1,205

- Bryan Harris’ 10k Subscribers: $813

- Grant Baldwin’s Booked & Paid to Speak: $62

- Nick Stephenson 10k Readers: $2,260

- Libsyn: $530 (promo code Fire)

- Audible: $774

- Tim Paige Voice Over: $0 (ask for the Fire Special)

- Pat Flynn’s Fusebox Podcast Player: $0

- Infusionsoft: $371

- Aweber: $0

- Shopify: $78

- Amber Ludwig-Vilhauer: $0

- Fire Pole Marketing: $78

- Music Radio Creative: $0

- WP Curve: $0

- Chris Ducker’s Virtual Staff Finder: $0

- High Speed Elite: $0

- Podmastery: $9,000

- UDemy Podcasting Course: $151

- Podcasting Press: $150

- Amazon Associates: $1,038

- Other: $678

Total Gross Income in March: $116,100

Business Expenses: $50,102

- Advertising: $1,752

- Affiliate Commissions (Paradise): $6,670

- Accounting: $250

- Cost of goods sold: $4,829.50

- Design & Branding: $1,990

- Training & Education: $244

- Meals & Entertainment: $1,602

- Merchant / bank fees: $2,385

- Amazon fees: $1,237

- Shopify fees: $524

- Stripe fees: $107

- PayPal fees: $1,010

- Office expenses: $400

- Libsyn: $306

- Other Business Expenses: $191

- Promotional / events: $5,969 (includes Podmastery)

- Paradise Refunds: $297

- WebinarOnFire Refunds: $0 (invoice total)

- Shipwire: $81 (1-0ff shipping & fulfillment of TFJ)

- Sponsorships: $3,500

- Show notes: $640

- Total Launch Package Fees: $350

- Travel: $8,811

- Virtual Assistant Fees: $4,899

- Website Fees: $2,058

Recurring, Subscription-based Expenses: $2,303

- Adobe Creative Cloud: $100

- Boomerang: $14.99

- Brandisty: $24

- Authorize.net: $91.10

- Cell Phone: $261

- Google Storage: $9.99

- Go2MyPC: $12

- HelloSign: $13

- Internet: $159

- eVoice: $9.95

- Infusionsoft CRM: $548

- Insurance: $551

- Chatroll: $150

- PureChat: $20

- ScheduleOnce: $16

- Skype: $2.99

- Shopify: $29

- Payroll fee: $77

- Workflowy: $4.99

- MeetEdgar: $49

- Wistia: $25

- Sweet Process: $29

- WPCurve: $29

- Taxes & Licenses: $77

Total Expenses in March: $52,405

Payroll to John and Kate: $18,193

In our May 2014 Income Report, Josh focused on how to pay yourself as an entrepreneur. Check it out!

Total Net Profit for March 2016: $63,695

Biggest Lesson Learned

Physical Products & Sales Tax + Your Team

You know those things we talk about that can’t really be planned for?

We’re creatures of habit, and we love to know what’s up ahead; but more often than not, you simply cannot predict what’s around every corner.

That’s why it’s so important to just TAKE ACTION. You will soon find out exactly what’s around that corner. :)

Is it scary? Yep.

Is it sometimes stressful? Sure – it can be.

But how will you ever know if you don’t just take that step?

We’ve got a perfect example for you, and it’s our lesson learned for the month: the sales tax that’s involved with selling physical products.

Not something you would necessarily feel like you had to “plan for”, right? You list your product, sales tax is applied when necessary, and you’re good!

We found out this month that it doesn’t really work that way…

After Ryan, who is a part of our bookkeeping team over at Kahuna, questioned how we were collecting and paying on sales tax, we jumped on Skype with Josh to start one of many conversations on the topic.

We then found out from Josh there really isn’t a clear black & white answer as to whether you have to register your business in each of the states where your product ships from.

After connecting to TaxJar, a software that pulls all of your distribution sources together in 1 place for you, we realized this whole state thing is a concern for us since Amazon is now shipping The Freedom Journal from 13 different states.

We’re still sorting through what this all means for us, and what the best next move is given our current situation – we’ll definitely keep you posted!

For now, we’ll share two lessons learned here:

1. You simply cannot know what’s around every corner – in order to find out, you have to take that next step forward.

2. Surround yourself with people who can help you once you do find our what’s around that corner; had we not had Ryan and Josh on our side, we’d be scrambling to try and figure this all out on our own, and you and I both know that’s NO FUN.

Alright Fire Nation, that’s a wrap!

Until next month, keep your FIRE burning!

~ Kate & John

Note: we report our income figures as accurately as possible, but in using reports from Infusionsoft to track our product income, they suggest the possibility of a 3 – 5% margin of error.

Click here for all of EOFire’s Income Reports