October 2014 Income At-A-Glance

Gross Income for October: $253,053.17

Total Expenses for October: $70,133.23

Total Net Profit for October: $182,919.94

Difference b/t Oct & Sept: +$5,955.16

Why We Publish An Income Report

This monthly income report is created for you, Fire Nation. By documenting the struggles we encounter and the successes we celebrate as business owners every single month, we’re able to provide you with a single resource that tells you what’s working, what’s not and what’s possible.

There’s a lot of hard work that goes into learning and growing as an entrepreneur (especially when you’re starting at ground zero), but the most important part of the equation is what you’re able to pass on to others through teaching. We’re passionate about helping you build the life YOU want to live, just like we have.

Now that may look very different from ours, but the lessons learned and techniques for running a successful business can be applied in many situations.

As you read through our day-to-day struggles and successes that help define our journey, focus on the lessons we’ve learned from these experiences. Our goal is to make YOUR journey as enjoyable and successful as possible.

That’s not to say you won’t encounter roadblocks. Believe us – we know that no one can escape those no matter how much reading or studying you do. Just keep in mind that every roadblock is a stepping stone towards your future success.

Let’s IGNITE!

**We’ll receive a commission on the affiliate links below. If you click on my affiliate link and sign up for the products and services I trust and recommend, then I will earn a commission.

CPA On Fire

Our CPA, Josh Baurle, shares his October Income Report Tip!

What’s up Fire Nation? My name is Josh Bauerle, and I am a CPA and the Founder of CPA On Fire, where we specialize in working with entrepreneurs to minimize their tax liability while keeping them in line with the ever changing tax laws.

I’ve been working with EntrepreneurOnFire to make sure their accounting systems are running smoothly and that their taxes are as low as possible. John and Kate have included me in the monthly income reports with unlimited access to all their accounts so I can verify that what they report here is complete and accurate.

And because they believe in delivering an insane amount of value, my job doesn’t stop at the verification level. I will also be providing tax and accounting tips to you along the way!

Over the next few months I’ll be going over the 5 best ways for entrepreneurs to save money on their taxes.

For our first three tips in July, August and September we talked about deducting every day expenses in your business, using retirement plans to save money on taxes and renting your house to your business.

This month, we’re going to talk about hiring an independent contractor vs. an employee

Whether you choose to hire an independent contractor or an employee could save you thousands of dollars in taxes, or cost you thousands, which is why it’s important to understand the differences between the two so you can make an informed decision.

Let’s face it: all successful businesses reach a tipping point where they can no longer take on additional work. If they want to make more money, they have to hire someone to help. But should they hire an actual employee, or keep things simple and go with an independent contractor? And what’s the actual difference between the two?

From a tax perspective, there’s a very big difference:

Employee

You’re responsible for paying half of the medicare and social security taxes associated with their pay, which essentially comes out to about 7.6% of their pay. On top of that, you’ll likely have to pay additional expenses like unemployment insurance and workers comp insurance.

Independent contractor

They’re responsible for all of their own taxes. The only expense you incur with an independent contractor is their pay.

So is an independent contractor the clear way to go?

Definitely not. There are other factors at play here, most importantly how you want the working relationship to be structured, because an independent contractor may offer your the clear money savings, but an employee gives you more control.

Knowing the difference between the two

Does your new hire have a set schedule, work where you tell them to work, and use your equipment? If so, they are very likely an employee and must be treated as such.

Do you simply give them tasks to complete by a certain deadline, which they can do from wherever they want, working whatever hours they want, using their own equipment? In that case, you are definitely dealing with an independent contractor.

While it may be tempting to label all your workers as independent contractors in order to save a lot of money on taxes and insurance, doing so incorrectly puts you at serious risk with the IRS – a risk that definitely doesn’t justify the savings. Make sure you know which way your workers should be classified.

How to decide

The decision comes down to your personal preferences and the needs of your business. But what is absolutely vital is not calling an employee an independent contractor and vice versa, because labeling them wrong could cost you thousands and thousands of dollars in taxes, interest and penalties.

If they do fall under the independent contractor label, be sure to have a conversation about what that means for them up front. I’ve seen many employers get in hot water when their independent contractor was stunned by their tax bill come April and reported to the IRS they should have been labeled an employee.

Good communication up front is your best defense here.

As always, please feel free to contact me if you’d like to discuss what would be best for YOUR business. I LOVE chatting with Fire Nation!

What Went Down In October

Creative LIVE!

October brought us an incredible opportunity amidst A LOT of craziness. John spent 3/4 of the month of September on the road – first traveling to New York for Camp GLP, and then to his home state of Maine for 2 weeks with family and to attend the Agents of Change Conference.

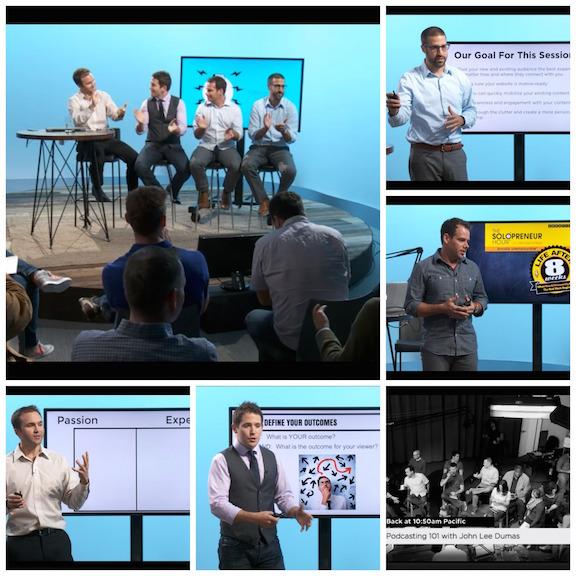

Right on the heels of returning home he was packing up again to jump back on the road, this time to present on stage at CreativeLIVE in San Francisco on Podcasting 101.

For maximum value, John invited some key players along, including Michael O’Neal, host of the Solopreneur Hour, Greg Hickman, host of Mobile Mixed, and Nick Unsworth, host of Life on Fire.

The day went off without a hitch, and these guys knocked it out of the park. They dished out details on everything from discovering your passion and podcasting topic, to naming your podcast, to defining your avatar, to branding, to “life after 8 weeks”, to leveraging mobile marketing, and even wrapped with a discussion about the importance of creating your own movement.

To check out more details about the course content, visit the Podcasting 101 course page here!

Paradise Turns 1 Year

On Oct 31st Podcasters’ Paradise celebrated its 1-year anniversary, and we couldn’t be more grateful, excited and FIRED UP about this incredible community of over 1,500 podcasters.

Getting to Paradise wasn’t easy, but now that we’ve arrived, we can’t wait for what the future holds.

What does the future hold?

Well, right now we’re laser focused on continuing to make improvements in Paradise, just like we’ve been doing since our launch. That means continuing to:

- WOW our members from day 1;

- Enhance the user experience;

- Provide up-to-date video tutorials on the latest and greatest tactics to create, grow and monetize your podcast;

- Create community perks like Pay it Forward Friday, Accountability in Paradise, and an entire area dedicated to requesting Guests for your podcast; and

- Much more!

A big takeaway here is that even though we have dozens of other opportunities knocking at our door – even though we could easily be letting countless distractions take us away from Paradise and into new projects like building other communities and coming up with more products and services – we’re choosing to give our FULL FOCUS to what’s working for us right now: Podcasters’ Paradise.

Did you know it took us failing miserably with two other product ideas before we even came up with the idea to create Paradise? And we couldn’t be more grateful for those two failures, because without them, we wouldn’t have known what wasn’t working.

Sometimes it takes putting something out there, getting feedback, tweaking it, and then putting it out there again and again before you can create something people actually want and need, and that’s exactly what we went through to come up with our idea to create Podcasters’ Paradise.

First, it was PodPlatform, a service John created to help podcast hosts publish their podcast without having to do any uploading, tagging or submitting. Send us your mp3, and we’ll do the rest!

Then, it was 6-Figure Podcasting: a video-based course that would teach people how to monetize their podcast.

The problem with both of these ideas was that there wasn’t a real need for them, and when I say need, I mean people weren’t actually willing to pay for them.

John did bring on a couple of clients with PodPlatform, but he quickly realized that he would never be able to scale that. 6-Figure Podcasting was never even created because after introducing it to our audience, we had very few people raise their hand and say they would actually pay for it.

What we learned from putting these two ideas out there and asking our audience for feedback is exactly what people didn’t want, and in turn, we were able to uncover what they did want.

Through listening to our audiences’ struggles, we were able to come up with the idea to create Podcasters’ Paradise. What struggles and pain points is your audience revealing to you, Fire Nation?

RescueTime summary

RescueTime is an incredibly powerful tool for anyone looking to manage their time more efficiently. In fact, John and I both attribute a huge chunk of our time management and efficiency skills to the RescueTime App itself. Honing these skills starts with fully recognizing what it is you’re spending your time on, and most people don’t take the time to track this because it’s difficult to write down every single thing you do in a day.

With RescueTime, you have software constantly working behind the scenes to log your time for you. Simply, easy and so powerful!

Kate’s October: 240 hours (vs. 195 in September)

Kate’s top 3 sites for the month:

1. Infusionsoft

2. Microsoft Word

3. EOFire.com

John’s October: 242 hours (due to travel, John’s Sept was not recorded)

John’s top 3 sites for the month:

1. Gmail

2. Microsoft Word

3. Adobe Audition

Our team

We also can’t forget about all the hard work and time that our virtual team members contribute! We couldn’t be doing what we’re doing without the help of JM, Jess and Adeel, our team!

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

October 2014 Income Breakdown

Product/Service Income: $234,396.87

Podcasters’ Paradise: $147,818.87 (invoice total)

Create, grow, and monetize YOUR Podcast.

WebinarOnFire: $10,786 (invoice total)

Create and present a Webinar that converts.

PodcastOnFire: $1,256 (invoice total)

Create and launch your Podcast in 14 days.

The One Thing: $35

$7 mini training.

Sponsorship Income: $59,587

Fire Nation Elite Mastermind: $10,559

1-on-1 Mentoring: $1,000 (residual from a previous month as John no longer mentors…)

Total Launch Package: $2,985

Podcast Launch (Audiobook on Audible): $148

Podcast Launch (eBook on Amazon): $222

Affiliate Income: $18,656.30

*Affiliate links below – if you click on my affiliate link and sign up for the products and services I trust and recommend, then I will earn a commission.

- BlueHost: $4,200 Step-by-step guide and 23 WordPress tutorials included! Disclaimer: This is my affiliate link and I will receive a commission if you sign up through my link

- LeadPages: $1,757

- Tim Paige Voice Over: $150 (ask for the Fire Special)

- Audible: $1,278

- Aweber: $143

- Amber Ludwig-Vilhauer: $95

- Infusionsoft: $139

- Music Radio Creative: $0

- LifeOnFire: $1,052.50

- Libsyn: $465 (promo code Fire)

- Mike Koenigs: $2,123

- Optimize Press: $124

- WP Curve: $120

- Fizzle: $82

- Optin Monster: $237

- Ramit Sethi: $4,944.80

- Amazon: $1,013

- Other: $733

Total Gross Income in October: $253,053.17

Business Expenses: $68,324

- Advertising: $654

- Design & Branding: $0

- Education: $344

- Meals & Entertainment: $1,629

- Merchant Account fees: $329

- LibSyn: $176

- Other Business Expenses: $823 (conference materials)

- Office expenses: $1,614

- Paradise Refunds: $30,695 (invoice total)

- WebinarOnFire Refunds: $5,089 (invoice total)

- PodcastOnFire Refunds: $0

- Webinar Giveaways: $923

- Fire Nation Elite expenses: $5,708

- Paradise expenses: $1,299

- Paradise Affiliate Commissions: $3,955

- Software: $291

- TheMidRoll (Sponsorships): $9,931

- Travel: $1,980

- Virtual Assistant Fees: $2,428

- Website Fees: $456

Recurring, Subscription-based Expenses: $1,809.23

- Adobe Creative Cloud*: $100

- Authorize.net*: $91.10

- Cell Phone*: $313

- Internet*: $171

- eVoice*: $9.95

- Infusionsoft CRM*: $382

- Insurance*: $551

- Quickbooks Online*: $25

- Chatroll: $49

- ScheduleOnce*: $42.19

- Skype*: $2.99

- Taxes & Licenses (recurring): $72

Total Expenses in October: $70,133.23

Payroll to John and Kate: $13,193

In our May Income Report, Josh focused on how to pay yourself as an entrepreneur. Check it out!

Total Net Profit for October 2014: $182,919.94

Can you believe this all came from the launch of a single Podcast?!

If you’re looking to start your own podcast, don’t miss our Podcast Workshop that we’re hosting next week on how YOU can create, grow, and monetize YOUR Podcast. Yes! Sign me up for the Podcast Workshop!

Here’s what our attendees are saying about the Podcast Workshop:

Rob: “This was a smart hour to set aside!”

Dave: “This is perfect for me! John is laying out exactly what I am working towards!”

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Lesson Learned In October

Being a successful entrepreneur requires that you make a lot of sacrifices

Warren G. Tracy’s student said it best:

“Entrepreneurship is living a few years of your life like most people won’t, so you can spend the rest of your life like most people cant.”

It’s easy to glance through the lens of a successful entrepreneur and see incredible things. According to our definition, and a big part of being an entrepreneur, is having the freedom to choose. You get to work on things that matter to you. The time you put in each and every day is time that is invested in meaningful projects that have meaningful outcomes.

But none of that comes without sacrifice.

Whether it’s not taking that vacation you’ve been planning for a year, not sleeping in on Saturday mornings anymore, or saving every single penny possible so you can invest it in building your business instead of on shopping trips and meals out, the sacrifices we make in order to become successful entrepreneurs are real. And let’s be honest: they’re tough to make.

What one sacrifice you’ve made recently in pursuit of your dreams?

Your turn! What’s your #1 takeaway from this month’s income report?

Alright Fire Nation, that’s a wrap!

Until next month, keep your FIRE burning!

~ Kate & John

PS: Click to Tweet… we’ll love you for it!

Note: we report our income figures as accurately as possible, but in using reports from Infusionsoft to track our product income, they suggest the possibility of a 3 – 5% margin of error.